The Treasury Department released

A

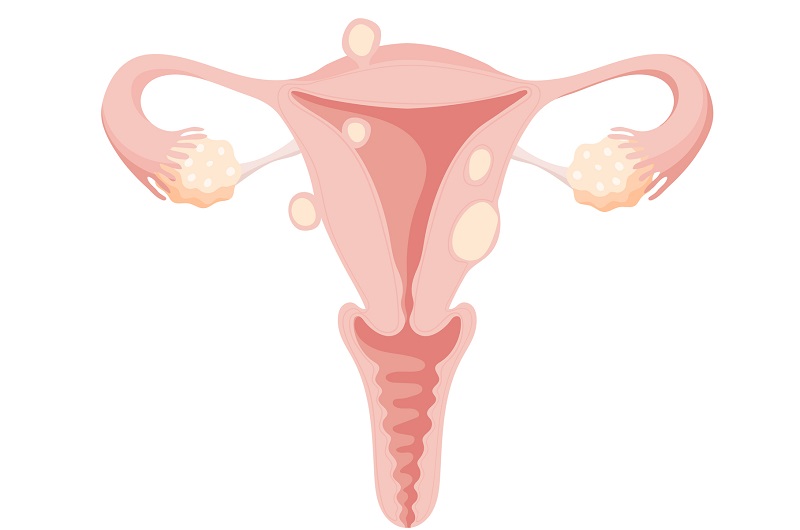

The no tax on tips provision allows employees and self-employed individuals to deduct up to $25,000 of qualified tips they receive in a tax year per return. Eligible taxpayers can claim the deduction on their 2025 tax return that they file next year. The deduction for qualified tips is available to eligible taxpayers who itemize their deductions, as well as those who do not itemize and take the standard deduction. The deduction phases out for taxpayers with income above $150,000 for single filers, or $300,000 in the case of a married filing jointly return.

To be deductible as qualified tips, the tips must be earned in an occupation on the list of occupations that customarily regularly receive tips for 2025. The tips must be paid in cash or an equivalent medium, such as a check, credit card, debit card, gift card, tangible or intangible tokens that are readily exchangeable for a fixed amount of cash or another form of electronic settlement or mobile payment application, excluding digital assets that are denominated in cash. There’s been some confusion about whether tips received on credit cards and debit cards count as cash tips, and the Treasury officials noted that they do. As far as tangible tokens that are readily exchangeable for a fixed amount of cash, that would include casino chips. As for intangible tokens that are readily exchangeable for a fixed amount of cash, that includes certain tokens that are provided on streaming platforms.

As for the deductibility of qualified tips received from customers, or In the case of an employee, through a mandatory or voluntary tip-sharing arrangement, the tip will also qualify. However, the tips must be paid voluntarily by the customer and not be subject to negotiation, automatic service charges or automatic gratuities for which the customer has no discretion to modify or disregard, are not qualified tips. Under the statute, the tip must be voluntary. A mandatory service charge is not a qualified tip, and mandatory service charges are not eligible for deduction. The proposed regulations include detailed examples as to how the rule works, including where there’s both mandatory service charge and an additional voluntarily paid amount.

In addition, the tips must not be received in the course of a so-called “specified service trade or business,” even if the tips received were for services in an occupation that’s on the list of occupations that customarily and regularly receive tips specified service trade or businesses. SSTBs include services in the performing arts, health and athletics, as well as other professional occupations like law and finance. Employees need to look to the SSTB of their employer to determine their eligibility for the adoption.

The proposed regulations provide some examples regarding this rule set, and Treasury officials acknowledged that the rules can be confusing. As they go through the notice and comment period, they hope to provide more clarity.

Questions have arisen about

The Treasury anticipates issuing additional guidance in the near term to advise on how individuals should determine their qualified tips for 2025, for example, if an individual receives a 1099 that aggregates their tip income with nontipped income. The Treasury also expects to issue additional guidance providing transition relief for employers and other entities with information reporting obligations.

The Treasury Department has received questions about digital creators. In the occupations list, the proposed regulations provide explanatory definitions for each occupation, as well as some examples for digital content creators. They define those as individuals who produce and publish on digital platforms, original entertainment and personality driven content, such as live streams, short form videos and podcasts. Accounting Today asked how to resolve the contradiction with performing artists, who are among the specified service trades or businesses that are supposedly excluded from qualified tips. Treasury officials responded that the administration believes that digital content creators are an important new industry and sees the no tax on tips deduction as supporting that industry. They generally do not believe the SSTB restriction should impact the vast majority of digital content creators. They plan to issue further clarifying guidance on SSTBs after the notice and comment period.

There’s a three-digit code and descriptions for the occupations listed within the proposed regulations. which group the occupations into eight categories:

The proposed regulations on the “no tax on tips” provision of the One Big Beautiful Bill Act outline which jobs and tips would be eligible.

Reality bites; can buy you love; community mistrust; and other highlights of recent tax cases.

Accounting software provider FloQast announced that users can now craft their own AI agents through natural language prompts, alongside several new AI-based capacities for the platform.

Firms utilizing outsourcing, offshoring and other methods to expand their workforce share what works, and what needs to be reimagined.

Senate and House Democrats proposed a bill to ensure billionaires pay a “fair share” of taxes, without actually raising their tax rate under current law, while Republicans advanced legislation pertaining to the IRS and the U.S. Tax Court.

Tax management platform Instead is planning to offer completely free tax return preparation and filing for Forms 1040, 1041, 1120, 1120-S and 1065.

Accounting Today is a leading provider of online business news for the accounting community, offering breaking news, in-depth features, and a host of resources and services.

Price had manipulated liquidity to the left, tapped into a clean demand zone, and then made its way upward to collect liquidity sitting above.

Price had manipulated liquidity to the left, tapped into a clean demand zone, and then made its way upward to collect liquidity sitting above.  That long scenario was almost textbook, and if you caught it, you probably know the satisfaction of seeing price behave exactly as mapped out.

That long scenario was almost textbook, and if you caught it, you probably know the satisfaction of seeing price behave exactly as mapped out. Price might want to dip lower, sweeping that liquidity, before even thinking about another push higher. Think of it as a quick reset — a pit stop before the next leg.

Price might want to dip lower, sweeping that liquidity, before even thinking about another push higher. Think of it as a quick reset — a pit stop before the next leg.