XRP Price Prediction: SEC Filings Hint at Imminent ETF Launch – Is This XRP’s Moment to Hit $1,000? Cryptonews

source

The CME Group launched CFTC-regulated contracts on XRP and SOL futures, joining BTC and ETH in the crypto options offering to Main Street. XRP and SOL outperformed the broader crypto market on Monday, October 13, as traders reacted to the launches.

The launch of CFTC-regulated options on XRP futures legitimizes the token ahead of potential XRP-spot ETF approvals. Crucially, the US Commodity Futures Trading Commission (CFTC) has given its seal of approval, deeming XRP sufficiently legitimate for institutional trading.

This development could have far-reaching implications for spot ETF approvals and institutional adoption.

The CFTC requires robust surveillance and underlying market capabilities, which are also prerequisites for spot ETFs. Furthermore, strong institutional demand for XRP futures and open interest, addresses the Securities and Exchange Commission’s (SEC) concern about whether there is sufficient market demand and whether XRP would serve a legitimate purpose.

There are several reasons why the CFTC-regulated contracts on XRP launch could fuel speculation about the SEC greenlighting the S-1s for XRP-spot ETFs. These include:

Historically, the SEC and the CFTC have not followed the same playbook. The SEC’s main concern was whether XRP qualified as a non-security under the Howey Test.

However, the SEC vs. Ripple case addressed this issue, with Judge Analisa Torres ruling that programmatic sales of XRP did not constitute securities transactions. Crucially, the SEC dropped its appeal against the Programmatic Sales of XRP ruling, paving the way for an XRP-spot ETF market.

For traders questioning the likelihood of an XRP-spot ETF launch, the resolution of the Ripple case and the launch of CFTC-regulated contracts on XRP futures should provide strong assurance.

Marty Party, a prominent crypto commentator with 240,000 followers on X (formerly Twitter), said:

“This marks a major expansion of regulated crypto derivatives beyond Bitcoin (BTC) and Ether (ETH), providing institutions with sophisticated hedging tools amid surging demand for altcoin exposure.”

While conditions appear favorable for an XRP-spot ETF market, the US Government shutdown continues to indirectly delay institutional inflows by slowing SEC processing.

On Tuesday, October 14, all eyes will turn to Capitol Hill. The US Senate could hold a vote on a stopgap funding bill as early as today, potentially reopening the US government.

A return to a full SEC office could enable the agency to review and approve the recently amended S-1s, clearing the way for spot ETF issuers to begin trading.

However, reports from Capitol Hill suggest a continued impasse, raising the risk that the shutdown extends into November. Republican Speaker Mike Johnson reportedly stated:

“We’re barreling toward one of the longest shutdowns in American history.”

Johnson has stated that he would not negotiate with the Democrats until they withdraw their health care demands.

Betting platform Kalshi predicts the US government shutdown will last 33 days, down from 37 days, but close to the 35-day shutdown in 2018-2019, the longest in US history. Furthermore, Kalshi puts the odds of the shutdown extending into November at 57%.

The delay of XRP-spot ETF launches beyond their final decision deadlines, ranging from October 18 to November 14, could weigh on XRP prices. However, speculation about an imminent launch could intensify if the Senate passes a stopgap funding bill, potentially sending XRP to $3.

XRP climbed 2.99% on Monday, October 13, following the previous day’s 6.1% rally, closing at $2.6073. The token outperformed the broader market, which gained 0.97%. Despite a three-day winning streak, XRP remained below the 50-day and 200-day Exponential Moving Averages (EMAs), reaffirming a bearish bias.

Key technical levels to watch include:

In the coming sessions, several key events could dictate near-term price trends:

Bearish Scenario: Risks Below $2.5

These bearish scenarios could drag XRP back toward $2.5. A break below $2.5 would expose $2.0.

Bullish Scenario: Path to $3

These bullish scenarios could drive XRP to $2.7 and bring the key psychological resistance at $3 level.

Recent updates from Capitol Hill suggested the ongoing impasse could continue into next week. However, the shutdown could come to an abrupt end, as a prolonged deadlock may slow the US economy.

Developments on Capitol Hill will be crucial for near-term price trends. While XRP-spot ETFs remain the focal point, the shutdown would also slow the Market Structure Bill’s progress. The Market Structure Bill is a key crypto legislation, providing clear rules of the road. For context, XRP soared 14.69% on July 17 in response to the US House of Representatives passing the bill to the Senate.

All eyes now turn to Capitol Hill, where a Senate vote could be pivotal in determining whether XRP reclaims $3 or slides back toward $2.

Traders should closely monitor developments on Capitol Hill, US-China trade developments, and Fed commentary, given market sensitivity to last week’s events.

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

NASDAQ Index, SP500, Dow Jones Forecasts – Stocks Rally As Traders Shrug Off Trade War Risks

Silver (XAGUSD) Price Forecast: Record Breakout Signals Higher Targets

Natural Gas Price Forecast: $3.03 Support Sparks Bullish Response

U.S. Dollar Gains Ground As Traders Stay Focused On U.S. – China Relations: Analysis For EUR/USD, GBP/USD, USD/CAD, USD/JPY

US Dollar Forecast: DXY Rises as Trump, Treasury Soften China Tariff Threats

The once-distinct worlds of traditional finance (TradFi) and cryptocurrency are rapidly merging, driven by a surge of institutional interest, landmark regulatory approvals, and technological advancements. This accelerating convergence, particularly evident from early 2024 to the present day in October 2025, marks a pivotal moment for the global financial ecosystem. Recent endorsements from financial titans like BlackRock (NYSE: BLK), Fidelity (NYSE: FNF), and JPMorgan Chase (NYSE: JPM) through spot Bitcoin and Ethereum ETFs, coupled with expanded crypto services from custodians such as BNY Mellon (NYSE: BK), have propelled digital assets into the mainstream.

