China’s DeepSeek AI Predicts the Price of XRP, Dogecoin and Pi Coin by the End of 2025 Cryptonews

source

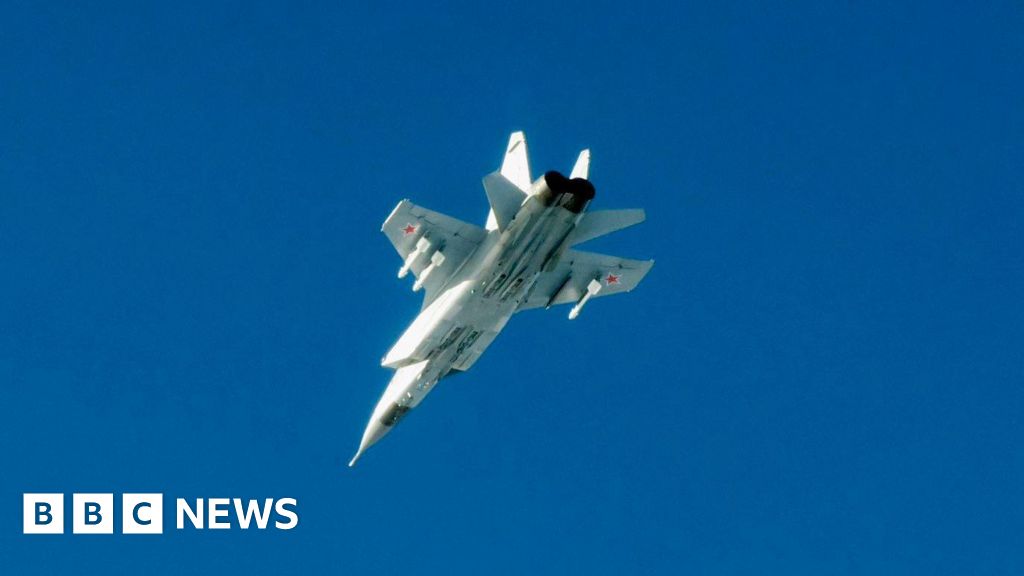

Estonia has requested a consultation with other Nato members after Russian warplanes violated its airspace on Friday.

Estonia's foreign ministry condemned the incursion as "brazen". It said three Russian MiG-31 fighter jets entered the Estonian skies "without permission and remained there for a total of 12 minutes" over the Gulf of Finland.

A Nato spokesperson said the military alliance "responded immediately and intercepted the Russian aircraft", calling it "yet another example of reckless Russian behaviour and Nato's ability to respond".

Italian jets responded to the incursion under Nato's mission to bolster its eastern flank, while Finland and Sweden also scrambled jets. Russia has not commented.

Tensions have escalated between the Nato military alliance and Russia since Moscow launched a full-scale invasion of Ukraine in 2022.

They have risen in the last week, after Poland and Romania – both Nato members – said Russian drones breached their airspace. In response, Nato pledged to move military assets, including fighter jets, eastwards to strengthen defence.

Speaking later on Friday, Estonian Prime Minister Kristen Michal said his government had "decided to request Nato Article 4 consultations" at an urgent meeting.

"Nato's response to any provocation must be united and strong. We consider it essential to consult with our allies to ensure shared situational awareness and to agree on our next joint steps," Michal said.

Article 4 of the Nato treaty formally starts urgent consultations within the 32-member alliance, which ties the US and many European nations together on collective defence.

It is the second time in a week that a Nato member has requested Article 4 consultations. Poland did so after Russian drones entered its airspace.

US President Donald Trump told reporters he was due to be briefed on the incident later on Friday.

He said: "I don't love it. I don't like when that happens. Could be big trouble. But I'll let you know later."

Estonia's foreign ministry earlier said it had summoned the Russian chargé d'affaires "to lodge a protest" over Friday's incursion, while top EU diplomat Kaja Kallas described the incident as "an extremely dangerous provocation".

The minister added Russia had already violated Estonia's airspace four times in 2025. Estonia shares a border with Russia to the east.

