XRP Millionaires Will Be Made In The Next One or Two Months, Here’s Why Binance

source

In a fascinating intersection of numismatics, precious metals, and cutting-edge cryptocurrency, a significant cache of over 38,000 Bitcoins (BTC), valued at more than $4 billion as of October 19, 2025, lies dormant within physical Casascius coins. These unique artifacts, crafted from brass, silver, and gold, represent a tangible link to Bitcoin’s nascent years, offering a rare blend of digital wealth and physical artistry. The existence of these unclaimed fortunes sparks intrigue among both seasoned crypto enthusiasts and traditional precious metals investors, highlighting a peculiar chapter in financial history where digital scarcity met physical form.

The ongoing mystery of these unredeemed physical bitcoins not only underscores the early experimental spirit of the cryptocurrency movement but also presents a compelling narrative about forgotten wealth. Each Casascius coin or bar contains a private key, securely hidden beneath a tamper-evident hologram, which grants access to the digital BTC stored on the blockchain. The fact that thousands of these remain “unpeeled” means their digital contents have yet to be claimed, creating a tantalizing prospect for those who might hold them, unknowingly or otherwise. This situation raises questions about ownership, historical preservation, and the evolving nature of value in the 21st century.

The concept of a “physical bitcoin” was brought to life by Mike Caldwell, a software engineer operating under the alias “Casascius,” who began minting these distinctive coins in 2011. Caldwell’s vision was to create a tangible representation of Bitcoin, making the abstract digital currency more approachable and understandable in its early days. These physical bitcoins were designed to facilitate face-to-face transactions, allowing individuals to exchange BTC value as easily as they might hand over a dollar bill, albeit with a crucial digital component.

Each Casascius coin or bar is a marvel of its own, embedding a private key beneath a tamper-resistant hologram. The integrity of this hologram is paramount; a disturbed or removed seal indicates that the private key has been exposed, and the associated digital bitcoins may have been redeemed. Production of these iconic pieces continued until November 26, 2013, when Caldwell was compelled to halt sales. The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Treasury Department, informed him that minting physical bitcoins classified him as a money transmitter business, necessitating federal and state licenses—a regulatory hurdle that ultimately ceased his innovative venture.

Over its operational period, Caldwell minted approximately 27,928 to just under 28,000 funded Casascius coins and bars, collectively holding more than 90,000 BTC. Fast forward to October 19, 2025, and the allure of these coins remains undiminished. Current estimates suggest that a remarkable 17,746 active Casascius coins still hold their digital treasure, with over 38,000 BTC yet to be claimed. This substantial sum, exceeding $4 billion, represents not only a significant amount of digital currency but also a testament to the enduring appeal and historical significance of these unique physical artifacts. The initial market reaction to these coins was one of fascination and utility, as they provided a novel way to interact with a revolutionary new asset, often commanding a premium even then due to their innovative nature and limited supply.

The phenomenon of unclaimed Casascius bitcoins carries nuanced implications for various market participants, though direct “winners” or “losers” in the traditional corporate sense are less clear-cut. Instead, the impact resonates more broadly across the cryptocurrency ecosystem, numismatic markets, and even the broader financial landscape.

For the Cryptocurrency Market: The existence of such a large, yet inaccessible, trove of Bitcoin highlights the concept of “lost” or “dormant” supply, which can subtly influence market dynamics. While these 38,000+ BTC are technically part of Bitcoin’s total circulating supply, their physical encapsulation and unredeemed status mean they are effectively out of active circulation. This scarcity, whether intentional or accidental, can contribute to Bitcoin’s (BTC) overall value proposition by reducing the readily tradable supply. Companies involved in Bitcoin security, such as hardware wallet manufacturers like Ledger (EURONEXT: LGG) or Trezor (Private Company), might indirectly benefit from the narrative, as it underscores the importance of secure private key management, contrasting the physical security of Casascius coins with modern digital solutions. Exchanges like Coinbase Global, Inc. (NASDAQ: COIN) or Binance (Private Company) are largely unaffected by these dormant coins, as they exist outside their custodial services, but the narrative adds to the mystique and historical depth of the asset they trade.

