Home / Health & Wellness

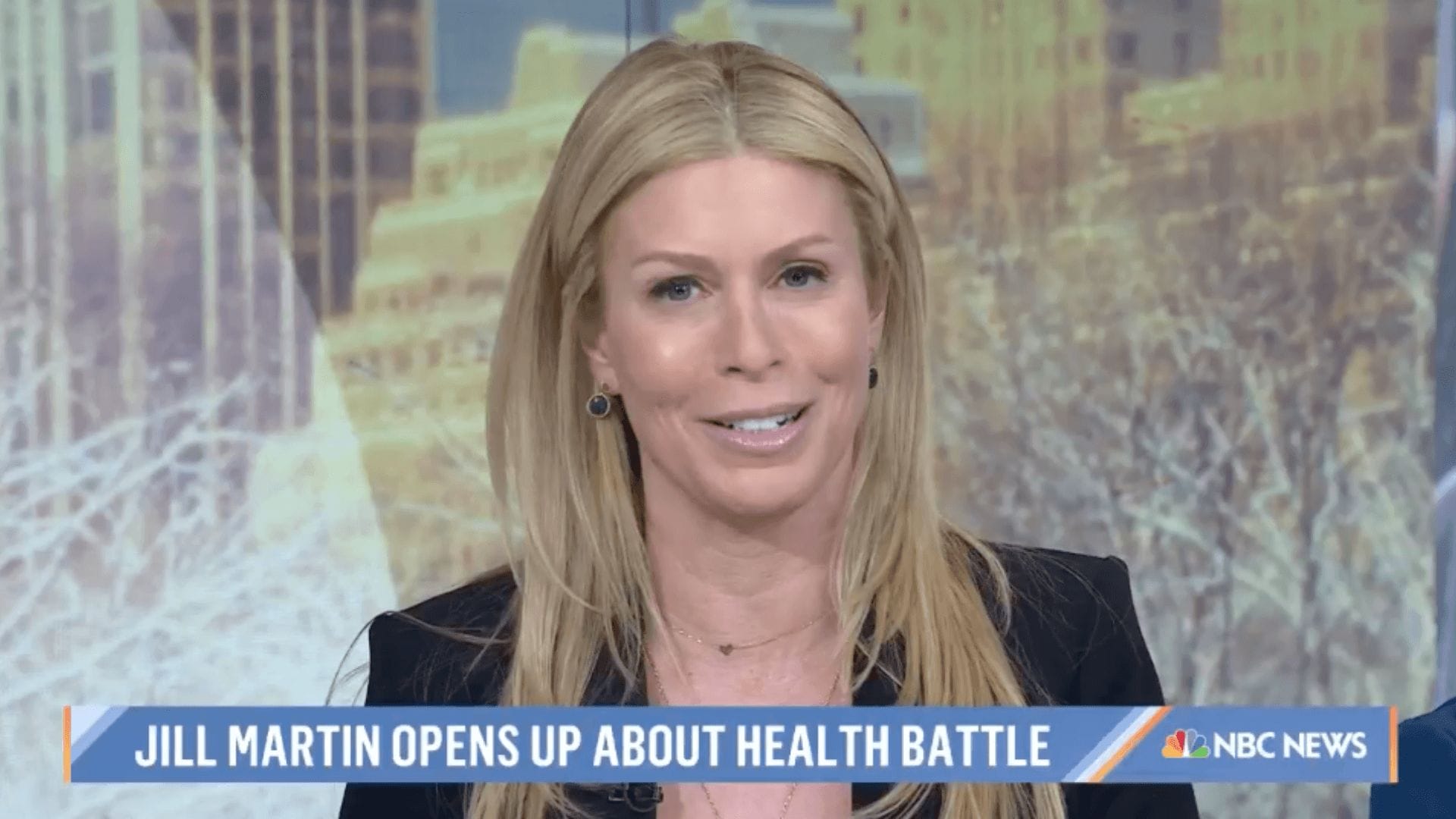

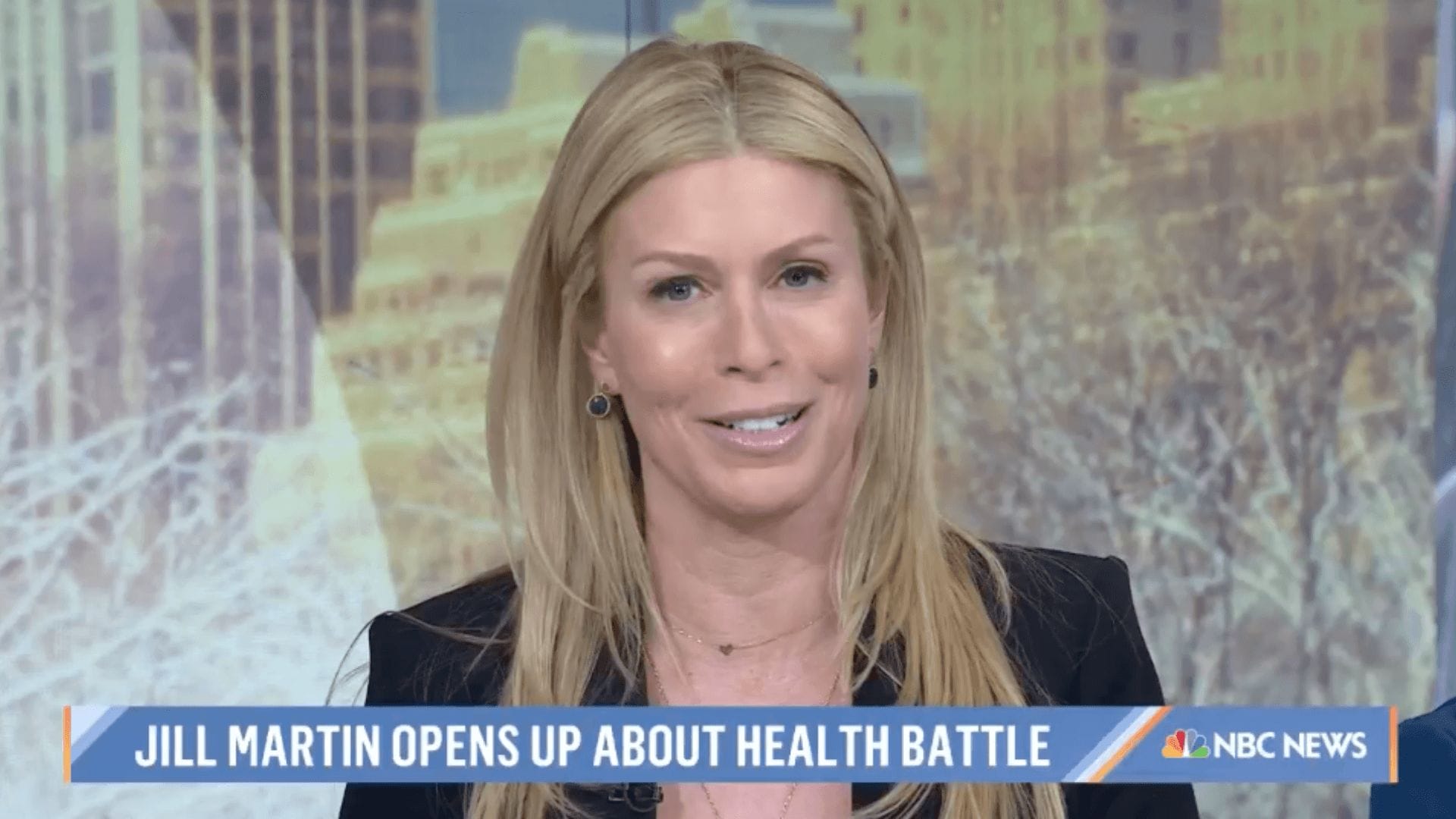

NBC NEWS/TODAY

I’ve been living with pain for two years. Recently, I decided to do something about it.

By Jill Martin Updated Sep. 08, 2022

Table of Contents

Three weeks ago was the first time I called in sick to work. I have never taken a sick day—ever. And I have been working since I was 16 years old, so you know something was wrong.

But that day, for the first time in my life, I was just in too much physical pain to go to work. In fact, I have been living in pain for two years. In 2019, I discovered during a routine gynecological exam that I had fibroids, or noncancerous growths on the uterus. If you could have seen me on Zoom calls or in TODAY’s greenroom between segments in recent months, you would know I was always looking for a place to plug in a heating pad. I was suffering all the time. Viewers were asking on social media if I had gained weight or if I was pregnant.

I wasn’t pregnant, but I looked like it: During an exam last August, my gynecologist, Dr. Karen Brodman, said that my uterus was the size of someone’s who is four months pregnant.

An estimated 20% to 50% of women of reproductive age have fibroids, according to Johns Hopkins Medicine. My mother has lived with fibroids for years and they have not bothered her. But for some women, they can cause painful and elongated periods, abdominal discomfort, lower back pain, bowel symptoms and more—even infertility.

They’re especially common among Black women, who are often underdiagnosed and undertreated. My friend and colleague Sheinelle Jones featured a story about this in her recent MSNBC documentary, “Stories We Tell: The Fertility Secret.” Black women are two to three times more likely to have fibroids than white women, Dr. Brodman told TODAY.

I know many of you are asking, “Is this what I have?” Well, here were my symptoms: I could not go anywhere without my heating pad. It hurt to have intercourse. I was physically distorted and bloated—see the photo of my stomach above; yes, that’s a fibroid—and I was in glaring pain most of the time. Oh, and another fabulous occurrence: When someone would say something funny, I would pee.

“Nobody likes a complainer,” my parents used to tell me when I was growing up. (They still do, actually.) I live by that. After learning my story, so many people said to me, “You must be in so much pain, but I have never heard you complain.” I don’t complain when something is fixable—I fix it. At first, although my fibroids were painful, they were manageable. But recently they became so painful that I needed to do something. I researched my options, with help from my fiancé. The good news is that what was wrong with me was fixable.