Estonia said the aircraft entered its airspace from the north east and were intercepted by Finnish jets over the Gulf of Finland. Once inside Estonian airspace, Italian F-35 jets, based in Estonia, were deployed under Nato's Baltic Air Policing mission to escort the aircraft out.

The government said the Russian jets had no flight plans, had their transponders turned off and also did not have two-way radio communication with Estonian air traffic control.

Estonian Defence Minister Hanno Pevkur told the BBC: "It is unprecedented that for 12 minutes the Russians were in our airspace."

He added that "in this situation, the only right thing to do is to push them out of Estonian airspace".

Michal also said the Russian incursion showed its war of aggression in Ukraine was not proceeding as the Kremlin had planned.

"The aim is to draw attention and assistance away from Ukraine by forcing Nato countries to focus more on the defence of their own territories," he added.

In a post on X, Kallas, who is an Estonian national, said the EU "will continue to support our member states in strengthening their defences with European resources".

She said Russian President Vladimir Putin was "testing the West's resolve. We must not show weakness".

Echoing her words, European Commission President Ursula von der Leyen said on X: "We will respond to every provocation with determination while investing in a stronger Eastern flank."

"As threats escalate, so too will our pressure," she added.

Estonia's ambassador to the UK, Sven Sakkov, told the BBC that "clear, practical steps" to increase the protection of airspace above Nato's eastern flank were needed in light of Friday's incident.

"If we had to face such times as we are living in now alone, we would be extremely concerned," he said, adding that Estonians nonetheless felt "determined" to defend themselves.

Last week, Poland's military said it had shot down at least three Russian drones, with prime minister Donald Tusk saying 19 drones were recorded entering Polish airspace.

Russia insisted the incident was not deliberate, and its defence ministry said there had been "no plans" to target facilities on Polish soil.

Belarus, a close Russian ally, said the drones entered Polish airspace accidentally after their navigation systems were jammed.

Several days later, Romania's defence ministry said it had detected a Russian drone when two F-16 jets were monitoring the country's border with Ukraine, after "Russian air attacks on Ukrainian infrastructure on the Danube [river]".

The ministry said the drone later disappeared from the radar.

Russia has not commented on the issue.

In response to Russia's incursions into Poland and Romania, Nato pledged to move troops and fighter jets eastwards.

Planes from the UK, France, Germany and Denmark are all taking part in air defence missions over Poland in a bid to bolster the alliance's eastern flank.

Pevkur said Nato needed to "put more focus on the eastern flank" and described it as "our joint response line in a way, that here in Estonia we keep the front door closed".

On Monday, a French jet was scrambled in response to another potential incursion by Russian drones. Nato said that alert was quickly over.

In June, member states agreed to boost defence spending and reconfirmed Nato's mutual security guarantee.

Outgoing MI6 chief Sir Richard Moore said potential agents in Russia and around the world will be targeted by the UK spy agency.

Arthur Polishchuk praises the "beautiful people" who welcomed him and his family into their home.

The two men and a woman were all arrested in Grays, Essex, the Metropolitan Police says.

University of Leeds experts are sharing technology to recycle debris from the conflict with Russia.

Copyright 2025 BBC. All rights reserved. The BBC is not responsible for the content of external sites. Read about our approach to external linking.

Nigerian social media is buzzing with reactions after a surprising moment between BBNaija housemates Koyin and Sultana caught viewers off guard.

What started as a quiet conversation in a corner of the bedroom quickly escalated into a passionate kiss, leaving fans shocked and sparking heated discussions online.

The unexpected connection has stirred curiosity, especially since Koyin was previously seen spending a lot of time with another housemate, Dede. With this sudden twist, fans believe the dynamics in the house may be shifting dramatically.

Watch the video here:

You are seeing SULTANA and KOYIN everywhere on the tl and you are wondering What? How? When?

Well let me take you in a ride on how it all happened…

A thread🧵 on how last night unfolded. Grab your popcorn cause you’re in for a ride🤌🏻

First Koyin and Sultana kissed!!!#BBNaija pic.twitter.com/eX58vkIe8Q

See some comments below:

@nwaka_esther1:”Same koyin, Dede pple claim is smitten by her? 😂😂😂 the boys this season na anywhere belle face, asides from kola, no boy really send that babe.”