For the Precious Metals Market: The Casascius coins, especially those made of silver and gold, bridge the gap between digital and physical assets. This crossover appeals to traditional precious metals investors, demonstrating a new form of “digital gold” that can also possess physical precious metal value. Dealers in rare coins and precious metals, such as APMEX (Private Company) or JM Bullion (Private Company), might see increased interest in rare crypto-related physical artifacts. The numismatic value of these coins, often far exceeding their embedded Bitcoin value, creates a unique asset class that could attract collectors from both worlds, potentially driving up demand and prices for similar hybrid collectibles in the future. The narrative reinforces the idea that value can be stored and transferred in innovative ways, challenging the traditional dominance of physical gold and silver as sole stores of value.

For the Public: The primary “losers” in this scenario are, ironically, the original owners or their heirs who have yet to claim the digital wealth locked within these physical tokens. The challenge of identifying and redeeming these coins often involves legal complexities, historical research, and the physical possession of the unpeeled coin. On the other hand, those who discover or inherit these unredeemed coins stand to gain immensely, turning a historical curiosity into a multi-million dollar windfall. This creates a fascinating treasure hunt narrative that captures public imagination and reinforces the long-term potential of early cryptocurrency investments.

The saga of Casascius physical bitcoins transcends a mere historical footnote; it serves as a powerful illustration of several broader industry trends and challenges. Firstly, it highlights the ongoing tension between decentralization and regulation. Mike Caldwell’s cessation of production due to FinCEN’s classification underscores the early regulatory uncertainties that plagued the nascent cryptocurrency industry. This event foreshadowed the complex legal frameworks that would later emerge, impacting everything from initial coin offerings (ICOs) to stablecoins and centralized exchanges. The regulatory scrutiny on physical bitcoins laid groundwork for how governments would begin to view digital assets, influencing policy decisions globally.

Secondly, these coins embody the enduring human desire for tangible assets, even in an increasingly digital world. Despite Bitcoin’s purely digital nature, the physical embodiment offered by Casascius coins provided a psychological bridge for early adopters, making the abstract concept of digital money more relatable. This trend continues today with the rise of non-fungible tokens (NFTs) that represent digital ownership of art, collectibles, and even real-world assets, mirroring the physical representation of digital value. The Casascius coins can be seen as a precursor to the digital collectible market, demonstrating the premium people place on unique, verifiable ownership, whether physical or digital.

The intersection of precious metals and cryptocurrency, exemplified by the gold and silver Casascius bars, also points to a broader convergence of traditional and modern finance. As of October 19, 2025, institutions and individual investors are increasingly diversifying portfolios with both physical gold and digital assets like Bitcoin, viewing them as complementary hedges against inflation and economic instability. The Casascius coins uniquely combine these attributes, appealing to both “gold bugs” and “crypto maximalists.” This dual appeal hints at future investment products that could further blend these asset classes, offering new ways to access and secure wealth.

Historically, the concept of a bearer instrument—where possession equates to ownership—has been central to physical currencies and commodities. Casascius coins revived this ancient principle for the digital age, creating a physical bearer bond for Bitcoin. This stands in contrast to modern digital wallets, which rely on software and network access. The challenges of reclaiming lost or forgotten Casascius coins also mirror historical precedents of lost treasures or unclaimed estates, emphasizing the importance of robust estate planning and secure key management in any form of wealth. The narrative of these coins continues to shape discussions around digital asset custody, inheritance, and the very definition of money itself.

Looking ahead, the story of unclaimed Casascius physical bitcoins presents a compelling mix of short-term challenges and long-term opportunities. In the short term, the primary focus remains on the ongoing effort to identify and redeem these dormant digital assets. For those who possess an unpeeled Casascius coin, the process involves carefully peeling the hologram to reveal the private key and then importing that key into a Bitcoin wallet. This act transforms a historical artifact into liquid digital wealth. However, the challenge lies in the sheer number of unredeemed coins and the potential for owners to be unaware of their true value, or even their existence. Efforts by online communities and specialized services continue to track these coins and educate potential holders on the redemption process, but the task is akin to a global treasure hunt.

In the long term, the fate of these unclaimed bitcoins could unfold in several intriguing ways. Should a significant portion of the remaining 38,000+ BTC be redeemed, it could introduce a modest influx of supply into the active Bitcoin market, though given Bitcoin’s current market capitalization and daily trading volumes, the impact would likely be absorbed without major disruption. More significantly, the numismatic value of the unpeeled Casascius coins is likely to continue its upward trajectory. As fewer and fewer remain unredeemed, their rarity and historical importance as pristine examples of early physical bitcoins will only increase, making them highly coveted collector’s items. This could lead to further strategic pivots for collectors and investors, who might choose to preserve the coins in their unpeeled state, prioritizing their collectible premium over the immediate redemption of the underlying BTC.