This unprecedented embrace has not only injected billions of dollars into the crypto market but has also fundamentally shifted perceptions, transforming cryptocurrencies from a fringe technology into a legitimate, strategic asset class. The immediate market reaction has been overwhelmingly positive, with Bitcoin and Ethereum reaching new all-time highs, while the broader crypto community views these developments as a significant validation, paving the way for a more mature and integrated financial future. This matters immensely as it ushers in a new era of liquidity, regulatory clarity, and widespread adoption, blurring the lines between centralized and decentralized finance.

The period from January 2024 to October 2025 has been nothing short of transformative for crypto market dynamics, largely catalyzed by TradFi’s deepening involvement. The U.S. Securities and Exchange Commission (SEC) approval of 10 spot Bitcoin ETFs on January 10, 2024, was a watershed event. Leading up to the approval, Bitcoin experienced sharp volatility, plummeting 10% on January 3 amid rejection fears before rebounding. Post-approval, Bitcoin initially saw a short-term correction, dipping below $40,000, primarily due to significant outflows from the Grayscale Bitcoin Trust (GBTC) as investors rotated into newer, lower-fee ETFs. However, this was quickly overshadowed by massive inflows into funds like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), with IBIT accumulating over $50 billion in assets within 11 months and becoming the fastest ETF to reach $10 billion in AUM in just 51 days.

This sustained institutional demand propelled Bitcoin to multiple all-time highs throughout 2024, surpassing $73,000 in March, reaching $108,000 by mid-December, and hitting a new record high of over $124,000 in October 2025. Trading volumes for these ETFs were explosive, exceeding $1 billion within 30 minutes on their debut day. The increased activity wasn’t limited to spot markets; CME Group’s cryptocurrency derivatives trading also surged, with Bitcoin futures hitting record open interest, largely due to basis trading for arbitrage opportunities. By October 2025, spot Bitcoin ETFs had attracted over $100 billion in assets under management (AUM), underscoring a profound shift in market liquidity and institutional confidence.

Following the success of Bitcoin ETFs, the SEC approved spot Ethereum ETFs on May 23, 2024, with trading commencing in July 2024. Ethereum (ETH) prices surged by 19.24% in the days leading up to the May approval, jumping from below $3,000 to between $3,800 and $3,900 that month. By September 22, 2025, ETH was trading around $4,400, reflecting an overall upward pressure since its ETF approval, and by October 2025, Ether’s closing price was up approximately 33% year-to-date. While less popular than Bitcoin ETFs, U.S. spot Ethereum ETFs generated a combined $2.4 billion in net inflows since July 2024, with $12 billion in AUM by December 2024, indicating growing institutional confidence in Ethereum’s ecosystem.

Further solidifying TradFi’s embrace, BNY Mellon (NYSE: BK) reportedly received SEC approval in September 2024 to offer institutional crypto custody services, a move facilitated by a variance from the SEC’s Staff Accounting Bulletin (SAB) 121. This provides a more secure and regulated option for institutional clients, potentially challenging existing crypto custodians and reinforcing the long-term integration of digital assets into global finance. This period has seen global crypto ETP assets under management (AUM) surge to $134.5 billion by November 2024, a 950% increase year-over-year, fundamentally altering Bitcoin’s price dynamics and volatility profile as long-term institutional investors take center stage.

The crypto community’s response to the increasing integration of TradFi has been largely enthusiastic, albeit with a healthy dose of caution. On platforms like X (formerly Twitter) and Reddit, the approval of spot Bitcoin and Ethereum ETFs generated widespread “animal spirits” and sustained bullish sentiment. Discussions around “flippening” scenarios, where Bitcoin’s market capitalization could surpass gold, and anticipation of new all-time highs have dominated conversations. The Crypto Fear & Greed Index has frequently soared into “Extreme Greed” territory, reflecting this optimism. However, a segment of the community maintains a cautious awareness of market volatility, with Reddit communities like r/CryptoCurrency emphasizing macroeconomic trends and regulatory updates, and advising prudence against speculative trading.

Crypto influencers and thought leaders have largely propagated a bullish narrative, highlighting Bitcoin’s scarcity, its role as “digital gold,” and the “unprecedented levels” of institutional adoption. Alvin Kan, COO of Bitget Wallet, noted in 2024 that the dominant trend in DeFi is its growing integration with TradFi, with institutions leveraging DeFi tools for higher yields and transparency. Kean Gilbert of Lido Finance echoed this, acknowledging institutional adoption as a key driver for DeFi’s growth while also raising concerns about potential power consolidation. Experts like Jeremy Allaire, CEO of Circle (private), project stablecoins to account for up to 10% of the world’s money supply by 2034, further solidifying the bridge between TradFi and DeFi. Conferences like Consensus Hong Kong 2025 have become crucial forums for leaders from both worlds to discuss blockchain innovations and interoperability.