@flawlessbyflo:”Ha, see my first born, he don dey kiss? 🥺🥺.”

@naijagraphy:”This relationship no go survive for outside. ODOGWU MEN go ride Koyin . Sultana is too s*xy abeg. Koyin should enjoy it while it lasts.”

@karlar_chris_benjamin said:”Ebuka will ask …koyin how was the kiss w sultana…. from there now his friend ship w dede will scatter..lol.”

@vivoflagos:”I saw it live ooo 😂she was even laughing like it was her first love 😂Sulty baby don loose guard 🙆♀️.”

@_mshlehle:”Hope she will leave Dede’s name out of her mouth 🙏 she must free that gal.”

@janemira317:”Mother and son relationship.”

@babirye_sophie:”I didnt see this coming.”

@chinweotito_to_you:”This season, I dey vote based on content for that week… all my votes dey go out on Wednesday and na the housemate wey entertain me most that week I go vote….. this week, na Thelma get am.”

@jbabyprettygirl:”I tot she said her kinda man isn’t in this house. She now fell for a small boy😂. His cute sha😍.”

Copyright © 2025 Gistlover Media. All Rights Reserved

Pro

Futures

Web3

Trading

Crypto Prices

View real-time crypto prices and top market movers.

Earn

Don’t just HODL, grow your assets by earning interest every hour!

PTU Staking

Stake PTU Token and enjoy a variety of benefits.

Learn

News

Stay up-to-date on the latest news about crypto, blockchain, and NFT.

Academy

Learn all about crypto. Whether you’re a newbie or pro, we got you covered.

Blog

Get insights, investing tips & tricks, and the latest information about Pintu.

FAQ

Have questions about crypto or Pintu App? Find your answers here.

Pro

Futures

Web3

Trading

Crypto Prices

View real-time crypto prices and top market movers.

Earn

Don’t just HODL, grow your assets by earning interest every hour!

PTU Staking

Stake PTU Token and enjoy a variety of benefits.

Learn

News

Stay up-to-date on the latest news about crypto, blockchain, and NFT.

Academy

Learn all about crypto. Whether you’re a newbie or pro, we got you covered.

Blog

Get insights, investing tips & tricks, and the latest information about Pintu.

FAQ

Have questions about crypto or Pintu App? Find your answers here.

Download Pintu App

Language

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia today, September 15, 2025, was recorded at around Rp5,811 per coin (equivalent to $0.3548). This price movement comes amid great attention to the latest developments of the Pi network, which has just reached the v23 testnet upgrade.

This upgrade is an important milestone in Pi Network’s journey towards the long-awaited mainnet launch by its community. For crypto users and enthusiasts, this news is not just a technical update, but also a signal that the project is getting closer to becoming a fully functional cryptocurrency ecosystem.

The Pi Network (PI) price chart on September 15, 2025 shows a downward trend in the last 24 hours. At the beginning of the period, the PI price was hovering around $0.37, but considerable selling pressure drove the price down sharply to a low around $0.35. A few green candlesticks appeared in the middle of the session, signaling a rebound attempt from buyers, but the buying impulse was not strong enough to reverse the market direction.

On the left-hand side, the data shows that PI’s market capitalization stands at around $2.87 billion, with daily trading volume reaching $41.87 million, down more than 25% compared to the previous day. The outstanding supply was recorded at around 8.09 billion PI out of a maximum total of 100 billion PI.

Meanwhile, the community sentiment on the right side of the screen is still quite optimistic, with 88% of the votes showing a bullish stance despite the price correction. Community activity and discussions on the platform also remain lively, indicating that many market participants are still following the development of the PI ecosystem despite the short-term price pressure.

Read also: Bitcoin vs Ethereum: Which Crypto Treasury Strategy Excels in 2025?

Pi Network (PI), one of the most anticipated cryptocurrency projects, is making waves again. The network has officially achieved the v23 testnet protocol upgrade, which is being called an important milestone towards the mainnet launch. With the current price of PI around IDR 5,811 (equivalent to $0.3548), the community sees this step as a clear proof of the progress of the infrastructure that the development team is building. The momentum also revived the enthusiasm of users who have been mining PI tokens since the initial phase.

