The cryptocurrency market, as of late September 2025, is witnessing a fascinating divergence in investor sentiment. While established altcoins like Ripple’s (XRP) continue to experience dramatic price swings driven by regulatory outcomes and market speculation, a growing cohort of investors is turning their attention to new, utility-driven projects like Ruvi AI (RUVI). The presale of Ruvi AI, an AI-powered super app for the burgeoning creator economy, is particularly appealing to those seeking a “safer entry” into potential high-growth opportunities, away from the unpredictable volatility that has long characterized the digital asset space.

This shift highlights a maturing market where participants are increasingly scrutinizing the underlying value proposition and stability of their investments. Ripple’s journey through a protracted legal battle has undoubtedly shaped its price action, creating both significant rallies and sharp corrections. In contrast, Ruvi AI’s structured presale, backed by a clear utility roadmap and security audits, offers a perceived haven for investors looking for more predictable gains in the rapidly expanding AI-crypto frontier.

Ripple’s (XRP) path to late 2025 has been nothing short of tumultuous, largely defined by its landmark legal battle with the U.S. Securities and Exchange Commission (SEC). The lawsuit, initiated in December 2020, alleged that Ripple Labs (XRP) and its executives, CEO Brad Garlinghouse and co-founder Chris Larsen, conducted an unregistered securities offering through XRP sales. This legal cloud led to significant price declines and delistings from several U.S. exchanges, branding XRP as “dead money” for a period. However, a pivotal moment arrived in July 2023, when U.S. District Judge Analisa Torres delivered a partial victory, ruling that XRP sold to retail investors on public exchanges did not constitute an unregistered security.

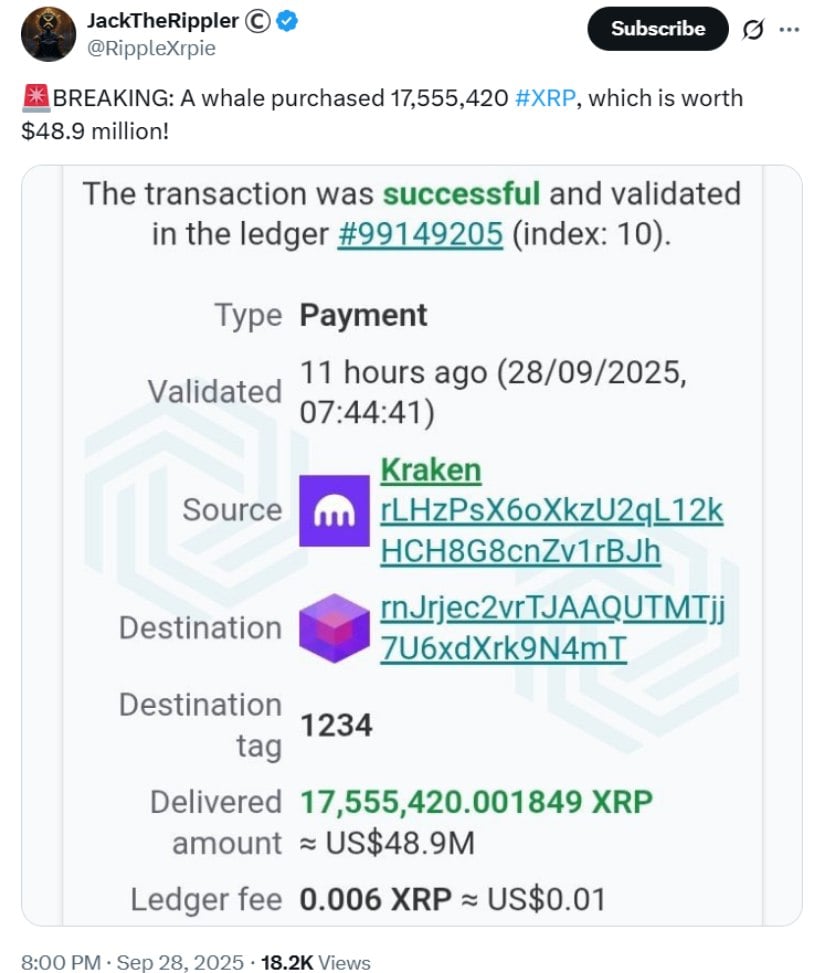

This ruling provided critical regulatory clarity for secondary market sales of XRP, sparking an immediate 87% price surge. The legal saga formally concluded in August 2025, when Ripple and the SEC jointly announced they would drop their respective appeals. This decision locked in Judge Torres’s 2023 summary judgment as the final word on XRP’s status, removing a significant overhang. Ripple subsequently paid a $125 million civil penalty for its institutional sales violations, a fraction of the $2 billion the SEC had initially sought. The lawsuit’s conclusion ignited another robust rally, pushing XRP’s price to around $3.05, peaking near $3.30, and driving institutional trading volume up by 208%.

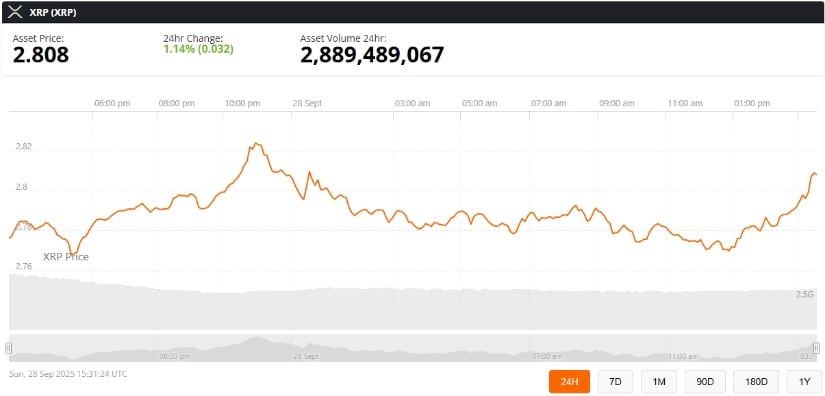

Despite this impressive comeback, XRP’s price has remained subject to considerable volatility. After reaching a seven-year high of $3.65 in July 2025, fueled by institutional adoption and the launch of products like the ProShares Ultra XRP ETF (UXRP), September 2025 saw a pullback, with XRP consolidating around the $2.80 mark. Analysts noted a “bearish weekly MACD cross,” historically a precursor to downward movements. Key players throughout this saga include Ripple Labs (XRP), relentlessly defending XRP’s currency status, and the U.S. Securities and Exchange Commission (SEC), whose shifting stance under new leadership (potentially influenced by a more crypto-friendly administration) ultimately led to the settlement. Market reactions have consistently shown that favorable legal news acts as a strong catalyst for XRP, drawing renewed investor confidence.

The sustained price volatility of (XRP) has created distinct implications for Ripple Labs (XRP) and simultaneously highlighted the unique appeal of emerging projects like Ruvi AI (RUVI). Ripple Labs, as the primary holder and issuer of XRP, directly experiences the financial impact of these price swings. Significant fluctuations affect its balance sheet, influence revenue generated from XRP sales (a historical funding source), and can impact the market perception and adoption of its enterprise solutions like RippleNet and On-Demand Liquidity (ODL) among financial institutions. While regulatory clarity has improved, the inherent volatility of a large-cap cryptocurrency means Ripple Labs must continually navigate market sentiment and competition.

Conversely, Ruvi AI (RUVI) has strategically positioned itself to capitalize on the market’s desire for more stable and predictable investment opportunities. The project’s presale model offers a “safer entry” for investors seeking potential gains without the immediate exposure to the dramatic price swings seen in established assets like XRP. Ruvi AI’s value proposition is rooted in its utility-driven approach: an AI-powered “super app” designed for the booming creator economy, offering tools for trend research, script generation, and media creation. This tangible utility provides a fundamental basis for its value, contrasting with purely speculative tokens.

The presale model’s structured pricing, with guaranteed incremental price increases across phases (e.g., Phase 2 at $0.015, Phase 3 at $0.020, with a guaranteed 40% increase to $0.028 in Phase 4), offers early investors a clear roadmap for potential “paper gains” before public listing. This predictable appreciation, coupled with VIP tiers offering substantial bonus tokens for larger investments, mitigates some of the speculative risk inherent in the broader crypto market. Furthermore, Ruvi AI’s credibility is bolstered by a CyberScope smart contract audit and a CoinMarketCap listing, along with a liquidity partnership with WEEX Exchange, all designed to instill investor confidence and ensure a smoother transition to public trading.

XRP’s price swings and the concurrent rise of AI tokens like Ruvi AI (RUVI) are emblematic of broader, transformative trends reshaping the cryptocurrency market by September 2025. The resolution of Ripple’s (XRP) SEC lawsuit has set a crucial precedent, classifying XRP as a non-security in secondary market transactions. This regulatory clarity is a significant development, not just for XRP but for other altcoins that have faced similar classification ambiguities. It de-risks a substantial segment of the crypto market, potentially paving the way for greater institutional participation across a wider array of digital assets and influencing global regulatory discussions.

