Crypto firm Tether eyes $500 billion valuation in major raise, Bloomberg News reports Reuters

source

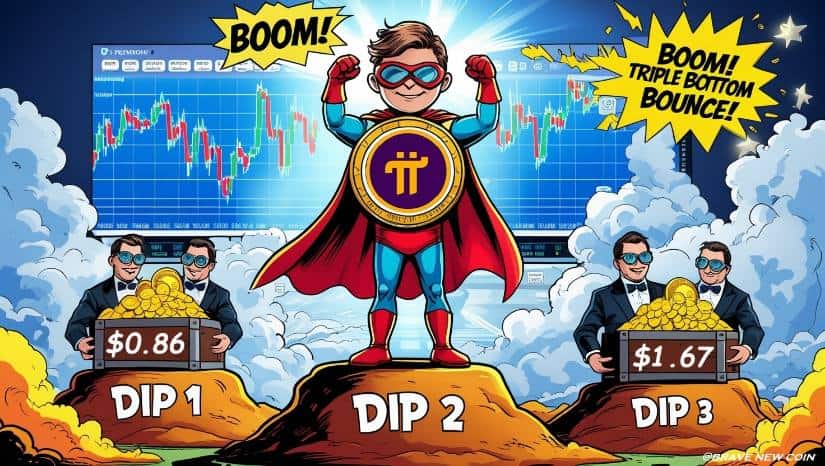

The Pi Network price appears to be gathering bullish momentum amid a convergence of technical and on-chain indicators that suggest a potential breakout.

With the formation of a triple bottom pattern and a surge in whale accumulation, the Pi Coin market is bracing for a possible move above the psychological $1.67 level — a milestone that could mark the beginning of a longer-term rally.

Currently, Pi cryptocurrency is trading around $0.64, showing minor gains over the past 24 hours but still down more than 40% for the month. Despite the sluggish short-term performance, the Pi Network Coin is forming a triple bottom on the four-hour chart — a classic reversal pattern known to precede strong upward moves.

The Pi Network price has formed a triple-bottom pattern on the four-hour chart, indicating strong support at lower levels. Source: Nshan on TradingView

This pattern consists of three distinct troughs with approximately equal lows, followed by a breakout above a defined neckline resistance. In this case, that neckline sits around $1.67, and a breakout could send the Pi token price soaring toward $2.74, according to projections based on the height of the pattern.

Supporting this bullish setup, volatility has dried up significantly. The Bollinger Bands have narrowed sharply, and the Average True Range (ATR) has fallen to 0.0136, its lowest level since May 7. Historically, such periods of low volatility have preceded explosive moves in either direction, though the triple bottom suggests an upward resolution.

In a major development, over 200 million PI tokens were recently transferred from a liquidity reserve to a private wallet — a move that many believe represents an Over-the-Counter (OTC) transaction by institutional players.

Moon Jeff, a well-followed crypto analyst on X, remarked, “This kind of quiet accumulation usually signals strong confidence from big players.” OTC deals are typically conducted to avoid slippage and are often interpreted as a sign of long-term accumulation by investors who foresee future gains in Pi Coin value.

Two million PI tokens were transferred from a liquidity wallet to a new address, likely indicating ongoing OTC accumulation and bullish sentiment for Pi Network. Source: MOON JEFF via X

Adding to the bullish sentiment, 72,720 PI tokens were reportedly withdrawn from exchanges within a 24-hour window, indicating a halt in selling pressure and potentially positioning Pi for a supply squeeze.

While momentum is gradually building, the path to higher Pi crypto prices is not without obstacles. The first major resistance stands at $0.8600, the swing high from May 21. This is followed by the critical $1 level, which carries strong psychological weight, and finally, the $1.6726 zone — the top formed in May and the neckline of the triple bottom pattern.

Pi faces resistance at $0.86, $1.00, and $1.67, where a breakout could confirm a bullish reversal. Source: DRAGUN1 on TradingView

A confirmed break above $1.67 would validate the bullish formation and likely trigger accelerated buying. In that case, the Pi Network token could aim for $2.74, unlocking new upside potential in the Pi Network market.

However, if the PI Coin price falls below $0.60, it would invalidate the bullish pattern and potentially open the door to further losses, possibly retesting the all-time low near $0.40.

Looking ahead, all eyes are now on June 28, known as “Pi2Day”, a date when the Pi Network team traditionally reveals key project updates. Speculation is growing around a potential Binance listing, though this remains unconfirmed. A listing on a major exchange like Binance would be a game-changing development, significantly improving Pi Network trading volumes and visibility.