Pi Network began a series of updates since version 19, with the aim of refining its technical foundations before launching the main network. The previous version 22 introduced improvements to the blockchain API and core components of the system, setting the stage for a big step up to v23.

Now, Testnet 1 has been officially updated to v23, signaling the team’s readiness to enter the next phase. Testnet2 is expected to follow in a few days before the full transition to mainnet.

This upgrade also confirms Pi Network’s commitment to building a stable and secure crypto ecosystem. With a maximum supply of 100 billion PIs, the success of this upgrade reinforces confidence that the project is moving from the pilot stage towards wider adoption.

The community’s enthusiasm was evident on various social platforms, with many users mentioning v23 as a signal that Pi Network is ready to bring real utility.

Also read: Who is the Biggest XRP Owner in 2025?

The move to the v23 protocol means that the testnet environment now meets the technical standards required for a secure and reliable mainnet launch. Such updates typically include improvements to consensus algorithms, transaction handling, as well as compatibility between network layers.

With these upgrades, Pi Network ensures that its infrastructure is able to cope with real-world user demand.

For users, the immediate changes may not feel significant. However, for developers and validators, v23 provides an opportunity to test important functions before the main network is released.

This helps identify potential issues early so that the block chain can be maximally strengthened ahead of the full launch. The success of this stage is also an important foundation for expanding the adoption of Pi cryptocurrency globally.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Start Investing Now

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by Bappebti, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.

Trade on Pintu

Buy & invest in crypto easily

TRADE NOW

Trade on Pintu

Buy & invest in crypto easily

TRADE NOW

The search for the best crypto presale of 2025 is gaining momentum, and MAGACOIN FINANCE is quickly gaining attention. Scarcity-driven tokenomics, high community demand, and dual audits make it an increasingly legitimate competitor in the presale market.

Its popularity comes when XRP and TRON are also in the limelight. The two projects are newly placed on analyst watchlists due to quite different reasons. XRP is gaining traction through its first U.S. spot ETF launch, TRON through its growing DeFi ecosystem, and MAGACOIN FINANCE with the growth potential of a new product with limited supply and transparent mechanisms. Together, these coins indicate that investors are balancing early-stage opportunities with proven credibility.

MAGACOIN FINANCE is emerging as one of the most promising crypto presales in 2025. Based on the Ethereum blockchain, its scarcity mechanism is appealing to both traders and long-term holders. The amount of tokens available is restricted to 170 billion. Every transaction burns 12% of the tokens, generating an endless deflationary force and making the long-term scarcity higher. This design is one of the distinctive items in a presale market that is normally overwhelmed with inflationary models.

There is already a strong interest from investors. Over 13,500 members have raised more than $13.5 million and allowed presale phases to scale progressively without affecting scarcity. Analysts point towards this adoption pace as an indicator of robust adoption and retail excitement.

The HashEx and CertiK audits contribute to additional credibility. Not many presales pass both security checks and this has reassured both the retail customers and the whales. To analysts, these characteristics explain why MAGACOIN FINANCE is increasingly appearing on 2025 watchlists.

Unlike other meme coins whose abundance in the market has caused overproduction of supply, MAGACOIN FINANCE is disciplined in design. According to the analysts, whales are starting to have a greater interest in assets that possess high scarcity mechanics. To them, MAGACOIN FINANCE hits the right boxes: capped supply, burn structure and community driven demand.

These are some of the reasons why many analysts keep it in the list of the most successful crypto presales of 2025. In a market that is seeking sustainability, the factor of scarcity is among the strongest indicators of long-term resilience.

In 2025, XRP has reappeared on analyst watchlists, benefiting from a long-awaited ETF in the U.S. spot market. REX Shares and Osprey Funds confirmed that the XRPR ETF had passed its review period under the Investment Company Act of 1940. The product will be released this week without any objections from the SEC.

The ETF is a big milestone for XRP. According to analysts, it will open up institutional flows and make it easier for traditional investors to access it. At the time of writing, XRP was trading above the critical support level between $2.70 and $2.80, at approximately $3.10. The resistance persists around $3.00-$3.10.