The effects on related DeFi protocols, NFT projects, and Web3 applications have been profound. In DeFi, integration with TradFi has led to increased liquidity and market reach, with Total Value Locked (TVL) surging as capital flows from Bitcoin profits into Ethereum and other Layer 1 and Layer 2 solutions. Real-World Asset (RWA) tokenization has emerged as a significant trend, with platforms connecting off-chain assets like government bonds and real estate to DeFi liquidity pools, providing stable returns. The volume of tokenized assets exceeded $16.7 billion in 2024, with projections reaching $500 billion by 2025. Major financial corporations like BlackRock (NYSE: BLK), JPMorgan Chase (NYSE: JPM), and Franklin Templeton (NYSE: BEN) are actively exploring and implementing DeFi solutions through tokenization. For NFTs, the market has seen a rebound, with projects increasingly evolving into financial assets and integrating into DeFi mechanics. Web3 applications are focusing on improved user experience, interoperability, and AI integration, with platforms adopting Web2-like features to drive user growth and engagement.

The increasing integration of traditional finance with cryptocurrency heralds a future of profound shifts, with both short and long-term implications extending well beyond October 2025. In the short term (up to October 2025), we anticipate continued market liquidity and stability driven by institutional capital. The market will likely see a surge in sophisticated crypto products from TradFi institutions, including structured products and derivatives. Stablecoins will cement their role as a crucial bridge, with their market size projected to double to $400 billion by the end of 2025. The emergence of hybrid financial systems, blending blockchain’s transparency with regulatory oversight, will become more prevalent, fostering enhanced security and streamlined operations. Regulatory evolution, such as the EU’s MiCA regulation (implemented in 2024) and the SEC’s streamlined ETF approvals, will continue to reduce uncertainty, though challenges in cross-border compliance may persist.

Looking long-term (beyond October 2025), blockchain technology is expected to underpin a significant portion of global financial infrastructure, moving beyond just digital assets to modernize operations across the board. Tokenization of Real-World Assets (RWAs) is projected to be a cornerstone, reaching $16 trillion by 2030, offering unprecedented liquidity in traditionally illiquid markets. Traditional assets will increasingly coexist with digital currencies, allowing for more diversified investment portfolios. Cryptocurrencies are poised to enhance financial inclusion globally and significantly boost efficiency in transactions, particularly cross-border payments, with potential cost reductions of 60% to 80%. The lines between crypto and TradFi will blur further, leading to a truly hybrid financial ecosystem where Centralized Finance (CeFi) and Decentralized Finance (DeFi) collaborate to create a more robust and accessible landscape.

Several catalysts will drive this evolution. Continued regulatory clarity, particularly the potential for further altcoin ETF approvals and harmonized global frameworks, will be crucial. Technological advancements, including Layer 2 scaling solutions and the integration of AI with blockchain, will enhance efficiency and accessibility. The growing demand for RWA tokenization, driven by the desire to unlock liquidity and broaden access, will also be a significant factor. Institutional demand and investment, recognizing Bitcoin as a legitimate asset class, will continue to fuel integration, moving from experimentation to strategic commitment.

For crypto projects, strategic considerations include prioritizing compliance and regulation, focusing on real-world utility and tokenization, enhancing scalability and security, and building bridges with TradFi while carefully maintaining decentralization. Investors should aim to understand this hybrid market, diversify portfolios across various crypto sectors, closely monitor the regulatory landscape, and assess institutional alignment of specific assets. While risks such as smart contract vulnerabilities and liquidity management challenges remain, the long-term trajectory points towards a more integrated and mature asset class. The most likely scenario is a gradual, steady integration, with a medium-to-high probability of accelerated integration leading to a “crypto supercycle.” However, fragmented integration due to regulatory bottlenecks remains a medium probability, and the risk of TradFi dominance and centralization is a low-to-medium probability to watch.

The confluence of traditional finance and cryptocurrency is not merely a trend but a fundamental reshaping of the global financial landscape. For crypto investors and enthusiasts, the key takeaways are clear: increased legitimacy and market access, enhanced liquidity and stability from institutional capital, and a burgeoning array of diversified investment products, including spot ETFs and tokenized Real-World Assets (RWAs). This integration, however, also brings the critical need to navigate the risks of potential centralization and heightened regulatory scrutiny. The recommended focus remains on established assets like Bitcoin and Ethereum, which continue to attract significant institutional flows and treasury adoption.

The long-term significance of this convergence is nothing short of transformative. Blockchain technology is set to reshape core financial infrastructure, offering faster, cheaper, and more secure services. The integration of TradFi and DeFi is seen as inevitable, leading to a hybrid financial ecosystem where digital assets are recognized as a legitimate, strategic asset class within diversified portfolios. This will foster broader financial inclusion globally and significantly enhance efficiency across various financial processes.

Crypto adoption is experiencing a boom driven by surging institutional demand, the critical development of clearer regulatory frameworks worldwide (such as the EU’s MiCA regulation), and continuous technological innovations like AI integration and Layer 2 scaling. Stablecoins are playing an increasingly vital role, projected to reach $400 billion by the end of 2025. While challenges around regulatory certainty and retail investor education persist, the overwhelming momentum points towards a future where digital assets are an integral part of daily financial life.