Pi Network (PI) was trading at around $0.64 at press time. Source: Brave New Coin

That said, community sentiment remains mixed. While some analysts, like Moon Jeff, are optimistic about a return to $1.2 and beyond, others remain skeptical. Dr. Altcoin, a crypto critic, recently stated that the Pi Core Team needs to offer “more clarity and value” to its user base, citing growing frustration from Pi mining participants who haven’t received their PI tokens despite completing KYC.

Despite the Pi Coin price hovering near its recent lows, the convergence of a bullish chart pattern, dwindling volatility, and strong on-chain activity may point to a pivotal turning point. If the current setup holds and bullish momentum carries it past the $1.67 resistance, Pi Coin’s worth could quickly appreciate, potentially reaching $2 or higher in the short term.

Until then, investors will continue watching the Pi wallet activity, developer updates, and market sentiment closely. While uncertainty remains, Pi cryptocurrency is clearly setting the stage for its next major move — and this time, the odds may be tilting toward the bulls.

24 Sep 2025

24 Sep 2025

24 Sep 2025

Aditya Das|24 Sep 2025|News|

Andy Pickering|24 Sep 2025|Podcasts|

Naveed Iqbal|24 Sep 2025|News|

Naveed Iqbal|24 Sep 2025|News|

Sven Luiv|24 Sep 2025|News|

Auckland / Melbourne / London / New York / Tokyo

A Techemy company

PO Box 90497, Victoria St West, Auckland Central, 1010, New Zealand.

© 2025 Brave New Coin. All Rights Reserved.

Sponsored

NURTW President, Musiliu Akinsanya (MC Oluomo), has debunked claims that he met Labour Party’s Peter Obi ahead of the 2027 elections.

NURTW President, Musiliu Akinsanya, popularly known as MC Oluomo, has denied claims of meeting Labour Party’s Peter Obi ahead of the 2027 elections.

Reacting to a viral photo suggesting a shift in loyalty, MC Oluomo said on Instagram that the image was fake and that he never met Obi or received a message from him. He stressed that he is currently outside Nigeria and remains firmly loyal to President Bola Tinubu.

He said: “I, Alhaji Musiliu Ayinde Akinsanya (MC Oluomo), National President of the National Union of Road Transport Workers (NURTW), have taken notice of a manipulated image and false news report circulating on social media, particularly in the northern part of Nigeria.

“The report falsely claims that Peter Obi paid homage to me and vowed to work with me. I categorically state that this report is entirely false and without basis. Multiple fact-checking platforms and blogs have already debunked this claim, revealing that the image was photoshopped.

“There is no evidence of any meeting or congratulatory message from Peter Obi to me. I am currently abroad, and any claims suggesting otherwise are baseless. I urge the public to disregard this false news and rely on credible sources of information. I reaffirm my support for HE Asiwaju Bola Ahmed Tinubu and his Hope Agenda.”

Copyright © 2025 Gistlover Media. All Rights Reserved

Leading cryptocurrencies failed to breakout on Tuesday, while stocks pulled back from highs, as Federal Reserve Chair Jerome Powell issued a cautionary note.

Bitcoin sank below $112,000 as the ongoing downturn tested the patience of the bulls. Ethereum was stuck in the $4,100-$4,200 zone. Trading volume for the two blue-chip currencies dropped significantly.

Outflows from Bitcoin exchange-traded funds increased to over $100 million on Sept. 23, according to SoSo Value, indicating tepid institutional interest.

Bitcoin's dominance remained below 58%, while Ethereum's market share dropped to 13%.

Over $260 million were liquidated from the cryptocurrency market in the last 24 hours, with long liquidations accounting more than half of the total.

Bitcoin’s open interest rose by a modest 0.19% in the last 24 hours. Meanwhile, over 67% of top trader accounts on Binance were long on the leading cryptocurrency.

Top Gainers (24 Hours)

The global cryptocurrency market capitalization stood at $3.87 trillion, following a drop of 0.54% in the last 24 hours.

Stocks retreated from record highs on Tuesday. The Dow Jones Industrial Average slid 88.76 points, or 0.19%, ending at 46,292.78. The S&P 500 fell 0.55% to finish 6,656.92, while the tech-focused Nasdaq Composite lost 0.95% to settle at 22,573.47

In his remarks, Fed Chair Powell reiterated that monetary policy is not on a preset course and that the Fed will remain data-dependent as it heads into the final two meetings of the year. He acknowledged the growing difficulty in balancing its dual mandate of stable prices and maximum employment.

According to the CME FedWatch tool, traders have priced in a 91% chance that the central bank would cut interest rates by another 0.25% at its October meeting.

In a note shared with Benzinga, analysts at cryptocurrency payment company B2BINPAY said that Bitcoin's recent retest toward the $113,000-$112,000 range showed increasing selling pressure.

