Home » Crypto & Blockchain » Coins » XRP »

Several central banks have explored Ripple’s technology in private trials, but clear proof of them using the XRP token for settlement is still limited.

As more countries test central bank digital currencies (CBDCs), attention has turned to Ripple and its XRP token. Some central banks are already experimenting with Ripple’s technology to improve settlement speed and reduce cross-border costs.

However, public evidence that they are using the XRP token itself for settlement remains scarce.

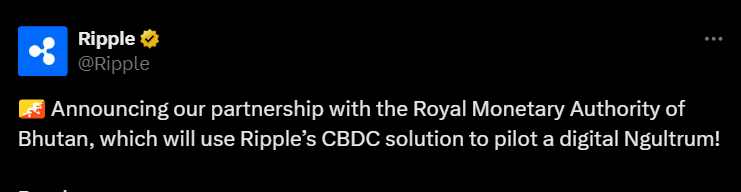

A few central banks have confirmed pilots using Ripple’s technology. Bhutan’s Royal Monetary Authority partnered with Ripple in 2021 to test a digital ngultrum, and Palau announced a similar collaboration in 2023.

In Europe, reports in mid-2025 mentioned experimental projects using Ripple-based systems for tokenized settlements in closed environments. These pilots focus on CBDC infrastructure and liquidity testing, not necessarily the XRP token on the public ledger.

So far, no central bank has confirmed actual settlement using XRP, suggesting most testing happens on private or permissioned networks.

RECOMMENDED: XRP Joins S&P Digital Markets 50 – What’s Next for Crypto in 2025

XRP offers instant settlement, low fees, and strong liquidity features, making it appealing for testing faster cross-border payments. It can act as a bridge between different currencies or CBDCs, reducing the need for banks to hold large reserves in foreign accounts.

Ripple’s focus on enterprise and stablecoin solutions, such as RLUSD, supports this concept of connected payment corridors. Still, central banks usually test these systems privately first.

While XRP’s technical design fits many settlement needs, the lack of public confirmation suggests regulators are moving carefully before wider adoption.

RECOMMENDED: Will XRP Hit $5? Three Scenarios for the 2025 Bull Run

Most central banks prefer private ledgers that meet strict security and compliance standards. Regulation also limits public token use in official settlements. Real adoption would become clear only if a central bank runs a live pilot on the public XRP Ledger, names XRP in official documents, or publishes audited transaction results showing token-based settlement activity.

RECOMMENDED: 5 Major Companies Quietly Acquiring XRP

Ripple’s technology appears in several central-bank projects, but proof of XRP being used for real settlement is missing. Future public pilots or disclosures could reveal how close adoption truly is.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

Download 50 crypto investing tips

Sam Ralph is a financial writer and researcher with over 10 years of market experience. Specializing in tracker funds and cryptocurrency, he combines disciplined research with actionable insights, helping investors navigate markets confidently. Sam’s expertise simplifies complex financial topics, empowering readers to make informed investment decisions.

Receive top notch forecasts for free.

*We hate spam as you do.

Precious metals market analysis including gold and silver price predictions. Crypto market analysis including highly accurate BTC ETH SOL XRP forecasts.

Copyright © 2025 InvestingHaven

Login to your account below

Fill the forms bellow to register

Please enter your username or email address to reset your password.

The views and opinions expressed in this article are solely those of the author and do not necessarily represent the official position, policies, or views of InvestingHaven or its affiliates. This content is provided for informational purposes only and does not constitute financial, investment, legal, or other professional advice. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Copyright © 2025 InvestingHaven