Key dates, events, and metrics to monitor include the full effectiveness of the EU’s MiCA regulation by December 2024, potential U.S. banking regulatory shifts in January 2025, and the July 2025 signing of the GENIUS Act establishing a federal framework for payment stablecoins. Institutional product milestones, such as the continued performance of Bitcoin and Ethereum ETFs, the expected approval of Altcoin ETFs in late 2025, and the growth of tokenized RWA products like BlackRock’s BUIDL, will be crucial. Market metrics like Bitcoin’s price targets (analysts project $100,000-$200,000 by end of 2025), stablecoin market capitalization, and on-chain metrics like “realized cap” and “hash rate” will provide vital insights. Major conferences throughout 2025, such as Consensus Hong Kong (February 2025) and Token2049 Singapore (October 2025), will also serve as barometers for industry sentiment and innovation. The bottom line is that TradFi and crypto are irrevocably intertwined, forging a new, hybrid financial landscape that promises greater efficiency, accessibility, and diversification in the years to come.

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry significant risk.

KERALA LOTTERY RESULT Thursday 17-04-2025 LIVE: KARUNYA PLUS KN lottery is one of the 7 lucky draws held every week. Each Thursday at 3 PM, the Kerala Lottery “KARUNYA PLUS KN 569” lottery draw is conducted. Every lottery has an alphanumeric code to identify it, and the Kerala “KARUNYA PLUS KN” lottery code is “KN” because it includes the draw number as well as the code. The first prize winner of lucky draw will receive Bumper 80 Lakh Rupees. Scroll down for the complete winners list of Kerala ‘KARUNYA PLUS KN 569’ lucky draw.

Trending Photos

Kerala Lottery Results Thursday 17-04-2025 LIVE: The Kerala Lottery Department, on behalf of the Keralan government, announces the “Karunya KN-569” Lucky Draw Result today Karunya KN-569, April 17, 2025. The draw will be held at Gorky Bhavan near Bakery Junction in Thiruvananthapuram. The Kerala Lottery Result 2025 for “Karunya KN-569” will feature 12 series, with changes in series possible each week. A total of 108 lakh tickets are available for purchase weekly. The ticket prices may vary. Check the Karunya KN-569 results right here to see if you’re the first-place winner of ₹80 Lakhs. Stay tuned to this website for the live update of Kerala Lottery Karunya KN-569 results today.

