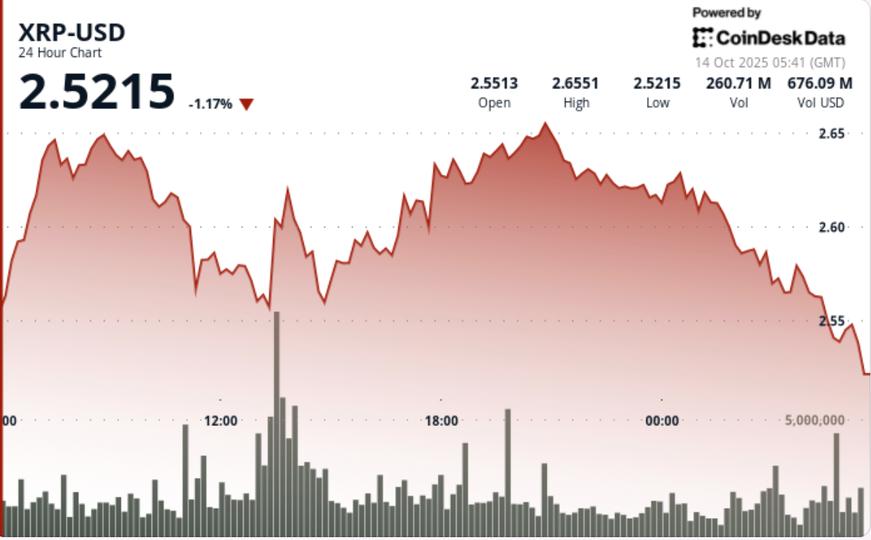

Aggressive selling near $2.66 resistance and a major Binance inflow signal short-term distribution while volume data show institutional dip-buying defending $2.55.

XRP’s rebound from Friday’s sub-$1.58 liquidation lows lost steam overnight as fresh whale activity hit exchanges. A single 23.9 M XRP transfer (≈ $63 M) to Binance coincided with selling pressure that erased early gains. The move came as open interest jumped 2.4 % to $1.36 B, suggesting leveraged positioning remains elevated even after the $32 B market-cap recovery that followed Trump’s tariff-driven crypto rout.

Broader risk markets stabilized as trade-war rhetoric softened, but derivatives desks flagged renewed short build-ups near $2.65–$2.66.

The $2.55–$2.56 zone continues to anchor near-term support after repeated high-volume defenses. Resistance is firm at $2.65–$2.66 where profit-taking and whale flows triggered multiple rejections.

Momentum bias leans bearish while XRP trades below its 200-day MA ($2.63), though a sustained reclaim above $2.60 could reset the structure for another $2.70 test. Volume remains the key tell: spikes on dips show institutions buying weakness, but lower highs suggest supply still outweighs demand.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

More For You

DOGE Faces Rejection at $0.22 as Dogecoin Treasury Firm Eyes Public Listing

The token found strong demand near $0.20 as institutional flows persisted, even as broader markets reacted to shifting trade rhetoric and renewed regulatory scrutiny following House of Doge’s Nasdaq debut.

What to know:

Disclosure & Polices: CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation.