Bitcoin Price Prediction: Can Jiuzi’s $1B Bet and Belarus Fuel Breakout? Cryptonews

source

Senators warn health secretary’s advice on Tylenol in pregnancy lacks scientific basis, raising alarm in GOP ranks

Donald Trump is facing a simmering Republican backlash over the policies of Robert F Kennedy Jr, the health secretary, amid unease over the administration’s pronouncements on the causes of autism and changes to children’s vaccine policy.

Republicans in Congress are threatening to “break ranks” after this week’s White House announcement by Trump – flanked by Kennedy – claiming a link between autism and Tylenol, an over-the-counter medication, also known as paracetamol, that is widely used to relieve pain experienced by pregnant women.

Medical experts and autism specialists say there is no scientific evidence to support the claim.

Leading the rebellion is Bill Cassidy, a Republican senator for Louisiana and chair of the Senate health committee, who previously voted to confirm Kennedy to become secretary of the Department of Health and Human Services (HHS), despite having voiced misgivings about his anti-vaccine views.

“HHS should release the new data that it has to support this claim,” Cassidy, a medical doctor, wrote on social media. “The preponderance of evidence shows that this is not the case. The concern is that women will be left with no options to manage pain in pregnancy.”

Cassidy, who is up for re-election to the Senate next year, expanded on his comments in an interview with the Hill.

“You’re going to change a medical guideline without science?” he told the site, referring to last week’s Senate testimony by Susan Monarez. She said during a hearing that she was sacked as head of the Centers for Disease Control and Prevention after Kennedy pressed her to approve new childhood vaccination recommendations regardless of scientific data.

“I mean, you’re going to build a bridge without physics? You’re going to fly a plane without engineering?”

Other Republicans supported Cassidy’s critique, including Susan Collins, a senator for Maine.

“It appears that [Monarez] was under a lot of pressure to approve recommendations that may come from the [vaccine advisory] committee that may lack scientific basis, so that is disturbing and would undermine our public health efforts,” Collins told the Hill.

“I’m very pleased that Chairman Cassidy is having these hearings.”

Lisa Murkowski, a senator for Alaska, called Monarez’s description of the workings of Kennedy’s vaccine policy committee “very unsettling and very concerning”.

Others said Kennedy threatened to become a political liability for Trump.

“You see a lot of Republicans starting to break ranks here, and there’s a lot of noise. I think it will come down to Trump and what his tolerance level is for all this noise around [Kennedy],” one unnamed senator told the Hill.

“I don’t think he likes all the noise. He hasn’t liked that previously. He has a really low tolerance level for that, but Bobby Kennedy is different. He’s not like anyone else in the cabinet.”

Medical bodies including the Society for Maternal-Fetal Medicine and the American College of Obstetricians and Gynecologists have endorsed the use of acetaminophen – a principal ingredient of Tylenol – as a treatment for fever and pain during pregnancy after Trump advised women during Monday’s press conference to avoid taking the drug and instead “tough it out”.

Leading cryptocurrencies edged higher on Wednesday, but overall market sentiment remained cautious and marked by “Fear.”

Bitcoin recovered slightly from the sharp sell-off earlier this week, nearly breaking $114,000 on the day.

Ethereum, on the other hand, dived further, hitting an intraday low of $4,081.35. The second-largest cryptocurrency is down 16.82% from its all-time high last month.

Bitcoin’s market dominance climbed to 58%, while altcoins, excluding Ethereum, accounted for more than 29%.

Nearly $270 million was liquidated from the cryptocurrency market in the last 24 hours, with long liquidations accounting for $186 million.

Bitcoin’s open interest dropped 1.35% in the last 24 hours. A drop in open interest coupled with a price increase typically signals that short sellers are closing their positions. Meanwhile, over 55% of Binance traders with open BTC positions were long Bitcoin.

"Fear" sentiment prevailed in the cryptocurrency market, according to the Crypto Fear & Greed Index.

Top Gainers (24 Hours)

The global cryptocurrency market capitalization stood at $3.90 trillion, following a modest increase of 0.44% in the last 24 hours.

Stocks dipped further on Wednesday. The Dow Jones Industrial Average fell 171.50 points, or 0.37%, to end at 46,121.28. The S&P 500 lost 0.28% to finish at 6,637.97, while the tech-heavy Nasdaq Composite closed down 0.34% at 22,497.86.

The sell-off comes ahead of the weekly jobless claims data and the all-important personal consumption expenditures price index, as investors look for clues on monetary policy following last week’s quarter-point rate cut.