<h2>Kerala Lottery Result 17-04-2025 April: FULL LIST OF WINNING NUMBERS FOR KARUNYA PLUS KN-569 Draw</h2><div id = "v-zeenews-india-v1"></div> <br><strong>LUCKY TICKET NUMBER FOR 1ST PRIZE OF RS 80 LAKHS IS: PT 351400</strong><div><div class="recommended_widget"><div id="taboola-mid-article-thumbnails"></div></div></div><div classname="googlePopUp" id="googleCTA" style="background-color:#FFD1D1;height:46px; border-radius:4px"> <div classname="googlePreferredAd" style="display:flex;padding:4px 20px;gap:20px;width:100%;justify-content:center"> <p style=" font-size:14px !important; font-weight:bold; color:#333333;">Add Zee News as a Preferred Source <a href="https://www.google.com/preferences/source?q=zeenews.india.com" target="_blank" style="margin-left: 20px;" id="googleIconBtn"> <img src="https://english.cdn.zeenews.com/static/public/updated_logos/googlePreferred.png" alt="" style="width:122px !important;" /> </a> </div> </div> <div id="trendingNow" class="mb-3"></div> <br>Add Zee News as a Preferred Source <a href="https://www.google.com/preferences/source?q=zeenews.india.com" target="_blank" style="margin-left: 20px;" id="googleIconBtn"> <img src="https://english.cdn.zeenews.com/static/public/updated_logos/googlePreferred.png" alt="" style="width:122px !important;" /> </a> <br><strong>LUCKY TICKET NUMBER FOR 2ND PRIZE OF RS 10 LAKHS IS: PX 664847</strong> <br><strong>LUCKY TICKET NUMBERS FOR 3RD PRIZE OF RS 1 LAKHS ARE: </strong><br /> <strong>1) PN 798859<br /> 2) PO 404070<br /> 3) PP 996469<br /> 4) PR 232060<br /> 5) PS 845770<br /> 6) PT 867280<br /> 7) PU 177279<br /> 8) PV 717445<br /> 9) PW 163090<br /> 10) PX 590557<br /> 11) PY 501747<br /> 12) PZ 131034</strong> <br><strong>LUCKY TICKET NUMBERS FOR CONSOLATION PRIZE OF RS 8,000 ARE: </strong><br /> <strong>PN 351400<br /> PO 351400<br /> PP 351400<br /> PR 351400<br /> PS 351400<br /> PU 351400<br /> PV 351400<br /> PW 351400<br /> PX 351400<br /> PY 351400<br /> PZ 351400</strong> <br><strong><em>(For The Tickets Ending with The Following Numbers below)</em></strong> <br><strong>LUCKY TICKET NUMBERS FOR 4TH PRIZE OF RS 5,000 ARE: </strong><strong>0581 0591 0769 0934 1494 1577 1777 2357 3256 3386 3629 4157 4290 4917 8167 8272 8773 8865</strong> <br><strong>LUCKY TICKET NUMBERS FOR 5TH PRIZE OF RS 1,000 ARE: </strong><strong>0260 1302 1319 1681 1852 2612 2769 2797 3005 3237 3799 3994 4342 4678 4870 4978 4992 5421 5429 5970 6009 6479 6583 7057 7072 7128 7138 7150 7161 8115 8451 8525 8660 9547</strong> <br><strong>LUCKY TICKET NUMBERS FOR 6TH PRIZE OF RS 500 ARE: </strong><strong>0147 0283 0318 0517 0831 0883 1134 1216 1304 1673 1853 1856 2195 2287 2368 2407 2686 2717 2800 2916 2940 3011 3154 3603 3642 3803 3809 3914 3977 3982 4014 4075 4087 4212 4403 4452 4515 4622 4638 4664 4811 5020 5287 5313 5373 5379 5464 5472 5661 5749 6020 6137 6272 6350 6571 6700 6713 6780 6869 6880 6944 7356 7396 7746 7901 7982 8251 8330 8334 8339 8814 8822 8900 9135 9260 9640 9758 9898 9953 9971</strong> <br><strong>LUCKY TICKET NUMBERS FOR 7TH PRIZE OF RS 100 ARE: </strong><strong>0233 0251 0326 0364 0414 0601 0629 0812 0945 1005 1054 1108 1110 1116 1250 1549 1622 1940 2133 2148 2199 2305 2355 2403 2507 2603 2637 2974 2993 2999 3212 3280 3281 3505 3511 3546 3579 3628 3632 3752 3938 3955 3962 4058 4149 4273 4473 4484 4559 4591 4682 4685 4915 4986 4993 5040 5180 5253 5264 5357 5507 5607 5655 5845 5847 6046 6069 6309 6392 6412 6737 6742 6799 6903 6913 6993 7051 7066 7127 7203 7234 7289 7349 7376 7424 7428 7510 7538 7584 7745 7813 7927 7936 7960 7980 8046 8070 8072 8073 8091 8129 8226 8237 8287 8540 8598 8608 8719 8766 8850 8868 8888 8938 8974 9057 9110 9136 9160 9390 9470 9590 9600 9609 9712 9902 9906</strong> <br><strong>KERALA LOTTERY RESULT TODAY 17-04-2025 April: KARUNYA PLUS KN-569 LOTTERY PRIZE DETAILS</strong> <br><strong>1st Prize: Rs 80 Lakhs<br /> 2nd Prize: Rs. 10 lakhs<br /> 3rd Prize: Rs. 1 Lakh<br /> 4th Prize: Rs. 5,000<br /> 5th Prize: Rs. 1,000<br /> 6th Prize: Rs. 500<br /> 7th Prize: Rs. 100<br /> Consolation Prize: Rs. 8,000</strong> <br><strong>(NOTE: Lottery can be addictive and should be played responsibly. The data provided on this page is for informational purposes only and should not be construed as advice or encouragement. Zee News does not promote lottery in anyway.)