According to technical predictions, the future gains may reach $5 at the end of the year, whereas long-term gains may target $9 to $15. Along with increased use in international payments, the resurgent credibility of XRP is why the cryptocurrency is on analyst watchlists.

Moreover, TRON is continuing to expand the reach of its DeFi and stablecoin offerings. Its TRC20-USDT stablecoin pool is worth approximately $60 billion, representing dominance in terms of liquidity.

Its ecosystem is further strengthened by the presence of DeFi systems such as SunSwap and JustStable. TRON has the second-fastest-growing DApp ecosystem, with Tron products like TRONSCAN and Tron Wallet becoming widely adopted. A new gasless stablecoin by founder Justin Sun scheduled to launch in the future is also likely to drive demand in 2025.

TRX price projections are moderately optimistic. Analysts project a consistent increase powered by DeFi adoption and the liquidity of stablecoins. The development of its ecosystem makes TRON a relevant entry on the watchlist of analysts in the coming year.

The balance between old and new coins in the market can be detected by the existence of XRP, TRON, and MAGACOIN FINANCE on analyst watchlists. XRP presents the gains of regulation and the power of its ETF launch. TRON shows the ability to endure due to DeFi, liquidity of stablecoin, and infrastructure development.

However, MAGACOIN FINANCE offers something different. As an Ethereum-based presale with a capped supply, strong burn mechanics, and dual audits, its limited market cap provides room for growth that older projects cannot match.

MAGACOIN FINANCE has emerged as the best crypto presale of 2025 to investors. Its model of scarcity and fast adoption, according to analysts, places it in a position to outshine and it is the underdog to follow throughout the year.

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

TLDR PayPal expands its PYUSD stablecoin to eight new blockchains including Tron and Avalanche. The…

Since launching 12 years ago, Bankless Times has brought unbiased news and leading comparison in the crypto & financial markets. Our articles and guides are based on high quality, fact checked research with our readers best interests at heart, and we seek to apply our vigorous journalistic standards to all of our efforts.

BanklessTimes.com is dedicated to helping customers learn more about trading, investing and the future of finance. We accept commission from some of the providers on our site, and this may affect where they are positioned on our lists. This affiliate advertising model allows us to continue providing content to our readers for free. Our reviews are not influenced by this and are impartial. You can find out more about our business model here.

A crypto crash is underway even as the US stock market surged to a record high. Bitcoin and most altcoins, such as Dogecoin (DOGE), Sui (SUI), and MYX Finance (MYX), were among the top laggards.

The market capitalization of all cryptocurrencies plunged to about $4 trillion, down from over $4.1 trillion. This article highlights some of the top reasons why the crypto market is going down.

Why a Crypto Crash is Happening: Options Expiry

The ongoing crypto crash is happening as investors react to a $4.3 billion options expiry on Deribit.

Data shows that Bitcoin options worth about $3.5 billion and Ethereum valued at over $800 million will expire today.

For Bitcoin, the maximum pain was about $114,000, down from the current $116,00. Ethereum’s maximum pain was about $4,500, slightly higher than the current price.

Historically, cryptocurrencies tend to drop before and after a huge options expiry event as investors sell some of their positions.

READ MORE: Ondo Crypto Price Forms Rare Bullish Pattern as Key Metric Surges

The other major reasons why the crypto crash is happening is that investors are booking profits after most of them went parabolic.

A closer look at the crash shows that the best-performers during the week were among the top laggards.

For example, MYX Finance moved from nowhere to becoming the best-performing coin in which some investors attributed to manipulation. It jumped by over 1,800% between its lowest and highest levels this month.

Similarly, Dogecoin jumped ahead of the Rex-Osprey Dogecoin ETF (DOJE) and then slipped after its launch as investors booked profits and sold the news. Some of the other tokens that surged during the week and then plunged on Friday were the likes of Worldcoin, Mantle, and Pump.

A few technical factors explain why the crypto crash is happening. The most notable one, which is shown in the chart above, is that the Bitcoin price has formed a rising wedge and a bearish divergence pattern on the daily chart.

A rising wedge pattern happens when an asset forms two ascending and converging trendlines. A breakdown happens when the two lines are about to converge. The coin has also formed a bearish divergence pattern as the MACD and the Relative Strength Index have moved downwards.