Market opportunities may emerge for specialized authentication and appraisal services catering to these unique hybrid assets. Companies that can verify the authenticity and unpeeled status of Casascius coins will play a crucial role in facilitating their trade and ensuring fair valuation. Challenges include the potential for counterfeits and the technical expertise required to safely access the embedded private keys. For the broader cryptocurrency market, the Casascius narrative serves as a powerful reminder of Bitcoin’s origins and its journey from an obscure digital experiment to a globally recognized asset. It reinforces the concept of “HODLing” and the long-term value potential of early investments.

Potential scenarios range from a gradual, steady redemption of coins as more owners become aware, to the eventual discovery of large stashes by heirs or historical researchers, leading to sudden, significant redemptions. Ultimately, the market will continue to watch for developments in this space, particularly any high-profile redemptions or auctions of rare, unpeeled Casascius coins. These events will not only provide insights into the evolving value of these unique assets but also contribute to the rich tapestry of Bitcoin’s history.

The story of Casascius physical bitcoins is a compelling testament to the innovative spirit of the early cryptocurrency movement and the enduring allure of tangible wealth. With over 38,000 BTC, valued at more than $4 billion as of October 19, 2025, still locked away in these brass, silver, and gold artifacts, the saga of unclaimed digital gold continues to captivate. These coins represent a unique bridge between the purely digital realm of Bitcoin and the traditional world of physical assets, appealing simultaneously to cryptocurrency enthusiasts and precious metals investors.

The journey of Casascius coins, from their creation by Mike Caldwell in 2011 to their regulatory-induced halt in 2013, highlights the early challenges and pioneering efforts in bringing Bitcoin to a wider audience. Their dual value—derived from both the embedded digital currency and their significant numismatic appeal—positions them as exceptional collector’s items and historical artifacts. This phenomenon underscores broader industry trends, including the complex interplay between regulation and innovation, the psychological draw of physical assets in a digital age, and the increasing convergence of traditional and modern financial instruments.

Moving forward, the market will keenly observe the ongoing efforts to redeem these dormant bitcoins, as well as the escalating numismatic value of the unpeeled coins. Investors should watch for further developments in authentication services, potential high-profile redemptions, and the continued integration of digital and physical asset narratives. The Casascius coins serve as a potent symbol of Bitcoin’s remarkable evolution and the persistent human quest for secure, valuable forms of wealth, leaving an indelible mark on the financial landscape.

This content is intended for informational purposes only and is not financial advice

October 19, 2025 – The cryptocurrency world is abuzz following a monumental prediction from Mexican billionaire Ricardo Salinas Pliego, who has publicly stated his belief that Bitcoin (BTC) is poised to reach an astonishing $1.5 million per coin. Made in mid-October 2025, this audacious forecast has injected a fresh wave of optimism into the digital asset space, reinforcing the long-held conviction among many enthusiasts that Bitcoin is not just a speculative asset, but the “real” new money destined to eclipse traditional stores of value like gold.

Salinas Pliego, known for his significant personal investment in Bitcoin—reportedly holding 70-80% of his liquid portfolio in the cryptocurrency—anchors his projection on Bitcoin’s inherent technological superiority, its fixed supply, and its burgeoning role as a hedge against global inflation and fiat currency devaluation. While the immediate market reaction didn’t manifest as an overnight price surge, the prediction has undoubtedly energized the Bitcoin maximalist community and intensified discussions around Bitcoin’s long-term trajectory and its eventual market capitalization relative to gold. This bold claim, coming from a figure of such financial stature, underscores the growing mainstream acceptance and the profound belief in Bitcoin’s transformative potential within the global financial landscape.

While Ricardo Salinas Pliego’s $1.5 million Bitcoin prediction is fundamentally a long-term forecast, its announcement in mid-October 2025 has resonated deeply within the crypto market, contributing to a prevailing bullish sentiment, albeit without triggering immediate, dramatic price movements. At the time of his remarks, Bitcoin was reportedly trading around $105,522, experiencing a slight 5% dip in 24 hours, even as gold hit new all-time highs. This short-term divergence highlighted the ongoing volatility inherent in the crypto market and the often-disparate immediate reactions compared to long-term macro theses.