</strong> <h2><strong><span style="color:#FF0000;">Stay Tuned To Zee News For Live And Latest Updates On Kerala Lottery Result 2025</span></strong></h2><br><strong>6th Prize Rs.500/-<br /> 0147 0283 0318 0517 0831 0883 1134 1216 1304 1673 1853 1856 2195 2287 2368 2407 2686 2717 2800 2916 2940 3011 3154 3603 3642 3803 3809 3914 3977 3982 4014 4075 4087 4212 4403 4452 4515 4622 4638 4664 4811 5020 5287 5313 5373 5379 5464 5472 5661 5749 6020 6137 6272 6350 6571 6700 6713 6780 6869 6880 6944 7356 7396 7746 7901 7982 8251 8330 8334 8339 8814 8822 8900 9135 9260 9640 9758 9898 9953 9971</strong><br /> <br> <br><strong>5th Prize Rs.1,000/-<br /> 0260 1302 1319 1681 1852 2612 2769 2797 3005 3237 3799 3994 4342 4678 4870 4978 4992 5421 5429 5970 6009 6479 6583 7057 7072 7128 7138 7150 7161 8115 8451 8525 8660 9547</strong><br /> <br> <br><strong>4th Prize Rs.5,000/-<br /> 0581 0591 0769 0934 1494 1577 1777 2357 3256 3386 3629 4157 4290 4917 8167 8272 8773 8865</strong><br /> <br> <br><strong>3rd Prize Rs.100,000/- [1 Lakh] <br /> 1) PN 798859<br /> 2) PO 404070<br /> 3) PP 996469<br /> 4) PR 232060<br /> 5) PS 845770<br /> 6) PT 867280<br /> 7) PU 177279<br /> 8) PV 717445<br /> 9) PW 163090<br /> 10) PX 590557<br /> 11) PY 501747<br /> 12) PZ 131034</strong><br /> <br> <br><strong>Consolation Prize Rs.8,000/-<br /> PN 351400<br /> PO 351400<br /> PP 351400<br /> PR 351400<br /> PS 351400<br /> PU 351400<br /> PV 351400<br /> PW 351400<br /> PX 351400<br /> PY 351400<br /> PZ 351400</strong><br /> <br> <br><strong>2nd Prize Rs.10,00,000/- [10 Lakhs]<br /> PX 664847 </strong><br /> <br> <br><strong>1st Prize Rs.8,000,000/- [80 Lakhs]<br /> PT 351400</strong><br /> <br> <br>The winning ticket must be presented to the Director of State Lotteries if the prize is more than one lakh rupees after the prize winner's name, address, and signature are pasted on the back of the ticket with the accompanying documentation.<br>- A claim Application along with a Self-attested Photocopy of both sides of the ticket.<br>- Two Passport size photos of the lottery winner duly attested by a Gazetted Officer/Notary.<br>- A receipt for the prize money in the prescribed form affixing a revenue stamp worth ₹1/- (Download Receipt Here).<br>- Self-attested copy of the PAN Card of the winner.<br>- Attested ID Proof Documents like Adhaar Card, Ration Card, DL, Passport, Voter ID Card, etc.<br> <br>A ticket with multiple security features can prevent claims if damaged. So keep the ticket safe. Those who won the prize less than Rs.5000 should approach any lottery shop in Kerala with the ticket to collect the amount. If the prize is more than 5000 then the ticket and identity documents should be brought to any bank or government lottery office.<br> <br>If the prize money is less than Rs 5,000, the winners can claim the money from any lottery shop in Kerala. If the amount won is above Rs 5,000, the winners will have to surrender their tickets before a bank or government lottery office with id proofs. The prize winners are advised to verify the winning numbers with the results published in the Kerala Government Gazatte and surrender the winning tickets within 30 days.<br> <br>Step 1: Visit the Kerala Lottery website.<br>Step 2: Choose the ‘Lottery Result’ option.<br>Step 3: Once you do that, a new page will appear, and you should select ‘View.’<br>Step 4: Finally, click on the ‘Download’ button located at the top right corner of the page to access the PDF file.<br> <br>Anyone may obtain the claim form from their official website. The rules of the Nagaland lottery must be followed by the players. If you won more over Rs.10,000, you can claim it at the Nagaland Office in Kolkata. Winners can submit their claims to the following location together with the required documentation.<br> <br>The Kerala Lottery Result for Karunya KN 569 is set to be drawn today. The public can view the Winning Number post at 2.55 pm during the live broadcast of Kerala Lottery Today. The announcement for the Kerala Lotteries Result today, dated April 17, 2025 is expected to follow shortly.<br>Stay informed on all the <a href="/">latest news</a>, real-time <a href="/"> breaking news</a> updates, and follow all the important headlines in<a href="/india"> india news</a> and<a href="/world">world News</a> on Zee News.<br>Thank you<br><br><br><a href="https://news.google.com/rss/articles/CBMingJBVV95cUxQZUxwVlhER0hta0pvSlBSaTBSLUFnVE5NRmFWU3RXZmpnenhlT3oxa3NPNDk4NlpRRGM0RXVkTlJfRlVPMWhOcHVsQmRIbnZmRDhXQVNNTDNYRVRsM3EzNFdhTkhlZ3J2MnNSemE5VVd4U0NqWGNNaGtpeHM5YXV0WENpNTdyQVk4cEtUYjFlNFliMmwtZ1pnTWxQUERHUks5M1l6ZTBncFhHVXlnNUl5QWtkQjlpX3FyTVpEYkd1MERiemZlZ0ZpY2dxMDdwZHZkR0JJSTBjNVh4WGdsRjM2dkpLOU1BQ3Q1WTF4Y2FzV2ZtZmZHLUlyNVNLVTFVUGxkWGdUNGwxZTA5VmJRcWpXM055NVlnOFk3WkkzNnB30gGjAkFVX3lxTE1KYWZYOTFNZDRkV21fY3V1c2VoT3VVN2hkNmVKR0JldEJaRkFLOUt4cVVRcThhTkZCOWp0MnpsWC1EbzVOU1YyUVBGQWEwd3BudVI4cWd2Q1dTbE4wbjgzN3c2ZmZDbEpDd245UUQ5MTBDamYxaUJHZWhmSWtBeUZqb0t3OTk0d2plT3h6UmkyTmx4MlpWWGY3aExmMWc5YVQtT0M5LV8wUzFpWDJiV3lPb1B5emJUeFUyX1BMZ29ocTJjVEVnNVpwTDlxZk9wM3piSkJmLTVlZXh4bWxqYjdXYkoyVzA0clBtMzE4VmxfRXM2RTE0bVhTNEkwWVFpX3RaanVFTWNiZ1hjYm9ibGJLUE9zU3JTTmR4clV6OUxpaFl3Yw?oc=5">source</a>