Chris Kline, the co-founder and COO of Bitcoin IRA, said in a note to Benzinga that the seasonal volatility shouldn’t "concern" long-term cryptocurrency investors, despite the September correction and Fed's rate cut falling short of expectations.

Kline predicted that things may change drastically in October, a month which has historically shown "strong performance patterns."

"We’re positioned at the threshold of a significant institutional adoption wave that will dwarf current market fluctuations," the analyst added.

On-chain analytics firm CryptoQuant said that Bitcoin's implied volatility has dropped to its lowest level since 2023, a point that previously preceded a historic rally of over 325%.

Moreover, with exchange reserves at multi-year lows, the Market Value to Realized Value ratio in the neutral zone and funding rates staying balanced, it was more like a "calm before the storm," CryptoQuant added.

Photo Courtesy: Shutterstock AI on Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A newsletter built for market enthusiasts by market enthusiasts. Top stories, top movers, and trade ideas delivered to your inbox every weekday before and after the market closes.

Winning numbers drawn in Wednesday’s Michigan Daily 3 Evening San Francisco Chronicle

source

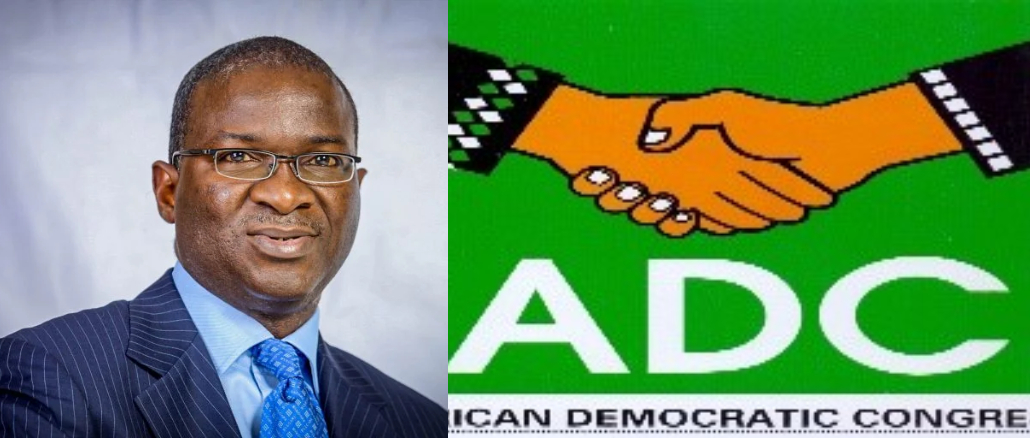

Former Minister of Works and Housing, Babatunde Fashola, has weighed in on the recent formation of a new political coalition involving key opposition leaders, asserting that the development disproves concerns that Nigeria is heading toward a one-party system.

Speaking during an interview on Channels Television on Saturday, Fashola said the decision to adopt the African Democratic Congress (ADC) as the coalition’s platform reinforces the constitutional right of Nigerians to freely associate politically. However, he raised questions about the ideological depth and sustainability of the alliance.

“There’s something significant about what’s happening. It completely counters the narrative that Nigeria is becoming a one-party state. The presence of a coalition even if its strength is uncertain shows that there is still organized opposition,” he remarked.

The former governor of Lagos State welcomed the renewed political participation, but emphasized that the coalition’s influence will depend on the strength of its policies and clarity of purpose.

“Coming together to say you want to change Nigeria is not enough. What is the alternative vision? Without a clear manifesto or action plan, it’s difficult to gauge how effective or convincing the group will be,” he said.

Fashola also criticized the opposition for what he called a prolonged period of silence, saying they had failed to perform their role of holding the ruling party accountable in recent years.

“I support political association and believe the country can benefit from this renewed energy in opposition politics. But truthfully, they’ve been inactive for the past two years,” he added

Copyright © 2025 Gistlover Media. All Rights Reserved

So, you’re an SME looking to take the plunge into crypto payments? Well, as someone who’s been keeping an eye on the market, let me tell you, these Bitcoin options expirations can be a double-edged sword. With over $17.5 billion worth of options about to expire, the stakes are high. I mean, the “max pain” price is sitting at an unrealistic $107,000. Sounds fun, right? But historical patterns suggest that Bitcoin often moves towards this max pain level, and that can mean significant volatility.