MYX Finance also formed a giant double-top pattern as it surged during the week. It also became highly overbought as the RSI and other oscillators soared.

The other reason why the crypto crash is happening is that investors are selling the news after the Federal Reserve delivered its first interest rate cut of the year.

READ MORE: Avalanche Price Prediction: Stablecoin Growth, AVAX ETFs Points to a Surge to $50

We`ve got crypto covered – every trend, every insight, every move that matters. Add us to your feed and stay ahead of the market.

Since launching in 2012, Bankless Times is dedicated to bringing you the latest news and informational content within the alternative finance industry. Our news coverage spans the whole crypto-sphere so you’ll always stay up to date — be it on cryptocurrencies, NFTs, ICOs, Fintech, or Blockchain.

Ian and Nick Steele initially thought their £1m lottery win was a "cruel joke"

A chef who has supported his wife through multiple sclerosis said winning £1m on the National Lottery "means everything".

Ian Steele, of Heywood, Greater Manchester, said he started "shaking like a leaf" when he realised his Euromillions Millionaire Raffle prize was not a mistake.

When the 53-year-old called his wife, Nick, who was diagnosed with MS 18 years ago, to tell her the news she too thought it was a "cruel joke".

"It was only when the lady from The National Lottery turned up to pay us and handed us a bottle of champagne that I think I finally let myself believe it was real," he said.

Mr Steele said he went off to work after checking the National Lottery app which confirmed he had no matching numbers.

But during his break he spotted an email which said he had won a prize.

The family said the money would take the pressure of them

"I thought no I haven't, I've already checked.

"I logged into the app and still only had £1.50 in my account, but then it sunk in. In the draw results the raffle number was lit up in blue with a tick next to it."

Mr Steele won by matching the raffle code on the EuroMillions Millionaire Maker – a unique code on each ticket which is entered into a raffle, with a top prize of £1m.

Mr Steele added that, because of Nick's diagnosis while pregnant with their daughter Chloe, the couple had not always been able to enjoy the things many people took for granted.

"Nick had to medically retire from her role as a specialist dental nurse, supporting and caring for extremely sick people at Manchester Hospital.

"While it was absolutely the right thing to do, it made things that little bit more difficult. We've had to be careful with money and not splurge," he said.

But the win now means the couple have a chance to fulfil lifelong dreams.

Daughter Chloe said she could not wait to go to Disneyland

"I'm the dreamer in the house and always said that if we won big, we'd treat ourselves," Mr Steele said.

He said the first thing daughter Chloe asked was if the win meant the family could go to Disneyland.

"We're big Star Wars fans and it's something we've always talked and dreamed about – and now that dream will come true," Mr Steele said.

He added that he planned to continue his job as a school chef manager but added that the win "takes the financial weight off our shoulders".

Tell us which stories we should cover in Greater Manchester

Listen to the best of BBC Radio Manchester on Sounds and follow BBC Manchester on Facebook, external, X, external, and Instagram, external and watch BBC North West Tonight on BBC iPlayer.

Lottery winner celebrates with Blackpool holiday

Winners of £61m EuroMillions jackpot revealed

Lottery winners create garden at children's hospital

Lottery winner wants to give back in boys' memory

Midwife continues labour of love after lottery win

National Lottery

Greater Manchester road cordoned off as emergency services called to incident

Two people rushed to hospital following crash on busy road

Trucker jailed for killing dad in M-way smash near Wigan

Predatory Wigan paedophile caged for abusing more than 40 girls

Farm shop frequented by Molly Mae changes operations due to high popularity

Police investigate reports of 'bleeding man carrying a knife' at Macclesfield park

Estonia seeks Nato consultation after Russian jets violate airspace

British couple freed by Taliban hug daughter in emotional reunion

US TV hosts back Kimmel as Trump threatens networks

Britishness and free speech – why we travelled 200 miles to Robinson's London rally

The lonely life and death of Delhi's only African elephant

The motive behind Charlie Kirk's killing: What we know and don't know

Why France is at risk of becoming the new sick man of Europe

Cardi B settles scores on first album for seven years

Brendan Carr's emboldened FCC takes on Trump's media foes

Rugby World Cup semi-final: England v France preview

Joy Crookes 'let go' of perfectionism – her music is better for it

Ros Atkins on… What Kimmel's suspension means for free speech in the US

Your first look at Alan Partridge’s 'brave' new project

Should we be having breakfast?