However, the significance of such a high-profile prediction lies in its potential to influence long-term investor psychology and capital allocation. Salinas Pliego’s rationale, comparing Bitcoin’s market capitalization to gold’s (which recently achieved a $30 trillion market cap), suggests a target market cap of approximately $31.5 trillion for Bitcoin to reach $1.5 million. This comparison provides a tangible framework for understanding the scale of growth anticipated, encouraging investors to look beyond short-term fluctuations and consider Bitcoin’s potential for exponential appreciation over the next few years.

Historically, Bitcoin’s price movements have been characterized by cycles of dramatic pumps and corrections, often fueled by institutional interest, technological advancements, and macroeconomic factors. Predictions from influential figures, while not always leading to immediate spikes, often serve as psychological anchors, reinforcing conviction during downturns and encouraging accumulation. The current trading volume and liquidity reflect a market that, while mature, remains susceptible to both speculative interest and fundamental shifts in investor sentiment. Key support levels are currently being tested around the $100,000 mark, with resistance anticipated at the previous all-time highs, should a sustained rally begin.

Comparing this to similar past events, such as Cathie Wood’s (ARK Invest, NYSEARCA: ARKK) initial multi-million dollar Bitcoin forecasts, these predictions often precede periods of significant institutional adoption and infrastructure development. While the path to $1.5 million will undoubtedly be volatile, the recurring theme from such bullish outlooks is the expectation of a massive capital rotation from traditional assets into Bitcoin, driven by its unique properties and the evolving macroeconomic environment.

The crypto community’s response to Ricardo Salinas Pliego’s $1.5 million Bitcoin prediction has been overwhelmingly positive, particularly among Bitcoin maximalists and long-term holders. Social media platforms like X (formerly Twitter) and Reddit are abuzz with discussions, analyses, and memes celebrating the billionaire’s bullish stance. The sentiment largely reflects an affirmation of Bitcoin’s destiny as “digital gold” and a superior store of value in an era of increasing fiat currency debasement. Influencers and thought leaders across the crypto space have amplified Salinas Pliego’s arguments, drawing parallels to previous cycles and reiterating the fundamental drivers of Bitcoin’s scarcity, decentralization, and global accessibility.

While some skeptics caution against overly optimistic price targets, the general consensus among the core crypto community is one of validation. Many see Salinas Pliego’s significant personal allocation (70-80% of his liquid portfolio in BTC) as a powerful testament to his conviction, lending substantial credibility to his forecast. This strong endorsement from a traditional finance titan serves to further legitimize Bitcoin in the eyes of mainstream investors and provides additional talking points for advocates.

Beyond price discussions, the prediction also bolsters confidence in the broader crypto ecosystem. As Bitcoin’s perceived value grows, it naturally uplifts the entire Web3 space, including related DeFi protocols, NFT projects, and other blockchain applications. While these ecosystems are not directly tied to Bitcoin’s price in the same way, a strong Bitcoin market often translates to increased capital flow and optimism across the entire digital asset landscape. The long-term vision articulated by Salinas Pliego encourages continued development and innovation within the space, as projects anticipate a future where digital assets play a central role in global finance.

Ricardo Salinas Pliego’s bold $1.5 million Bitcoin prediction by 2025, alongside similar high targets from Cathie Wood (ARK Invest, NYSEARCA: ARKK) and Arthur Hayes, paints a picture of a dramatically revalued crypto market in the short to long term. For the immediate future, these forecasts will likely continue to fuel investor interest and strategic accumulation, particularly during market dips. The short-term implications suggest that while volatility will persist, the underlying narrative of Bitcoin as a premier inflation hedge and a superior alternative to gold will strengthen, attracting more institutional and retail capital.

Looking further ahead, the long-term implications are profound. Such a price target implies a significant shift in global wealth allocation, with Bitcoin potentially becoming a core component of diversified portfolios worldwide. Potential catalysts to watch include further macroeconomic instability, continued devaluation of fiat currencies by central banks, and accelerated institutional adoption facilitated by increasingly robust regulatory frameworks and financial products (like spot Bitcoin ETFs). The generational wealth transfer, with millennials and Gen Z showing a strong preference for digital assets, is also a critical development that could catalyze massive capital flows into Bitcoin.