Historically, September has been a tough month for Bitcoin. It often sets the stage for seasonal bottoms before the more positive vibes of Q4. Combine that with the anticipation of the options expirations, and you’ve got a potentially bearish setup. For SMEs who are planning to pay employees in cryptocurrency, this volatility could wreak havoc on payroll timing and amounts.

So how do we manage this rollercoaster? Well, here are a few strategies that could save some sanity:

Timely Conversion: Think about converting your Bitcoin receipts immediately. This way, you can avoid the wild swings that could mess with your cash flow.

Diversification: Don’t put all your eggs in one crypto basket. Spread those assets around a bit. It’s good to have a cushion when the crypto tides turn.

Hedging: Use disciplined buying and selling guidelines, and consider stop-loss orders if you’re comfortable.

Crypto Payment Platforms: Some third-party platforms convert crypto payments to fiat instantly. That could offload some of the volatility risk from your balance sheet.

Stablecoins are your friend. They’re pegged to traditional currencies, which means your employees won’t be affected by Bitcoin’s wild swings. And your payroll processes will be a lot smoother.

As the crypto payment landscape continues to evolve, staying adaptable is key for SMEs. With the right strategies, you can navigate the volatility of Bitcoin and keep your payroll stable. It’s a tricky dance, but with some foresight, your business can still thrive in this ever-changing environment.

Get started with Crypto effortlessly. OneSafe brings together your crypto and banking needs in one simple, powerful platform.

Bybit's 245 trading model revolutionizes finance, enhancing global access and liquidity while presenting unique regulatory challenges for digital banking startups.

Explore the CFTC's initiative on stablecoins, compliance strategies for SMEs, and the risks of using stablecoins in traditional finance.

Institutional investment in Ethereum is on the rise, with innovative yield strategies and structured products reshaping asset management. Discover how ETH is now a cornerstone for institutional portfolios.

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free

![]() Vishal Dixit

Vishal Dixit

FXStreet

Pi Network (PI) trades at $0.3653 at press time on Thursday, retracing from the $0.3747 high. The technical and exchange reserves indicate a bullish bias, with an RSI divergence, a double bottom pattern, and a sharp outflow from the Centralized Exchanges (CEXs) wallet balances, pointing to increased demand.

PiScan data shows the CEXs’ wallet balances recording an outflow of 5.14 million PI tokens in the last 24 hours, dropping the reserve to 409.55 million tokens. This massive withdrawal accounts for a 1.24% decrease in CEX’s balances, indicating a surge in demand among investors, is likely driven by the start of the Pi Hackathon 2025, the ecosystem’s first hackathon after the launch of Open Network.

CEXs’ wallet balances. Source: Coinglass

Pi Network’s PI token edges higher by nearly 1.50% at press time on Thursday, extending the 4.92% rise from Wednesday. The reversal from the $0.3442 support level hints at a double bottom pattern reversal, previously tested on August 6, targeting the 50-day Exponential Moving Average (EMA) at $0.4319.

The declining average line aligns with the resistance trendline of a falling channel pattern, as marked on the daily chart (shared below). A decisive close above this level could reinforce a potential bullish trend, targeting the $0.5000 psychological level.

The Relative Strength Index (RSI) reads 42 on the daily chart, inching closer to the halfway line as buying pressure recovers. Additionally, the RSI has significantly recovered compared to the previous dip at $0.3442 level, indicating a bullish divergence.

Still, the Moving Average Convergence Divergence (MACD) and its signal line have merged and moved sideways, signaling a loss in decisive trend momentum.

PI/USDT daily price chart.

On the contrary, a reversal below the $0.3442 support level would invalidate the double bottom reversal pattern, increasing the risk of the $0.3220 support level, which aligns with the all-time low.

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Nasdaq-listed DeFi Development Corp (DFDV) is increasing its stock repurchase program from $1 million to $100 million, following board approval on Wednesday.

BNB is holding steady above $1,000 on Wednesday as Franklin Templeton announced it will expand its Benji tokenization platform to the BNB Chain.

Ripple (XRP) rises above $2.88 on Wednesday, reflecting a bullish wave across the wider cryptocurrency market, which has seen Bitcoin (BTC) also climb above the $113,000 level.

Hyperliquid (HYPE) is staging a recovery, following five consecutive days of declines, which have been mirrored across the cryptocurrency market since late last week.

Bitcoin shows strength, continuing its three consecutive weeks of recovery and holding steady above $116,000 on Friday. The recovery extends following the dovish Federal Reserve stance.

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

©2025 "FXStreet" All Rights Reserved

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.