During our research, we came across something I had never heard of: uterine fibroid embolization, a minimally invasive treatment in which blood flow is cut off to the fibroids, causing them to decrease in size. I called my gynecologist and she referred me to Dr. Marc Schiffman, a radiologist. I was in his Zoom office days later. We made an appointment to do the procedure.

A post shared by Jill Martin (@jillmartin)

I thought I had two fibroids: one the size of a large grapefruit and the other a bit smaller than that. But the doctor found 18. (My mom said I was always an overachiever!) We won’t know if the treatment worked until six months from now, but I’m hopeful. About 9 out of 10 patients who undergo UFE experience significant improvements, or their symptoms go away entirely, according to Johns Hopkins Medicine. I already see my stomach getting flatter. I’m still in pain, but it’s good pain, because I know I am healing. Dr. Schiffman said my body is slowly reabsorbing the tissue. There is inflammation. My body just needs time.

Before discovering this treatment, I thought the only way to fix my pain meant getting a hysterectomy. After talking with other women who suffer from fibroids, I realized I’m not alone—many of them thought that a major surgery to remove their uterus was their only real solution, too. But there are other options. And when you are in pain, more often than not, it is time to do something.

I share my story because I think a lot of women don’t know all of their options for fibroid treatment. Dr. Schiffman told me that many women suffer for years because they think that surgery is the only solution, and that Black women in particular are less likely to be told of minimally invasive treatment options.

Today I am recovering. I took time off, which was put to good use. Sometimes you just need to take time and rest. It is so important to normalize that it is OK to not be OK. I feel like we all need to give ourselves—and others—a bit of a break. Walking without pain now feels like a luxury. So does not having to plan my days around having a bathroom in my near vicinity at all times. Having this (almost! hopefully!) in the rearview mirror is a blessing.

One of the most important lessons I learned through this experience and wanted to share is that it is up to each of us to be our own advocate, to make the best decisions to live healthy and happy lives—and to always be your own best friend. That, actually, is perhaps the best lesson my mother taught me.

This post originally appeared on NBC NEWS / TODAY.

Jill Martin is an Emmy Award-winning television personality, lifestyle contributor on NBC’s TODAY Show and a New York Times bestselling author.

Not only can it shorten the time kids spend feeling sick, but it can also reduce the chances of other family members catching the illness.

While most research has focused on general air pollution, emerging studies indicate that wildfire smoke can have similar health effects.

A groundbreaking study has revealed that a single iron infusion during the third trimester can significantly reduce anemia in pregnant women

Norovirus is a highly contagious virus that causes gastroenteritis, more commonly known as the “stomach bug” or “stomach flu.”

A study from McGill University shows that pregnancy might activate a natural flu defense in your body—keeping you and your baby safer.

A new study published in the Journal of Epidemiology & Community Health highlights just how important regular sleep is for our health.

New research shows just how powerful nutrition during the first 1,000 days—from pregnancy through age two—can be in shaping lifelong health.

A new mom’s heartfelt conversation with her baby’s grandmother, asking her not to kiss the newborn, has gone TikTok viral—and it’s easy to see why.

A novel AI-powered tool, developed by a team led by Dr. Zev Williams, found what doctors had never been able to detect in her husband’s semen sample—viable sperm.

You are stronger than you know.

PSA: You don’t even have to contribute to feel supported.

It’s the irrational anger at the baby section in Target. It’s the hundreds of times each day I wonder what it is that’s keeping me from getting pregnant.

Plus expert tips on how to boost your chances.

Unlike an incubator that supports premature babies, this robot would replicate the entire gestational process from conception to delivery.

The FDA has elevated part of a multi-state tomato recall to Class I, the most serious level.

I’ve been living with pain for two years. Recently, I decided to…

According to a brand new report from the CDC’s National Vital Statistics System, births among women in their 40s have more than tripled since 1990, while the teen birth rate has plummeted to a historic low.

The recall affects brown cage-free and certified organic eggs distributed by August Egg Company, based in Hilmar, CA.

Turns out, smartphone ownership might not be the doom spiral we’ve all been warned about—in fact, it might actually help our kids thrive.

Because the romance doesn’t have to end—even when you’re taking a break from sex.

Here's how to tell if swelling is normal or a sign of infection.

A therapist's essential roadmap for parents navigating the minefield of toxic masculinity online

A popular unicorn-print helmet has been recalled for failing federal safety tests, posing a serious risk of head injury. Here’s how to check if your child’s gear is affected.

I’ve been living with pain for two years. Recently, I decided to…

HG ravages both the body and the mind, leaving lasting emotional scars.

The issue? The remote’s button batteries can be accessed too easily. And for babies and toddlers, that tiny detail can mean a life-threatening risk if the batteries are swallowed.

Three baby loungers on Amazon recalled for serious safety risks—parents should act immediately.

Gen Z creator Jason Saperstone humorously teaches his parents the “right” way to text—focusing on when to use the emphasis or exclamation point tapback

“I’m gonna bite someone.”

© 2025 Motherly. All Rights Reserved.

source