The gang who stole over £50 million from taxpayers

Ian traces the 'useless man' joke back to an old British tradition

Estonia seeks Nato consultation after Russian jets violate airspace

Ambulance workers arrested after six people die

Judge strikes down 'superfluous' Trump lawsuit against the New York Times

US TV hosts back Kimmel as Trump threatens networks

Naked and high flight attendant 'let himself down'

Britishness and free speech – why we travelled 200 miles to Robinson's London rally

British couple freed by Taliban hug daughter in emotional reunion

HGV driver 'distracted by porn' killed dad-of-two

Corbyn allies disappointed at row with Sultana over new party

Phillipson suggests two-child benefit cap could be lifted

Copyright © 2025 BBC. The BBC is not responsible for the content of external sites. Read about our approach to external linking.

We participate in marketing programs, our editorial content is not influenced by any commissions. To find out more, please visit our Term and Conditions page.

We participate in marketing programs, our editorial content is not influenced by any commissions. To find out more, please visit our Term and Conditions page.

–

Pi Network price is currently $0.3545 and the altcoin is approaching a crucial moment with the TOKEN2049 event in Singapore on October 1–2. Investors are hoping for clear guidance that could drive Pi Coin back toward the $1 mark. Meanwhile, Cardano continues to face resistance near $0.90, and Remittix (RTX) is gaining momentum as a top pre-launch PayFi altcoin, attracting investors looking for high-growth opportunities.

Pi Network is still under pressure even after recovering from its all-time low of $0.3223. Currently trading at approximately $0.356, the token has made multiple attempts to break out above the $0.40 resistance but has been turned back. Technical charts are showing a pattern of a converging triangle, which implies consolidation before a breakout.

The community is looking for four key updates at TOKEN2049: the Protocol Version 23 upgrade with smart contracts and improved nodes, a transparent roadmap toward exchange listings, updates on the Pi App Studio, and clarity about the $100 million Pi Ventures fund. If these announcements meet expectations, Pi Coin price could see a short-term rise toward $0.50, with long-term potential toward $1 by late 2025 or early 2026.

Cardano is currently $0.871. ADA recently attempted to break the $0.90 resistance but was rejected, leaving the price consolidating below this level. Key support sits at $0.77 and $0.70, while resistance remains at $0.90 and $1.

Momentum is running out of steam. A pennant pattern suggests the uptrend can catch its breath while buyers reload. Meanwhile, the RSI has been printing lower highs since July, reflecting bearish divergence. If ADA cannot reclaim $0.90 in the near future, prices can drift toward $0.77 or worse.

Remittix continues to gain attention in the crypto market as a high-potential PayFi token. The team is now fully verified by CertiK, ensuring top-level security and transparency. Remittix is officially ranked #1 on CertiK for pre-launch tokens, giving investors confidence in its credibility.

The Remittix wallet beta is now live, allowing community members to test the platform ahead of the full launch. The project also offers a 15% USDT referral program, payable daily, creating opportunities for investors to grow their holdings while promoting the token.

Investors are drawn to Remittix for several reasons:

With over 664 million tokens sold and $25.9 million raised, Remittix is attracting smart money looking for a high-growth alternative to traditional meme coins and altcoins.

Pi Network price remains in consolidation under $0.40, awaiting major announcements at TOKEN2049. Cardano faces resistance at $0.90 with bearish signals showing a potential pullback. Meanwhile, Remittix is emerging as a top pre-launch PayFi altcoin, verified by CertiK and actively testing its wallet, offering 15% USDT referral rewards. Investors seeking growth in 2025 are keeping a close eye on Remittix, as its combination of real-world use cases, security, and early adoption could make it a standout in the altcoin market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

LiveBitcoinNews is a leading online platform dedicated to providing the latest news and insights about Bitcoin and the broader cryptocurrency market. It offers timely updates on market trends, regulatory developments, technological advancements, and expert analyses, catering to both seasoned investors and newcomers in the digital currency space. The site features a variety of content, including articles, guides, interviews, and opinion pieces, making it a comprehensive resource for anyone interested in staying informed about the rapidly evolving world of cryptocurrencies.