"Our base case is that BTC holds $110,000-$112,000, keeping dominance near 58-59% and alts in consolidation," the analysts projected. "But a breakdown below $110,000 risks a spike in dominance above 60%, deeper alt losses, and the slide toward $105,000."

On the other hand, a rebound toward $120,000 could bring "relief" to Ethereum, Solana and other coins, they added.

Widely followed cryptocurrency analyst Ali Martinez said that Ethereum could reclaim $4,400 if it holds the support at $4,000.

Read Next:

Photo Courtesy: Marc Bruxelle on Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A newsletter built for market enthusiasts by market enthusiasts. Top stories, top movers, and trade ideas delivered to your inbox every weekday before and after the market closes.

Home – Crypto Presales – XRP Price Prediction: Remittix Becomes Dubbed The New XRP After Analysts Expect 30x Gains By January

Analysts are raising bold expectations for XRP price prediction, with some suggesting XRP could surge toward $20 to $30 by year’s end if institutional support and technical setups hold strong. In parallel, Remittix is earning comparisons as the “new XRP” or “XRP 2.0,” driven by its utility, security, and rapid early growth.

This comparison grows louder amid claims that Remittix could deliver returns well beyond XRP’s projected trajectory. The XRP price prediction debate now includes scrutiny of Remittix’s metrics, tokenomics, and how its fundamentals might outshine those of XRP in a high-growth scenario.

XRP has seen speculative price predictions ranging from around $4.50 if certain resistance zones break, to ultra-bullish targets of $20 to $30 in favorable conditions. Analysts using Elliott Wave patterns, institutional inflows, and ETF speculation are among those anticipating that kind of run.

However, it bears risks. Resistance remains at around $3.40 on most charts, and XRP’s continuation of bullish impulse depends largely on favorable regulation news and ongoing purchase interest by institutions and retailer investors alike. If they fail or sentiment across markets declines, analysts project a correction to support areas in the range of $2.80 to $3.10.

When comparing Remittix to XRP under the lens of XRP price prediction narratives, Remittix appears to offer advantages in startup momentum and utility execution. Unlike many predictions for XRP that hinge on regulatory clarity or ETF developments, Remittix already holds real validations. It is verified by CertiK and ranked number one on CertiK for pre-launch tokens.

It has launched a beta wallet, which community members are actively using and is projected to multiply in value by 30x from current levels by January. It also runs a 15% USDT referral program with daily claimable rewards, and it has a $250,000 giveaway. These factors create foundations that some say position Remittix to possibly outperform XRP if both are on growth curves.

Remittix has sold over 668 million tokens, the current token price is $0.113, and the project has raised over $26.3 million. It has secured listings on centralized exchanges after surpassing both the $20 million and $22 million funding milestones.

Its functional roadmap makes its case compelling when comparing against XRP’s path, which, while strong, now requires more breakthrough events to keep its biggest price predictions plausible.

Here are some of the strongest points favoring Remittix:

Given current projections, XRP’s price prediction toward $20 to $30 by year’s end remains possible but depends heavily on catalysts outside its immediate control.

Meanwhile, Remittix is being dubbed “the new XRP” by many analysts because its fundamentals are already delivering what XRP is still expected to produce in the future. If Remittix continues its current trajectory, then what many expect for 30x gains in XRP might realistically occur sooner for Remittix.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

RELATED POSTS

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

Crypto Economy Newsletter

I accept the conditions and receive your newsletters.

© Crypto Economy

Privacy Policy

Ethical Journalism Politic

Cookie Policy | Contest Rules | Partners | About us

Winning numbers drawn in Tuesday’s New York Take 5 San Antonio Express-News

source

Coins

Top 100 Coins

Trending Cryptos

Performance

Recently Listed

Gainers

All Categories

All Time High

Blockchains

Global Market Data

Ecosystems

Fundraising

Funding Rounds

Funds

Analytics Dashboard

IDO/ICO

IDO/ICO

IDO Launchpad ROI

Launchpads

CEX Launchpad ROI

Launchpool

Analytics Dashboard

Node Sale

Exchanges

CEX

CEX Transparency

CEX Listing Performance

DEX

Exchange Tokens

ETH Bridge

Token Unlocks

Token Unlocks

Analytics

VC Pressure

Products

Research

Rewards

Maps

Drop Hunting

Alerts

Converter

Widgets

Market Data API

Futures and Options

Affiliate Program

Watchlist

Portfolio

Astar ($ASTR) is preparing for a structural overhaul through its Tokenomics 3.0 proposal. The plan introduces emission decay, fee burning, and Protocol-Owned Liquidity, marking a shift toward a fixed supply model that could redefine how investors value the token.