Defense department policy requires outlets to vow not to obtain unauthorized files and restricts access to some areas

Several leading news organizations with access to Pentagon briefings have formally said they will not agree to a new defense department policy that requires them to pledge they will not obtain unauthorized material and restricts access to certain areas unless accompanied by an official.

The policy, presented last month by the defense secretary, Pete Hegseth, has been widely criticized by media organizations asked to sign the pledge by Tuesday at 5pm or have 24 hours to turn in their press credentials.

The move follows a shake-up in February in which long-credentialed media outlets were required to vacate assigned workspaces which was cast as an “annual media rotation program”. A similar plan was presented at the White House where some briefing room spots were given to podcasters and other representatives of non-traditional media.

On Monday, the Washington Post joined the New York Times, CNN, the Atlantic, the Guardian and trade publication Breaking Defense in saying it would not sign on to the agreement.

Matt Murray, the Post’s executive editor, said the policy runs counter to constitutional guarantees of freedom of the press.

“The proposed restrictions undercut First Amendment protections by placing unnecessary constraints on gathering and publishing information,” Murray wrote in a statement published on X. “We will continue to vigorously and fairly report on the policies and positions of the Pentagon and officials across the government.”

The Atlantic, which became embroiled in a dispute with Pentagon and White House officials earlier this year after editor Jeffrey Goldberg was accidentally added to a group chat on Signal, said it “fundamentally” opposes the new restrictions.

The new policy “constrains how journalists can report on the U.S. military, which is funded by nearly $1 trillion in taxpayer dollars annually,” a New York Times statement said. “The public has a right to know how the government and military are operating,” wrote the Times Washington bureau chief, Richard Stevenson.

Hegseth responded on social media to statements from the Atlantic, the Post and the Times by posting a single emoji of a hand waving goodbye. Later, the defense secretary, a former Fox weekend anchor, posted a list on X of what he called “press credentialing FOR DUMMIES: Press no longer roams free Press must wear visible badge Credentialed press no longer permitted to solicit criminal acts”. He also reposted a cartoon that depicted the Atlantic as a crying baby.

Some righ-leaning outlets have also declined to sign the document. “Newsmax has no plans to sign the letter,” the network told the New York Times reporter Erik Wemple. “We are working in conjunction with other media outlets to resolve the situation. We believe the requirements are unnecessary and onerous and hope that the Pentagon will review the matter further.”

Pentagon spokesperson Sean Parnell told the Washington Post that media outlets had “decided to move the goal post”, saying that the policy doesn’t require reporters to agree, but just acknowledge they understand it.

Sign up to This Week in Trumpland

A deep dive into the policies, controversies and oddities surrounding the Trump administration

after newsletter promotion

Parnell said that request had “caused reporters to have a full-blown meltdown, crying victim online.” He added: “We stand by our policy because it’s what’s best for our troops and the national security of this country.”

The Pentagon Press Association, which represents the press corps covering the defense department, said last week that a revised policy that seeks to prohibit journalists from soliciting unauthorized information in addition to accessing it, appeared to be “designed to stifle a free press and potentially expose us to prosecution for simply doing our jobs”.

The PPA noted that the revised policy “conveys an unprecedented message of intimidation to everyone within the DoD, warning against any unapproved interactions with the press and even suggesting it’s criminal to speak without express permission – which plainly, it is not”.

The new rules were accepted by the far-right cable channel One America News, whose White House correspondent is frequently invited by the president to ask him questions. One of the channel’s hosts, former Florida congressman Matt Gaetz, said the pro-Trump outlet “is happy to follow these reasonable conditions”.

Now

60

Tue

64

Wed

79

Armstrong Williams takes on the news of the week and asks the questions you want answered. This week we talk with DC Mayor Muriel Bowser.

by Alexandros Barbosa-Rewinkel

TOPICS:

LINCOLN, Neb. — Mayor Leirion Gaylor Baird has introduced a new ordinance in Lincoln aimed at safeguarding older adults from cryptocurrency fraud. The proposal mandates businesses with cryptocurrency ATMs to display warnings about potential fraud risks.

"Some individuals are using cryptocurrency to attempt to defraud our seniors," said Mayor Gaylor Baird.

She noted the proliferation of crypto ATMs, with 45,000 nationwide, including 200 in Nebraska and about 40 in Lincoln, as a growing concern for scams.

Police Chief Michon Morrow reported that since 2021, Lincoln has experienced 426 cases of cryptocurrency fraud, resulting in $11.1 million in losses. The average age of victims is 56, with 42% aged 65 or older.

"Cryptocurrency fraud is on the rise, so is our result to stop it," said Morrow, announcing a new position within the Lincoln Police Department's Technical Investigations Unit dedicated to cryptocurrency fraud investigations, starting in January 2026.

Randy Jones, Aging Partners Director, and Todd Stubbendieck, AARP Nebraska Director, supported the mayor's announcement. Stubbendieck highlighted a 99% increase in complaints related to virtual currency kiosks in 2024, with losses exceeding $246 million. He stressed the ordinance's role in helping potential victims recognize scams. Jones advised older adults to be cautious with money transfer requests.

The ordinance is set to appear before the City Council on Oct. 27, followed by two more readings, with final approval expected at the Nov. 17 meeting. If passed, it will take effect on Jan. 16, 2026, allowing time for business education. The Lincoln Police Department and AARP will collaborate on these efforts, providing necessary signage to businesses.

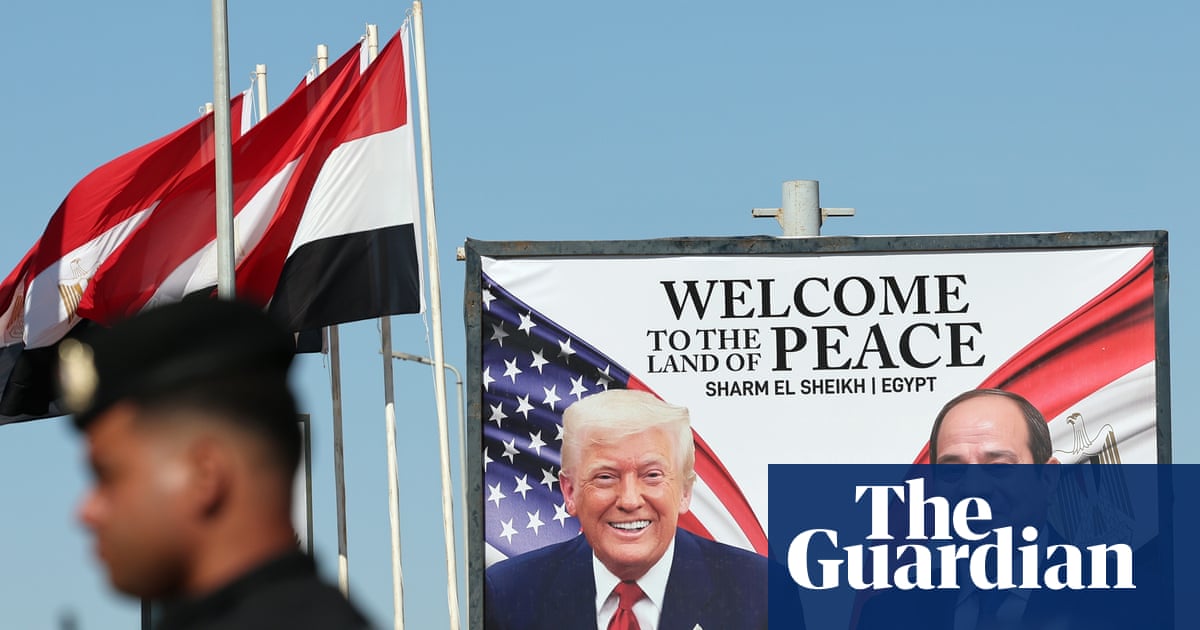

Trump and Egyptian president Abdel Fatah al-Sisi will co-host a summit of more than 20 world leaders in Sharm El Sheikh

Donald Trump and Egyptian president Abdel Fattah al-Sisi will co-host a summit of more than 20 world leaders in Sharm El Sheikh on Monday, after the US president first visits Israel to speak at the Knesset and meet families of the hostages.

The summit’s aim is “to end the war in the Gaza Strip, enhance efforts to achieve peace and stability in the Middle East, and usher in a new era of regional security and stability”, according to the Egyptian presidency.

The impressive aims of the meeting are matched by a similarly impressive guest list, many of whom have played a vital role in securing the ceasefire and hostage release deal that is currently in place.

The continuing success of the deal – and how closely the next stages match up to Trump’s 20-point peace plan – are all expected to be up for discussions at Monday’s meeting.

Donald Trump

The US president will be seeking to advance his peace, with several crucial elements – including how Gaza is to be ruled when fighting ends, and the ultimate fate of Hamas – still unconfirmed. Still, Trump is riding high on his current successes, telling reporters on Sunday “the war is over”.

Abdel Fatah al-Sisi

Egypt has played a leading role in negotiations between Israel and Hamas over the course of the two-year conflict. Al-Sisi’s invitation for Trump to take a “victory lap” of the region will help ensure the ceasefire sticks, a source told Reuters.

Sheikh Tamim bin Hamad Al Thani

Qatar’s Emir was reportedly among the Arab leaders pushing to bind Trump to the peace process, hoping that tying it to the president would help ensure its success.

Mahmoud Abbas

Trump’s peace plan left open the possibility of a role for Abbas’s Palestinian Authority in Gaza – contingent on various reforms – but Benjamin Netanyahu has rejected such an idea.

Also attending:

French President: Emmanuel Macron

Turkish President: Recep Tayyip Erdoğan

UK’s prime minister: Keir Starmer

Spanish prime minister: Pedro Sánchez

Italian prime minister: Giorgia Meloni

European council president: Antonio Costa

UN secretary-general: António Guterres

Arab League secretary-general: Ahmed Aboul Gheit

Jordan’s King Abdullah II

Kuwait’s prime minister: Ahmad Al Abdullah Al Sabah

Bahrain’s King Hamad bin Isa Al Khalifa

Indonesia’s President: Prabowo Subianto

Azerbaijan’s President: Ilham Aliyev

German Chancellor: Friedrich Merz

Dutch prime minister: Dick Schoof

Greek prime minister: Kyriakos Mitsotakis

Armenian prime minister: Nikol Pashinyan

Hungary’s prime minister: Viktor Orbán

Pakistan’s prime minister: Shehbaz Sharif

Canada’s prime minister: Mark Carney

Norway’s prime minister: Jonas Gahr Store

Iraq’s prime minister: Mohammed Shia al-Sudani

Israeli officials

Israel will not send a representative to the peace summit, a spokesperson for prime minister Benjamin Netanyahu said on Sunday.

Representatives from Hamas

A Hamas political bureau member said the group “will not be involved”, adding that Hamas “acted principally through … Qatari and Egyptian mediators” during previous talks on Gaza.

Iranian officials

Iranian state media reported that Egypt had invited Iran to attend the summit, but on Monday the country confirmed that neither its President Masoud Pezeshkian nor foreign minister Abbas Araghchi would take part.

On Monday, Araghchi posted on X: “Neither President Pezeshkian nor I can engage with counterparts who have attacked the Iranian People and continue to threaten and sanction us,” in reference to the United States.

Washington briefly joined Israel in attacks that targeted Iran’s nuclear sites during a 12-day war in June.

To stream WLTX 19 on your phone, you need the WLTX 19 app.

Next up in 5

Example video title will go here for this video

Next up in 5

Example video title will go here for this video