Strategic considerations for projects and investors will involve focusing on infrastructure development, regulatory compliance, and user-friendly interfaces to onboard the next wave of adopters. For investors, it means evaluating Bitcoin’s role as a long-term strategic asset rather than a short-term trade. Possible scenarios range from a gradual, steady climb fueled by consistent demand to more explosive parabolic rallies driven by specific macroeconomic events or technological breakthroughs. The likelihood of reaching such ambitious targets hinges on sustained global economic uncertainty and the continued erosion of trust in traditional financial systems, both of which appear to be ongoing trends.

Ricardo Salinas Pliego’s prediction of Bitcoin reaching $1.5 million by 2025 serves as a powerful reminder of the immense long-term potential that many influential figures see in the cryptocurrency. For crypto investors and enthusiasts, the key takeaway is the reinforcement of Bitcoin’s fundamental value proposition as a scarce, divisible, and globally transferable asset, positioned to outperform traditional stores of value like gold. This forecast, supported by arguments ranging from technological superiority to its role as an inflation hedge and generational asset, suggests a future where Bitcoin plays a central, rather than peripheral, role in global finance.

The long-term significance of such a prediction cannot be overstated. It underscores the ongoing paradigm shift in financial markets, where digital assets are increasingly being recognized as legitimate and superior forms of money and investment. While the path to $1.5 million will undoubtedly be marked by volatility and challenges, the consistent bullish outlook from billionaires and institutional investors suggests a growing conviction in Bitcoin’s inevitability.

For crypto adoption, these high-profile forecasts act as significant catalysts, drawing in new investors and encouraging further development within the Web3 ecosystem. The narrative of Bitcoin as “digital gold” is gaining undeniable traction, setting the stage for broader integration into mainstream financial products and services. Important dates and events to monitor include future macroeconomic reports, central bank policy decisions, regulatory developments surrounding digital assets, and the ongoing accumulation trends by institutional players. As of October 19, 2025, the conversation around Bitcoin is no longer about if it will succeed, but rather how high it can truly go.

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry significant risk.

DallasCowboys.com Staff Writer

ARLINGTON, Texas — It’s an NFL rivalry that feels as old as Father Time himself. The battles between the Washington Commanders and the Dallas Cowboys include several classic clashes, including just recently when the two traded haymakers in the nation’s capital in 2024, the heavyweight bout ending, more or less, when KaVontae Turpin turned into a human video game.

And with Turpin returning for the first matchup of the season against the Commanders, alongside rookie first-round pick Tyler Booker and fellow All-Pro CeeDee Lamb, the offensive side of the equation was stacked for the Cowboys.

The biggest challenge would be in trying to shut down Jayden Daniels, even without Terry McLaurin on the field, with Trevon Diggs unexpectedly ruled out with a concussion only two days prior. In the end, that challenge was met, and then some, by a defensive unit that had a lot to prove, and Dak Prescott did the rest with an offensive onslaught that keeps him firmly in the MVP conversation.

A statement win was needed. A statement win was delivered.

And below are those who couldn’t and wouldn’t be denied against the Commanders to move the Cowboys to second in the NFC East as they try to track down the Eagles.

[Note: This list is unranked.]

Your eyes do not deceive you. This is the first time a coach has made my list, and this isn’t because there were none deserving. I could’ve easily named Klayton Adams here, or Conor Riley, several times but, contextually speaking, the defensive turnaround witnessed in Week 7 over games past was nothing short of jaw-dropping and deserves the highest of praise — the praise deserving to be as loud as the justifiable criticism was.

Now, it’s about doing it next week, and the week after, so forth and so on. But against the Commanders, Eberflus coordinated a thing of beauty that included PLENTY of man and press man coverage, to great success, pivoting from his comfort zone in a big way.

Half of the equation for defensive success was the change in scheme, and the other was the execution by players following the change. Was it a perfect outing? Nope. Was it arguably the best, up there with what the Cowboys did to the Jets in New York? Yep. There was DaRon Bland with multiple critical tackles to not only stop at two-point conversion early in the game, but also to halt third-down conversion attempts in open space, later grabbing the sixth pick-six of his career to push Dallas to another 40 burger.

