Lost Bitcoin Wallet Passwords Fuel Rise of Crypto Recovery Services Reuters

source

When is a stock too good to be true? According to the U.S. Securities and Exchange Commission (SEC), it could be when that stock soars over 900% in just half a month.

Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins required.

yesSubscribe to our daily newsletter, PYMNTS Today.

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions.

On Monday (Sept. 29), the SEC showed what can happen when market exuberance meets the hard limits of oversight when, per a Bloomberg report, it suspended trading in the shares of QMMM, a Hong Kong–based digital media firm.

The agency cited concerns that the surge in QMMM’s share price may have been driven by social media touts rather than fundamentals after the company announced it was diving into crypto with a $100 million “diversified cryptocurrency treasury.”

The company’s meteoric rise instead quickly turned into a cautionary tale about the combustible mix of crypto hype, meme-era markets, and regulatory vigilance. For investors, the episode offers a stark reminder that market narratives, particularly those tied to hot sectors like crypto and AI, can be seductive but fleeting.

The trading halt will last until Oct. 10.

See also: Crypto Is Coming for the Cubicle; Are Finance Teams Ready?

Advertisement: Scroll to Continue

From Anonymity to Meme-Stock Fame

Before September, few investors had heard of QMMM. The company makes its money in digital advertising and trades on Nasdaq via a Cayman Islands holding structure. Its pivot to crypto, complete with talk of artificial intelligence and blockchain, seemed designed to tap the market’s appetite for futuristic narratives.

It worked. In the wake of the announcement, trading volumes spiked and the share price took off. On Reddit threads and X posts, QMMM was hailed as a sleeper bet poised to ride the next crypto wave. Whether or not the buzz was organic, the SEC believes “unknown persons” may have promoted the stock to pump up the price.

The QMMM suspension signals that regulators remain wary of the playbook that mixes bold crypto pronouncements with aggressive online marketing.

QMMM did not immediately reply to PYMNTS request for comment.

At the same time, concept of a corporate crypto treasury has captivated markets before. MicroStrategy famously turned itself into a quasi-Bitcoin holding company, a move that helped propel its stock during bull runs but punished it in downturns. Many smaller firms have tried to replicate that magic, often with disappointing results.

QMMM’s core advertising business offers no obvious synergy with managing digital tokens. Analysts questioned whether its crypto move was visionary or opportunistic. The company’s emphasis on AI and blockchain suggested ambition, but not necessarily capacity.

Read more: Stablecoins Face Liquidity Shakeout That Could Upend Payment Strategies

QMMM’s whiplash rise and pause encapsulate several powerful trends reshaping capital markets.

First, the speed of speculative surges has accelerated. A narrative that once might have taken months to influence a stock now moves markets in days — or even hours — thanks to social platforms and trading apps.

Second, retail investors continue to play an outsized role in shaping price action, particularly in small-cap names. This democratization of investing brings energy and liquidity but also amplifies herd behavior.

Third, regulators are asserting that, even in an era of decentralized finance and social media-driven sentiment, the rules of disclosure and market integrity still apply. Sudden halts like QMMM’s are blunt instruments, but they remind companies that exuberant storytelling has limits.

This episode underscores that, even amid technological shifts and evolving capital flows, fundamental principles — transparency, sound governance, and investor protection — remain essential.

Corporate adoption of crypto assets may yet prove transformative for financial markets, and PYMNTS heard from Farooq Malik, CEO and Co-Founder of Rain, on Wednesday (Sept. 24) about the growing impact of another crypto asset: stablecoins.

Malik expects that one year from now, we’ll be “talking a lot about how stablecoins and tokenized bank deposits interplay with each other,” and especially “how do we create interoperability between various closed loop systems … and the various open loop systems that already exist.”

In a separate PYMNTS roundtable on digital assets with John Ainsworth, general manager at Metallicus; and Jon Ungerland, chief information officer of DaLand CUSO, PYMNTS heard that, within financial services, the ongoing aim is to move the crypto conversation from “can we do this?” to “here’s how we do this responsibly.”

SEC Suspends Trading of QMMM Shares, Alleging Crypto Stock Pump

PayOS, Mastercard Complete First AI Payment

BNPL Growth Softens Tariff Impact on Higher Retail Prices

Fiserv Releases AI Content Platform for Financial Institutions

We’re always on the lookout for opportunities to partner with innovators and disruptors.

Have you ever pondered the hidden stories behind those seemingly forgotten vaults of digital currency? The cryptocurrency universe has recently been jolted awake by the stirring of a long-dormant Bitcoin wallet, and with it, an entire industry is buzzing with intrigue and speculation. What might this revival mean for Bitcoin’s future trajectory?

In a move reminiscent of awakened giants from slumber, a Bitcoin wallet that had lain inactive for over a dozen years has come back to life, executing a staggering transfer of 1,000 BTC—worth an impressive $115 million. This massive influx occurred just as the cryptocurrency was bleeding value back in January 2014, when Bitcoin sat at a mere $847. The act of shifting such a substantial amount draws attention not only for its volume but also due to its timing amid looming financial decisions from the Federal Reserve. Could the stirring of this wallet be a portent of future price upheavals?

Blockchain analysts have confirmed that this significant move didn’t precede any immediate deposits into exchanges, quieting fears of a market massacre. The movement of large Bitcoin entities has historically rattled the market, leading to an eagerness among observers to decipher any shifts this time around. A report from XWIN Research Japan emphasizes that on-chain indicators suggest Bitcoin’s bull market continues to stand firm, despite recent turmoil that sent tremors throughout the ecosystem.

Recent market analyses reveal a more prudent approach among long-term Bitcoin holders. The Market Value to Realized Value (MVRV) ratio, currently floating around 2, hints that a considerable number of investors are content to maintain their impressive gains. Analysts view these signs as indications of stabilization rather than panic—often a precursor to accelerating price increases. What appears to be the last quakes of volatility could herald the onset of a robust new bullish era.

Interestingly, the resurgence of this dormant wallet coincides with macroeconomic maneuvers that have a history of sparking market tremors. Major transactions leading up to Federal Reserve meetings often provoke heightened market sensitivity. Yet, the subdued immediate repercussions on exchanges may indicate a reinforced market structure. If the trend toward off-exchange holding persists, we may find ourselves cushioned against sudden market shocks.

While some seasoned Bitcoin holders begin to realize profits from their investments, others are meticulously reshaping their portfolios in light of evolving market conditions. This ongoing recalibration highlights the tension between the desire for liquidity and the quest for greater returns, with indicators suggesting that the bullish fabric remains intact. There are signs that a discerning faction of investors is strategically repositioning assets, reflecting an astute understanding of the market’s rhythms.

Recently, the Crypto Fear & Greed Index took a noteworthy turn, returning to a neutral reading for the first time since late September. This shift, moving from a state of “Fear” to neutrality, often foreshadows impactful price movements, as traders gear up for fresh strategic positions. A neutral sentiment hints at a pickup in speculative trading, a dance that could either uplift or hamstring current momentum.

With the awakening of long-silent Bitcoin wallets reverberating through the market, we are reminded of the latent forces shaping trading landscapes. The intricate ties between traditional economic signals, on-chain data, and speculative behaviors depict a multifaceted environment for investors. While the present bull market shows signs of resilience, adept navigation of liquidity and regulatory challenges remains paramount. As we turn the page to Bitcoin’s next chapter, the potential for reinvention and strategy overhaul awaits in the ever-evolving realm of cryptocurrency.

Get started with Crypto effortlessly. OneSafe brings together your crypto and banking needs in one simple, powerful platform.

Discover the investment potential of Floki vs. Pepeto, the impact of crypto payroll, and strategies for navigating the volatile crypto landscape.

The GENIUS Act sparks a clash between traditional banks and crypto platforms over stablecoin rewards, impacting innovation and consumer trust in finance.

WebX and HashKey's partnership marks a pivotal shift in corporate treasury management, positioning Bitcoin as a core reserve asset for fintech startups.

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free

In the world of cryptocurrency, there lies a constant quest for life-changing profits, often just a presale away. As the buzz around new tokens like Pepeto heats up, we have to acknowledge the competition from established players like Floki. The tension between these two is palpable. Let’s unpack how to navigate this space, especially when it comes to crypto payroll.

The charm of early-stage tokens lies in their potential for explosive growth. Pepeto, with a minuscule price of $0.000000156, has already accumulated over $6.8 million in its presale. Unlike many tokens born from hype, Pepeto aspires to be a utility-driven project, boasting features like PepetoSwap and a cross-chain bridge. This could translate into a high demand for the token, leading to a significant price increase.

Floki, on the other hand, began as a meme and has become a multifaceted toolkit with a live Valhalla platform and various staking options. Floki has established a firm position in the market, with a market cap around $1 billion. It still holds promise for Q4 2025, but that rapid growth might be behind it.

Investing in presales can offer lucrative returns but comes with its fair share of risks. The presale arena is rife with volatility and regulatory fog, which makes it essential to do your homework. Projects that focus on real-world use cases and have transparent roadmaps are more likely to attract serious investors. But you still have to watch out for scams and liquidity issues.

Pepeto’s unique selling points could lead to significant gains, but the large token supply and memecoin volatility are red flags. Established tokens like Floki provide some level of stability, but may not be the path to the kind of explosive profits that draw in early investors.

The regulatory environment is another layer of complexity for crypto startups. Asia’s regulatory landscape is a mixed bag, with supportive regions like Singapore and more restrictive jurisdictions. The disparity increases operational hurdles for smaller startups and affects their ability to grow.

Europe’s MiCA regulations aim for clarity but come with compliance costs that may hinder startups. Being aware of these regulatory issues is crucial for anybody looking to invest in or operate within this industry.

With the crypto market maturing, more companies are considering crypto payroll. Paying employees in cryptocurrencies can streamline processes and attract talent, especially from tech-centric industries. But moving from fiat to crypto payroll requires a well-thought-out strategy.

To protect against volatility, startups could offer stablecoins pegged to fiat currencies, letting employees choose their payment method. A hybrid model—paying base salaries in fiat and bonuses in crypto—can also help. Utilizing dedicated self-custodial wallets and automating payroll through smart contracts adds security and efficiency.

Managing volatility in crypto payroll is crucial for keeping employees content and compliant. Keeping meticulous records of crypto transactions and educating employees about tax implications can avoid nasty surprises. Engaging employees on their payment preferences can also boost satisfaction.

By using these strategies, companies can harness the perks of crypto payroll—like quicker, global payments—while managing the challenges posed by market fluctuations and regulatory uncertainties.

In short, maneuvering through the crypto landscape requires a good grip on both the rewards and risks that tokens like Floki and Pepeto present. Early-stage projects are alluring but established tokens provide stability. As crypto payroll gains traction, startups must have effective plans to manage volatility and compliance.

Doing thorough research and staying updated with regulatory changes is essential for informed investment. Whether you choose stable tokens or venture into new projects, understanding the landscape can mean the difference between profit and loss.

Get started with Crypto effortlessly. OneSafe brings together your crypto and banking needs in one simple, powerful platform.

Discover the investment potential of Floki vs. Pepeto, the impact of crypto payroll, and strategies for navigating the volatile crypto landscape.

The GENIUS Act sparks a clash between traditional banks and crypto platforms over stablecoin rewards, impacting innovation and consumer trust in finance.

WebX and HashKey's partnership marks a pivotal shift in corporate treasury management, positioning Bitcoin as a core reserve asset for fintech startups.

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free

Home » Altcoins »

The top-tier financial conglomerate is ready to test blockchain tech: which chain will give SWIFT the ultimate power-up?

The crypto bull has returned to the crypto market after SWIFT announced to be working on a dedicated blockchain. But who’s getting the SWIFT nod: Hedera (HBAR), Ripple (XRP) or Linea? The latest competitor uses a zero-knowledge roll-up technology that can batch transfers off-chain by sending lean cryptographic proof to Ethereum (ETH) L1.

Sponsored

Indeed, SWIFT announced blockchain testing on their global bank message service for late 2025, so November should be hot for Ripple (XRP) & Hedera Hashgraph (HBAR) supporters. More recently, tongues have been wagging about SWIFT’s testing of Linea, an Ethereum (ETH) based Layer-2 chain.

Processing over $155 trillion in annualized trading volume, the traditional financial market conglomerate is looking to meet customers’ demand for immediately settled transactions. Partnering in this trial with Consensys, the company behind MetaMask DeFi wallet, SWIFT aims to reduce the processing time to one hour at most.

We tried to tell you. https://t.co/zwEYU7jsx2

Linea inherits Ethereum’s (ETH) 15-30 transactions per second (TPS), but the Layer-2 has its own boosts that can at least triple this speed. Meanwhile, Ripple’s (XRP) can handle up to 1,500 TPS, having an edge over both HBAR & Linea in terms of practically-proven volume weights.

XRP’s third position by global market cap comes naturally with billions of dollars in daily trading volume on Spot. The popular remittance altcoin garners billions on leveraged markets too. On the other hand, the competing Hedera (HBAR) altcoin nets figures around $200 – 300 million per day, despite having 10,000 TPS capabilities with shardings potentially adding even more.

🚨BREAKING: $HBAR live on stage with SWIFT for the 2nd time this year. This time with the German national Bank discussing the future of currency transactions pic.twitter.com/yZLIgyWiXA

Within the fierce competition, Ripple (XRP) clearly has the most ample experience. On the other hand, HBAR Network’s gigantic Distributed Ledger Technology (DLT) capabilities might seduce SWIFT just as much as XRP Ledger, while Linea’s testing remains an absolute wild card due to the roll-up’s freshman status.

Stay in the loop with DailyCoin’s hottest crypto news:

Stellar (XLM) Blasts Off: $0.41 Stop Before $1 Moonshot

$467K Sale of Free Hyperliquid Hypurr NFT Stuns Market

SWIFT handles global payments but is slow. XRP (fast payments), HBAR (scalable), and Linea (Ethereum-based) aim to make it faster and cheaper.

SWIFT takes days. XRP and HBAR settle in seconds; Linea’s faster than Ethereum but slower than XRP/HBAR.

XRP and HBAR are in live SWIFT trials (2025). Linea isn’t directly involved at the moment.

XRP excels with bank ties, HBAR’s scalable for enterprises. Linea’s DeFi focus isn’t ideal.

XRP or HBAR adoption by SWIFT could speed up trillions in payments, boosting their value.

This article is for information purposes only and should not be considered trading or investment advice. Nothing herein shall be construed as financial, legal, or tax advice. Trading forex, cryptocurrencies, and CFDs pose a considerable risk of loss.

Tadas Klimaševskis is a DailyCoin Journalist, covering memecoins & latest developments. Tadas has moderate holdings in SHIB, HBAR, LTC, MATIC and a selection of low-cap meme currencies.

Crypto features | September

About Us

Learn

Policies

Popular Sections

TECHi . Investing

Governments and institutions, once skeptical about the potential of cryptocurrency, are moving in. In the last two years alone, Bitcoin has found itself at the center of major national debates. Countries like the USA, China, UK, Ukraine, El Salvador, and more have increased their Bitcoin holdings considerably. Discussions about including cryptocurrency in various federal reserves remain open.

Institutional involvement is marked by increased investment into various assets through controlled channels like ETFs and institutional custodians. Sovereign funds are indirectly acquiring portions of this lucrative pie. Federal banks are also exploring the possibility of CBDCs as a future opportunity.

This rising interest among big players is fueling the demand for sustainable blockchain solutions, causing cloud computing platforms to expand and benefit their users in the process. While large players are accumulating through direct acquisitions, smaller investors gradually build their portfolios through passive profits on computing platforms like RockToken.

In just a decade, cryptocurrency has grown from a niche investment into one of the fastest-growing financial industries. In 2015, Bitcoin was valued at just $430 after a year-over-year growth of 34.4%. Between then and 2025, the asset surged dramatically to over $122,000 before stabilizing around $110,000. Innovative financial products like Bitcoin ETFs were approved in early 2024, marking a significant step in attracting institutional investment.

Cryptocurrency holds a unique position in the investment industry: it operates independently of any state authority. It is the first widely adopted currency not controlled by any central authority, offering unrestricted access, anonymous transactions, and decentralized transfers. This has contributed to its appeal as a powerful asset in the global financial system.

Various governments have shown growing interest in cryptocurrency, with the main focus on Bitcoin. Here are the most recent recorded top government Bitcoin holdings:

Governments holding substantial Bitcoin volumes send a clear message: digital assets have evolved from a fringe interest to a fast-growing investment opportunity. As regulatory frameworks stabilize, including licensing and anti-money laundering laws, the uncertainty surrounding digital investments is decreasing, thus favoring blockchain investors.

The rise in institutional interest is evident, with major firms gradually entering the cryptocurrency space. While some individuals like Larry Fink (CEO of BlackRock) once criticized Bitcoin, calling it the “index of money laundering,” the same firm became a pioneer of Spot Bitcoin and Spot Ethereum ETFs, as well as the operator of the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA).

Spot ETFs have allowed various sovereign funds to indirectly gain exposure to cryptocurrency assets. Before the approval of Spot Bitcoin ETFs, only a few sovereign funds ventured into crypto. Bhutan’s sovereign fund, Druk Holding and Investments, and El Salvador were early adopters. After 2024, sovereign wealth funds, such as Mubadala Investment Co. in Abu Dhabi and the state of Wisconsin’s sovereign fund, acquired millions of shares in Bitcoin Trust ETFs. This trend of institutional adoption is accelerating, with more institutions even exploring involvement in Bitcoin mining.

With these regulated and compliant services, the blockchain landscape is steadily maturing, becoming a trusted ecosystem that continues to attract institutional capital.

While governments, hedge funds, and deep-pocketed institutions directly acquire cryptocurrency assets and drive up demand, cloud computing is becoming a more accessible entry point. Various enterprises and individual investors are starting their portfolios with computing contract benefits and scaling their investments up to coveted holdings. They engage compute services that are compliant, efficient, and can sustainably scale up without crippling initial capital and expensive hardware. And the positive results are clear.

Tokenized rewards, DeFi, and Web3 innovation further intensify the demand for robust and reliable compute support. Companies with the right infrastructure, cost-effective operations, and the right security measures are shining in this new investment revolution.

Retail investors often follow institutional investment trends in the blockchain space. Large institutions tend to enter trusted, regulated, and scalable ecosystems that can provide predictable returns. This trend is driving many investors into platforms offering sustainable computing contracts, which support cloud-based operations in the crypto space.

When selecting a cloud mining or blockchain computing service, trust is a key factor for investors. Companies that are legally registered, operate with transparency, and are compliant with regulations gain higher investor confidence. Such platforms are able to scale operations efficiently and profitably, meeting the growing demand for cloud computing services in the cryptocurrency market.

The cloud computing industry is also placing a significant emphasis on sustainability. Many companies now run their operations on renewable energy sources like solar power to reduce their environmental impact. This commitment to green energy aligns with the increasing demand for sustainable blockchain operations.

Governments, sovereign funds, hedge funds, and various major institutions are driving the cryptocurrency adoption wagon, and retail players are not far behind. In the past few years, the blockchain cloud has shifted: everyone wants a piece of the pie. However, not everyone can directly purchase Bitcoin and some top altcoins at their current high values, and cloud computing plays as the bridge, offering a low entry point with gradual scalability.

Cloud computing is positioned to meet the growing demand for blockchain infrastructure, with a focus on scalability, security, and sustainability. This shift offers opportunities for both institutional and retail investors to grow their portfolios.

Disclosure: Some of the links in this article are affiliate links and we may earn a small commission if you make a purchase, which helps us to keep delivering quality content to you.

Promotional Disclaimer: This article may contain promotional content. The views and opinions expressed are those of the author and do not necessarily reflect those of TECHi.com.

News Writer

Warisha Rashid is a seasoned writer and Corporate Strategy Analyst at TECHi, where she explores the dynamic worlds of stocks, the automobile industry, and quantum computing. With a sharp eye for market trends and emerging technologies, she brings expert analysis and forward-thinking insights to the table, keeping reade…

The cryptocurrency landscape continues to evolve, with growing institutional adoption and new financial products like spot Bitcoin and Ethereum ETFs…

Amazon’s stock has shown little movement for much of 2025, drawing fresh questions about its appeal to investors. As of…

Advanced Micro Devices (AMD) stock ran wildly earlier this year, only to stumble over U.S export controls to China and…

The chipmaker has transitioned from tech darling to the ultimate champion of AI, with analysts confident to update their predictions…

Unlock the future of technology with TECHi intelligence. We provide expert guidance on the latest innovations in AI, delivering cutting-edge insights and progressive ideas that are shaping our world.

Navigate the complexity of the tech landscape with TECHi. Our indepth analysis of AI and technological breakthroughs empowers you to understand the forces driving global challenges, offering a clear vision for the future.

Please note that all market data is delayed by atleast 15 minutes. For details regarding exchanges and data latency, please refer to our complete list.

© TECHi.com – All rights reserved | Combines individuality (“I”) with technology.

The cryptocurrency market has been witnessing turbulence, and Pi Network Coin (PI) is no exception. Over the past 24 hours, the Pi Network price has suffered a significant decline, falling over 15% to trade around $1.16.