The success of utility-driven AI tokens like Ruvi AI signifies a maturing investor appetite that prioritizes tangible use cases and technological innovation over pure speculation. This trend could lead to a shift in capital allocation, with investors increasingly favoring projects that demonstrate real-world applications, particularly in high-growth sectors like the $104 billion creator economy. The convergence of AI and blockchain is a “transformative” trend for 2025, addressing issues like trust and data privacy, and fostering the growth of decentralized AI (DeAI) systems. Projects like Ruvi AI are at the forefront of this movement, showcasing how AI can enhance content creation, automate workflows, and provide data-driven insights within a decentralized framework.

Regulatory shifts are also playing a pivotal role. Globally, jurisdictions are moving towards more structured frameworks for digital assets. The EU’s MiCA regulation, the UK’s new Cryptoasset Regulatory Regime, and similar initiatives in Asia are creating clearer guidelines for crypto businesses and cross-border payments. The U.S.-U.K. Transatlantic Taskforce for Markets of the Future, aiming to unify digital asset regulations by 2026, could further benefit Ripple’s (XRP) cross-border infrastructure. These developments suggest a future where digital assets are more integrated into mainstream finance, with regulatory clarity reducing market friction and unlocking new avenues for growth.

The coming months and years promise a dynamic evolution for both Ripple (XRP) and Ruvi AI (RUVI), each navigating distinct opportunities and challenges. For Ripple (XRP), the short-term outlook into late 2025 is largely positive, buoyed by the August 2025 lawsuit settlement and the anticipation of spot XRP Exchange-Traded Funds (ETFs) in October. These factors are expected to inject significant institutional capital, boosting liquidity and potentially driving XRP’s price to $5 or even higher. Long-term, Ripple aims to solidify XRP’s role as a global payments asset, potentially rivaling SWIFT, and is strategically pivoting to establish the XRP Ledger (XRPL) as an institutional hub for tokenized finance, including real-world assets (RWAs) and Central Bank Digital Currencies (CBDCs) through its RLUSD stablecoin.

Strategic pivots for Ripple (XRP) include a renewed focus on transaction volume and utility through its ODL service, an aggressive re-entry into the U.S. market by pursuing banking charters, and product diversification through XRPL upgrades and stablecoin integration. However, challenges persist, including incomplete global regulatory frameworks, intense competition from other blockchain networks and traditional systems, and the need to translate XRP’s utility as a bridge asset into sustained long-term holding demand. The increasing prominence of RLUSD could also potentially divert some utility away from XRP itself.

For Ruvi AI (RUVI), the immediate future involves a critical transition from its highly successful presale phase, which has raised over $4 million, to public trading. This will bring initial volatility as early investors may take profits, but successful listings on major exchanges are crucial for wider adoption and liquidity. Long-term, Ruvi AI’s (RUVI) market opportunities lie in the continued growth of the creator economy and its ability to deliver on its roadmap for an AI-powered super app. This includes deploying its in-house AI model, launching a functional creator marketplace (scheduled for early 2026), and implementing DAO governance by late 2026. Analysts are highly optimistic, predicting 66x to 100x returns for early investors and a potential post-listing valuation of $1. Challenges will include fierce competition in both the AI and crypto sectors, the need to continuously innovate and differentiate, and sustaining the strong community momentum generated during its presale phase.

The current financial landscape, particularly in the digital asset market, is characterized by both profound transformation and inherent volatility. The journey of Ripple (XRP), from regulatory uncertainty to a landmark settlement and renewed institutional interest, underscores the impact of legal clarity on market dynamics. While XRP offers a compelling case for utility in cross-border payments and RWA tokenization, its price continues to be influenced by macroeconomic factors and broader market sentiment, leading to significant swings.

In this context, the strong appeal of Ruvi AI (RUVI) highlights a growing investor preference for projects that combine high-growth potential with a perceived “safer entry” and tangible utility. Its presale success, driven by a clear roadmap for an AI-powered super app targeting the creator economy, reflects a broader market trend towards utility-driven, audited, and strategically partnered projects. The overall crypto market, despite a “Red September” in 2025, shows signs of resilience and a long-term shift towards greater institutional integration and technological convergence, particularly with AI.

Investors moving forward should remain vigilant. For traditional altcoins like XRP, monitoring regulatory developments (especially spot ETF approvals), macroeconomic shifts, and network utility will be crucial. For emerging AI tokens such as Ruvi AI (RUVI), the focus should be on demonstrable real-world utility, successful roadmap execution, strong community engagement, and strategic partnerships. While the allure of high returns is strong, a diversified approach, balancing established assets with promising newcomers, and a keen eye on both technological innovation and regulatory landscapes, will be key to navigating this transformative era of digital finance.

This content is intended for informational purposes only and is not financial advice.

source