There was the pressure by Osa Odighizuwa and Kenny Clark to force Marcus Mariota into throwing the eventual pick-six in the first place. There was the play on a previous sequence that saw rookie linebacker Shemar James blitz Jayden Daniels and force a fumble that was recovered by Jadeveon Clowney. There were timely run stops and pressures by Donovan Ezeiruaku and others, and the list goes on from there. Standing ovation, in my opinion.

How do you spell Dak? Simple: M-V-P.

Prescott was on fire from the moment the Cowboys took the ball and marched downfield for a touchdown on the first offensive drive of the game. There were some sequences the Cowboys’ offense would like a mulligan for, like the safety allowed on the one-yard line, but they were so razor sharp that without mistakes like that, they might’ve dropped sixty points on the Commanders — George Pickens and CeeDee Lamb alone combining for 182 receiving yards and a touchdown before halftime. Thanks to Prescott’s ability to dissect defenses and drop dots all over the field, the Cowboys’ offense could only be stopped by their own hand.

The Terror Twins™ were back at it again in Week 7. Lamb returned from a three-game hiatus due to a high ankle sprain and any talk of potential rust looked laughable in hindsight. All the All-Pro receiver did was join with Pickens in torturing the Commanders’ secondary, be it the 76-yard touchdown to make it a 17-8 affair or his several chain-moving plays. Pickens didn’t take a backseat and continued his career-best heater, delivered big play after big play and openly scoffed at the glowing ball in the sky that tried, and failed, to join the Commanders in trying to stop him.

Williams was running like the rent was due on Sunday, and there’s no other way to describe the brutality of his runs, but also the quickness of his feet to deliver juke moves that probably changed the degree of the Earth’s axis a bit. It was one hell of a bounceback game for the young bell cow who gained only 29 total yards one week prior against the Panthers, looking more on Sunday like the Williams who racked up 135 rushing yards two weeks ago. Averaging nearly seven yards per carry as the game neared its conclusion, yeah, it’s safe to say Williams simply had a bad day at the office in Week 6, and nothing more.

When you casually boot a 61-yard field goal that would’ve been good from somewhere in feudal Japan, and I mean that both as a measurement of distance and in how it had enough power behind it to travel in time, you’re going to make my list — not in the Chris Jericho way, though. Add in the fact said kick also set the NFL record for Aubrey, well, it only gets more deserving with that. With that boot, Aubrey now has the most made field goals from 60 yards or further (6) and, by the way, he’s only in his third NFL season, in case you might’ve forgotten.

Much like Lamb, it was not a quiet return for Turpin. The Tasmanian Devil of a returner began the game with a 30-yard kick return that set the stage for Dak Prescott and the offense to march down the field the rest of the way for a touchdown. Turpin also impacted the game on offense, a critical catch or two making sure the Commanders remembered what he’s capable of, not that they could ever forget the events of 2024 at FedEx Field.

It’s often the little things that lend to the big things, so when Ferguson saved a drive from being killed by penalties with a 15-yard conversion on third down, please note that it led to Aubrey’s historic 61-yard kick. The Pro Bowl tight end was not done there, though. He also racked up another two touchdowns to surpass his 2023 season, when he produced five touchdowns, the most for him at the time. Ferguson sits at six touchdowns through the first seven games of 2025, ending his TD drought with a bang.

For the third time in as many seasons, the Cowboys squared off against the Panthers, and several gave their all for Dallas in Carolina.

It wasn’t the first time the Cowboys faced a desperate team in 2025, but several Dallas players laid it all on the line to keep the Jets from getting their first win.

With so much on the line as the Cowboys tried desperately to avoid a 1-3 start to the 2025 season, several gave their all against Micah Parsons and the invading Packers.

It was a trek to the Windy City in Week 3, and several Cowboys did their best to try and push the Bears into hibernation.

For the second week in a row, the Dallas Cowboys were tasked with trying to take down an NFC East opponent, as several key players left it all on the field.

You couldn’t ask for a better kickoff to the 2025 NFL season than the Cowboys facing off against the Eagles in Philly, as several of Dallas’ finest tried to will their way to an upset.

In the final preseason game for the Cowboys, there were several players who fought hard to leave a mark for themselves against the Falcons.

Another preseason test awaited the Cowboys when John Harbaugh and the Ravens flew into AT&T Stadium, and several players did all they could to pluck the birds.

