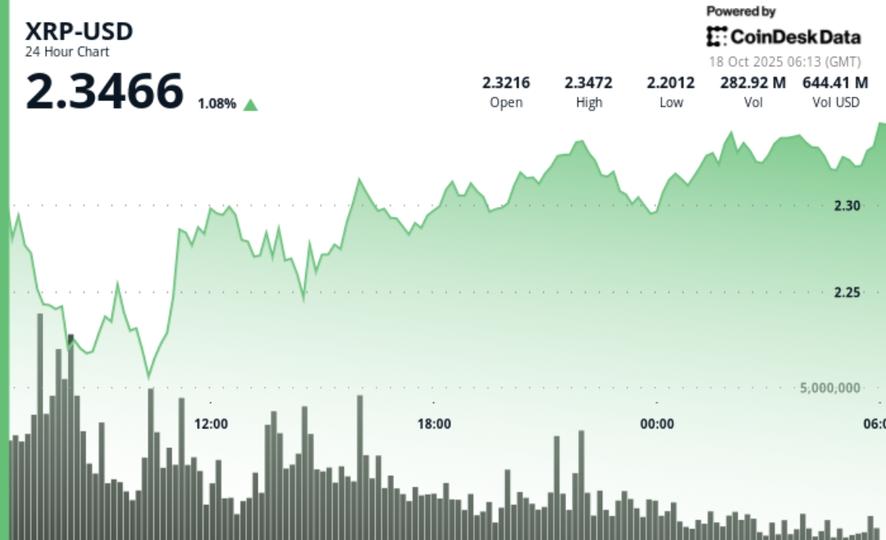

• XRP traded defensively, recovering from an early dip to $2.19 as institutional buyers absorbed selling pressure.

• Trading volume surged to 246.7M, nearly triple the 24-hour average, as sellers capitulated near $2.23.

• The SEC's review of six pending spot XRP ETF filings continues, with Ripple planning a $1B treasury raise.

XRP traded defensively but held key supports Friday, recovering from an early dip to $2.19 as institutional buyers absorbed selling pressure. The move came amid renewed U.S.–China tariff fears and cautious positioning ahead of next week’s SEC deadlines for spot XRP ETFs.

What to Know

• XRP oscillated between $2.19 and $2.35 over the 24-hour session from Oct 17, 06:00 to Oct 18, 05:00 — a 7% range.

• Trading volume hit 246.7M during the 07:00 hour, nearly triple the 24-hour average, as sellers capitulated near $2.23.

• Price recovered from a $2.19 low to settle at $2.33, logging a 1% gain from the session open.

• Broader crypto market cap dropped 6% to $3.5T as macro tensions and U.S.–China trade rhetoric spurred risk-off flows.

• SEC review of six pending spot XRP ETF filings continues through Oct 25, alongside Ripple’s planned $1B treasury raise.

News Background

The early-session decline mirrored weakness across the digital asset complex as investors reduced exposure ahead of trade-related headlines and ETF deadlines. Despite a sharp morning drawdown from $2.33 to $2.19, XRP stabilized quickly as market depth recovered on strong buy programs. Ripple’s $1B fundraising initiative for its treasury division bolstered confidence, while analysts framed the move as “controlled rotation” rather than structural weakness.

Price Action Summary

• XRP dropped to $2.19 at 07:00 UTC on 246.7M volume, setting key intraday support.

• Bulls regained control through mid-session, driving a steady climb to $2.33–$2.35 resistance.

• The final 60 minutes (04:22–05:21 UTC) saw a minor flush to $2.32 followed by a rebound to $2.33 (+1.8%), with 1.69M in peak tick volume.

• Consolidation between $2.32–$2.34 formed the new short-term base, validating strong absorption near prior lows.

Technical Analysis

• Support – $2.23–$2.25 remains the key accumulation zone; sub-$2.20 exposure continues to attract long interest.

• Resistance – $2.35–$2.38 intraday band caps upside; breakout confirmation needed above $2.40.

• Volume – Peak at 246.7M during selloff; late-hour surges (~1.7M) signal return of liquidity.

• Trend – Gradual upward bias after morning flush; RSI neutral, MACD stabilizing.

• Structure – Short-term consolidation within $2.19–$2.35 suggests reaccumulation ahead of potential ETF headline catalysts.

What Traders Are Watching

• ETF approval window (Oct 18–25) and potential market repricing once SEC determinations land.

• Whether $2.30 holds as base support through weekend trading.

• Continuation of Ripple’s $1B treasury raise and potential secondary-market implications.

• Broader risk sentiment as tariff escalation dampens altcoin liquidity.

• Technical breakout above $2.40 as signal for rotation back toward $2.70–$3.00 range.

More For You

OwlTing: Stablecoin Infrastructure for the Future

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

Chainlink's LINK Plunges 9% as Intense Selling Overpowers Caliber's $2M Accumulation

Nasdaq-listed Caliber purchased $2 million LINK while the Chainlink Reserve added nearly 60,000 tokens, but bears remain in control.

What to know:

Disclosure & Polices: CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of Bullish (NYSE:BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services. Bullish owns and invests in digital asset businesses and digital assets and CoinDesk employees, including journalists, may receive Bullish equity-based compensation.