This sharp downturn has raised concerns among investors, prompting questions about the reasons behind the drop and the potential for recovery.

One of the major contributors to PI Coin price fluctuations is the looming Pi token unlock event. According to data from PiScan, approximately 129 million Pi cryptocurrency tokens, valued at around $175 million, are set to be unlocked. Large-scale token releases typically increase supply, exerting downward pressure on prices. Investors fear that the influx of new tokens into the Pi Coin market could drive prices even lower.

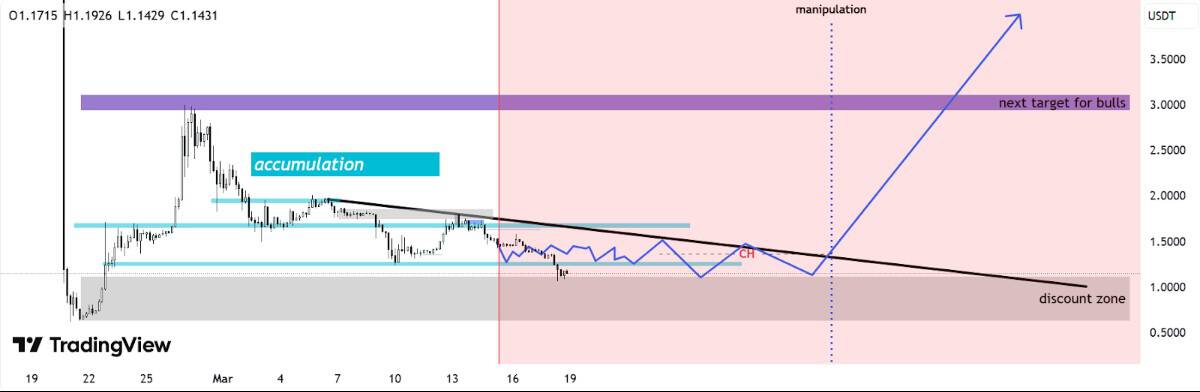

Pi Network Coin was trading at around $1.14 at press time. Source: TradingView

Another factor weighing on Pi crypto price is the conclusion of the KYC verification grace period on March 14. Miners who failed to complete the process risk losing their Pi wallet holdings, which has created uncertainty within the Pi Network market. The deadline may have triggered panic selling, adding to the Pi Coin trade downturn.

Despite strong community demand, Pi Network Binance listing remains uncertain. In February, Binance held a community vote in which over 86% of participants supported adding Pi Network Coin to the platform. However, no official confirmation has been provided, leading to frustration among investors. Additionally, Bybit’s CEO has publicly criticized Pi cryptocurrency, labeling it a scam, further dampening market sentiment.

The crypto community is urged to demand Binance’s transparency, fair Pi Network ranking, and an end to price manipulation. Source: Drnicolan via X

Pi Network has been in development for six years, yet many investors believe the project lacks a clear roadmap. The absence of concrete updates regarding Pi mainnet launch and the implementation of decentralized applications (DApps) has led to growing skepticism.

Crypto analyst Dr. Altcoin recently pointed out that Pi Network news reflects the community’s disappointment, as Pi currency value has seen a significant drop. He emphasized that without a transparent roadmap, investor confidence could continue to erode, leading to further declines in Pi token price.

Despite the recent Pi Coin value slump, some analysts remain optimistic about its future. One of the key factors that could drive a rebound is the increasing adoption of Pi currency in China. Reports suggest that an increasing number of businesses, including restaurants and retail stores, are accepting Pi Coin buy transactions. This real-world utility strengthens the project’s credibility and could help stabilize Pi crypto value in the long run.

Pi Network Coin price must survive the $1.05-$1.10 support zone and exceed the $1.37 resistance to revive the bullish momentum. Source: PropTradePros on TradingView

Technical analysis reveals that the price of Pi Network today has major support at $1.20. If the price holds above this level, it may set the stage for a reversal towards $1.50 and ultimately $2. If the bearish sentiment continues and the exchange rate of the Pi Coin goes below $1.20, it may test the support at $1.10 or even go below $1.00, an important psychological level for investors following the price of Pi network in dollars.