The move comes as Astar broadens its ecosystem. A SafePal native integration, scheduled for September 28, is expected to bolster utility and drive adoption across wallets and users. Market participants now watch closely, as the tokenomics upgrade could reset supply dynamics and long-term sentiment.

At present, $ASTR’s pri…

Read The Full Article Astar SafePal Integration and Tokenomics 3.0 Could Reshape $ASTR Supply Model On Coin Edition.

Read More

Astar ($ASTR) is preparing for a structural overhaul through its Tokenomics 3.0 proposal. The plan introduces emission decay, fee burning, and Protocol-Owned Liquidity, marking a shift toward a fixed supply model that could redefine how investors value the token.

The move comes as Astar broadens its ecosystem. A SafePal native integration, scheduled for September 28, is expected to bolster utility and drive adoption across wallets and users. Market participants now watch closely, as the tokenomics upgrade could reset supply dynamics and long-term sentiment.

At present, $ASTR’s pri…

Read The Full Article Astar SafePal Integration and Tokenomics 3.0 Could Reshape $ASTR Supply Model On Coin Edition.

Read More

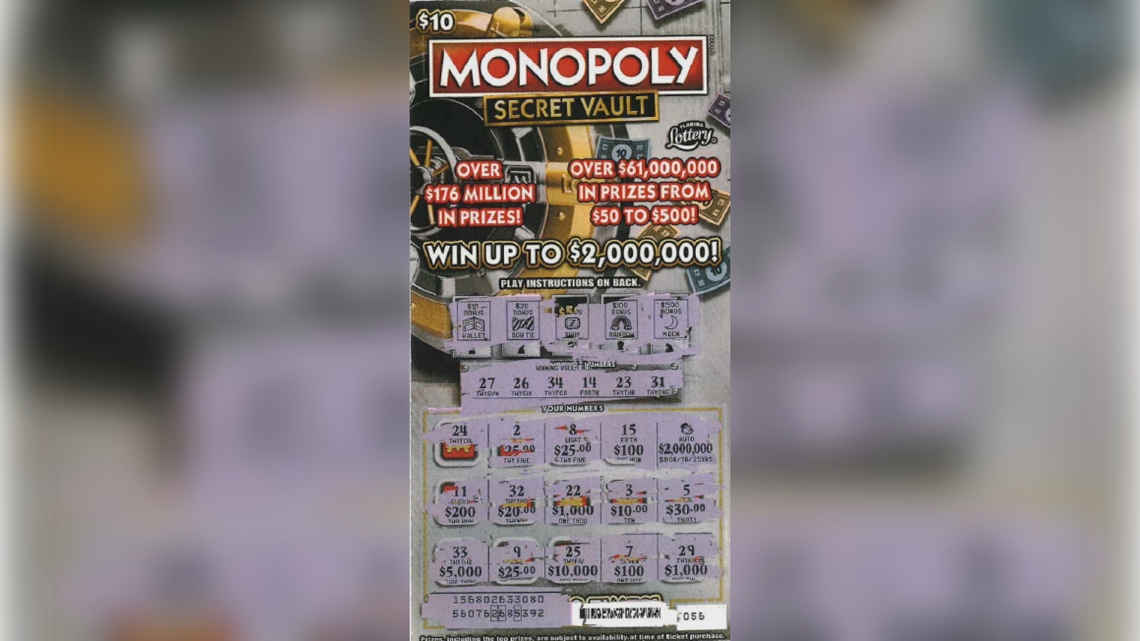

VALRICO, Fla. — After Pablo Herrera, 42, scratched off his lottery ticket, he was able to claim a top prize from Monopoly Secret Vault’s scratch-off game of $2 million, the Florida Lottery said in a press release.

Herrera claimed his prize on June 16 at the lottery’s district office in Tampa, according to the state organization. They also said Herrera chose to receive his winnings as a one-time, lump-sum payment of $1,153,865.

The Hillsborough County man purchased his winning ticket earlier this year in an MM Food Mart, located on Highway 60 in Valrico.

According to Florida Lottery, the $10 Monopoly Secret Vault game launched in July 2024, and it includes four top prizes of $2 million.

“This game offers over $176 million in cash prizes, including 6.8 million winning tickets. The game’s overall odds are 1-in-3.41,” the press release said.

To promote responsible play, the state lottery website advises players to set a budget and stick to it, instead of viewing the games as means to make money, to avoid chasing loses and to never borrow money to play the lottery.

To stream 10 Tampa Bay on your phone, you need the 10 Tampa Bay app.

Next up in 5

Example video title will go here for this video

Next up in 5

Example video title will go here for this video

In Other News