Contact us: support@livebitcoinnews.com

© Copyright – Livebitcoinnews.com

Ethereum is starting to get some serious attention from institutional investors, and it seems like the days of Bitcoin being the only game in town are over. The recent surge in ETF inflows for Ethereum has been nothing short of phenomenal. On September 18, 2025, Ethereum’s ETFs raked in $213 million in net inflows, putting Bitcoin’s $163 million to shame. This is a huge moment for Ethereum and a sign that we’re entering a new chapter in the cryptocurrency world.

If you’re not familiar with them, Exchange-Traded Funds (ETFs) are a way for both institutional and retail investors to get into cryptocurrencies without actually owning them. The recent inflow numbers show that more people are willing to put their money into these digital assets. It’s no longer just a trend; it’s becoming a standard part of the financial landscape. And now, with Ethereum rising in popularity, it seems like it’s going to be a big player.

The age-old rivalry between Ethereum and Bitcoin is heating up. For a long time, Bitcoin was the king, but Ethereum’s technical advancements and its role in decentralized finance (DeFi) have caught the eye of many institutional investors. It’s clear now that Ethereum is not just another cryptocurrency; it’s becoming a core part of a new financial system. The inflow numbers reflect that.

This surge in institutional money isn’t just a flash in the pan; it’s a sign that cryptocurrencies are becoming legitimate assets in the eyes of big investors. These guys are looking for safe, regulated ways to invest in this space, and they’re finding it in Ethereum. This could mean better liquidity and stability for Ethereum, which is something everyone can get behind.

One of the most interesting trends emerging from all this is the adoption of crypto payroll solutions. Companies, especially small and medium-sized firms, are starting to pay their employees in crypto. Why? Because it allows for faster cross-border payments and cuts down on transaction fees. By using stablecoins and blockchain, companies can pay their employees in different parts of the world without the usual banking headaches.

This is particularly appealing to tech-savvy workers or freelancers who would rather receive their salary in crypto. As more companies jump on board, the demand for crypto payroll services is likely to rise, which means the worlds of crypto and traditional finance are becoming even more intertwined.

Ethereum isn’t just a cryptocurrency; it’s also a key player in the DeFi movement. Thanks to its smart contracts, a whole new world of financial products and services is opening up. As institutional interest grows, so will the acceptance of DeFi applications.

Expect to see more Ethereum in various financial services as more people recognize its potential. This could lead to a financial system that’s a bit more accessible, where anyone can get financial services without having to go through traditional banks.

Looking forward, the trends surrounding Ethereum’s ETF inflows and crypto payroll solutions will likely continue to evolve. As regulations become clearer and technology improves, more investors will probably want a piece of the Ethereum pie. The acceptance of digital assets in traditional finance could lead to new financial products designed for a wider range of investors.

As companies increasingly adopt crypto payroll solutions, the demand for platforms and compliance services will surge. Expect new startups to emerge, focusing on helping businesses navigate the increasingly complex world of crypto payments.

There you have it. Ethereum’s recent ETF inflows are changing the game, signaling a new era of institutional interest and market dynamics. As businesses warm up to crypto payroll solutions, we’re seeing digital assets becoming a part of everyday financial operations. For investors and companies, understanding these trends is key to navigating this evolving landscape and seizing the opportunities ahead.

Get started with Crypto effortlessly. OneSafe brings together your crypto and banking needs in one simple, powerful platform.

Circle's CCTP V2 revolutionizes USDC transfers with seamless cross-chain capabilities, enhancing liquidity and interoperability across blockchain networks.

The recent minting of 1 billion USDT by Tether signals a shift in crypto liquidity, raising questions about market trends, risks, and alternative stablecoins for startups.

Discover how crypto payroll enhances financial inclusion for the unbanked, offering faster payments, lower costs, and greater financial autonomy.

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free