Market analysts are optimistic about Pi Coin’s survival of the $1 support. Source: Chad_Sniper on TradingView

While Pi Network trading remains limited, there is speculation regarding future listings on exchanges. If exchange listings for Pi Coin widen to include exchanges such as Binance, Coinbase, or Kraken, it might stimulate fresh buying interest and drive prices upwards. Experts are of the opinion that a formal listing on an exchange would cause a huge rally and take the price of Pi Coin back to its earlier highs.

The recent decline in Pi Coin worth highlights the volatility and uncertainty surrounding the project. While factors such as the token unlock, KYC verification deadline, and lack of exchange listings have contributed to the downturn, the growing adoption of Pi mining rewards in China provides a glimmer of hope.

For a strong recovery, Pi Network Coin price needs greater transparency from the core team, clear updates on Pi mainnet progress, and expanded exchange listings. Until then, investors remain divided on whether Pi Coin news will signal a rebound or further losses.

30 Sep 2025

30 Sep 2025

30 Sep 2025

Sven Luiv|30 Sep 2025|News|

Sven Luiv|30 Sep 2025|News|

Sven Luiv|30 Sep 2025|News|

Naveed Iqbal|30 Sep 2025|News|

Naveed Iqbal|30 Sep 2025|News|

Auckland / Melbourne / London / New York / Tokyo

A Techemy company

PO Box 90497, Victoria St West, Auckland Central, 1010, New Zealand.

© 2025 Brave New Coin. All Rights Reserved.

Sponsored

The Powerball jackpot continues to grow after no one matched all six Powerball numbers to win Saturday’s drawing.

Grab your tickets and check your numbers to see if you’re the game’s newest millionaire.

Here are the numbers for the Saturday, Sept. 27, Powerball jackpot worth an estimated $145 million with a cash option of $67.3 million.

The winning numbers for Saturday night’s drawing were 10, 16, 32, 61, 66, and the Powerball is 4. The Power Play was 2X.

No one matched all six numbers to win the Powerball jackpot.

Nobody matched all five numbers except for the Powerball worth $1 million.

Double Play numbers are 5, 21, 22, 49, 68, and the Powerball is 25.

Zero tickets matched all six numbers, and no one matched all five numbers except for the Powerball worth $500,000.

The Powerball jackpot for Monday, Sept. 27, 2025, rises to $160 million with a cash option of $74.2 million, according to powerball.com.

Drawings are held three times per week at approximately 10:59 p.m. ET every Monday, Wednesday, and Saturday.

You only need to match one number in Powerball to win a prize. However, that number must be the Powerball worth $4. Visit powerball.com for the entire prize chart.

Matching two numbers won’t win anything in Powerball unless one of the numbers is the Powerball. A ticket matching one of the five numbers and the Powerball is also worth $4. Visit powerball.com for the entire prize chart.

A single Powerball ticket costs $2. Pay an additional $1 to add the Power Play for a chance to multiply all Powerball winnings except for the jackpot. Players can also add the Double Play for an additional $1 to have a second chance at winning $10 million.

Friday night’s winning numbers were 4, 21, 27, 33, 49, and the Mega Ball was 21.

The Mega Millions jackpot for Tuesday’s drawing grows to an estimated $497 million with a cash option of $229.5 million after no Mega Millions tickets matched all six numbers to win the jackpot, according to megamillions.com.

Here is the list of 2025 Powerball jackpot wins, according to powerball.com:

Here are the all-time top 10 Powerball jackpots, according to powerball.com:

Here are the nation’s all-time top 10 Powerball and Mega Millions jackpots, according to powerball.com:

Chris Sims is a digital content producer at Midwest Connect Gannett. Follow him on Twitter: @ChrisFSims.

RALEIGH, N.C. (WTVD) — A Raleigh woman plunked down $5 on a scratch-off ticket, and it paid off big-time.

Debra Deloatch bought a 5 Times Lucky ticket from K&B Sabri Inc. on Poole Road in Raleigh. When she scratched it off, she had won a $200,000 top prize.

She went to lottery headquarters in Raleigh on Friday to claim her prize. After required state and federal tax withholdings, she took home $143,501.

The 5 Times Lucky game debuted in July with five $200,000 top prizes. Three $200,000 prizes remain unclaimed.

ALSO SEE | Knightdale man wins $135,218 in digital instant lottery game

ALSO SEE | Johnston County man wins $1 million top prize in new lottery game

Stay on top of breaking news stories with the ABC11 News App