The 2025 preseason got underway with the Cowboys taking on the LA Rams, and eleven players jumped off of the film in a game Dallas must learn from.

©2025 Dallas Cowboys. All rights reserved. Do not duplicate in any form without permission of the Dallas Cowboys.

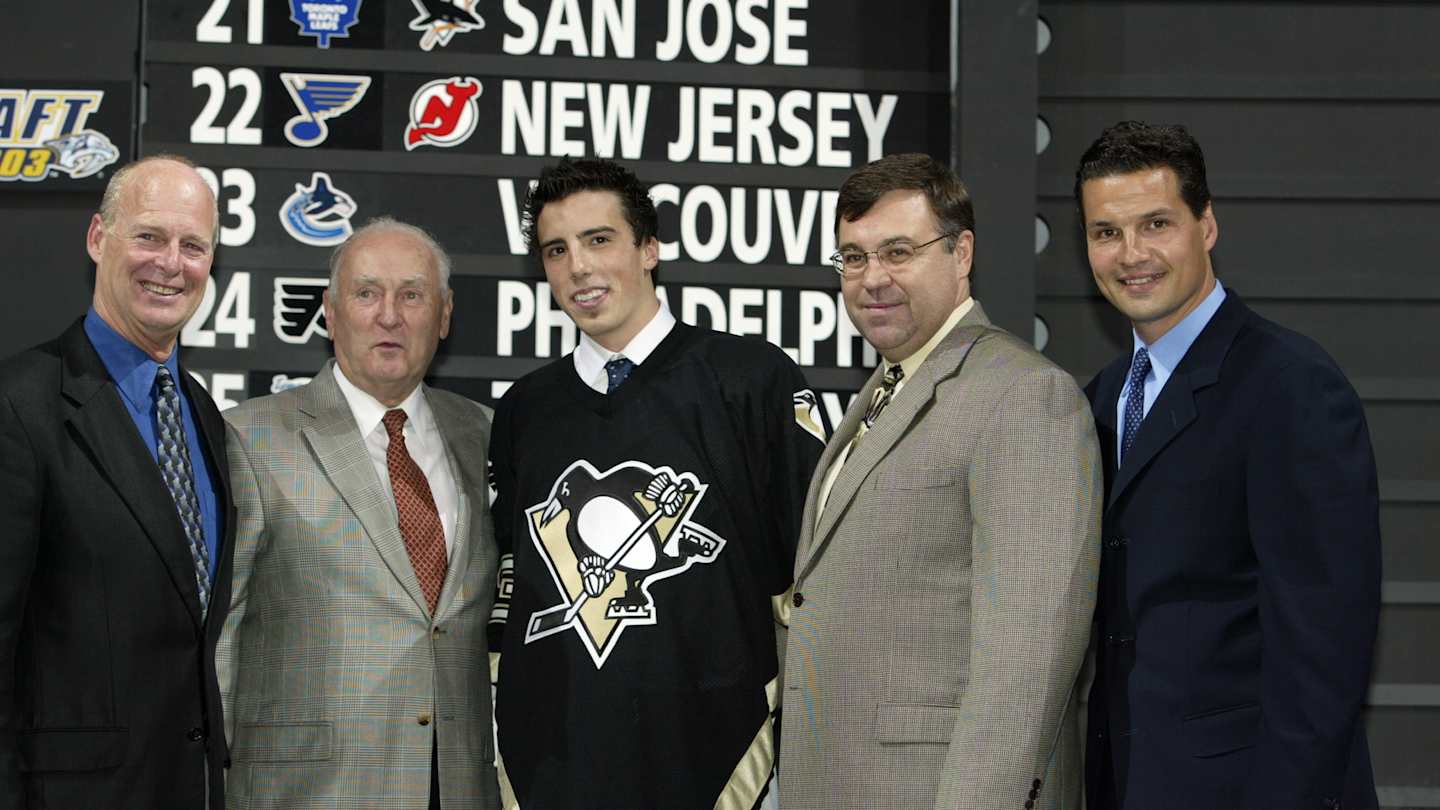

There haven't been many more iconic classes in the NHL Draft in the past few decades in the league than the 2003 entry draft class, which took place a little over two decades ago in hockey. Highlighted by Marc-Andre Fleury and Eric Staal, the 2003 draft class is guaranteed to yield a number of Hall-of-Fame inductees.

We also have multiple Stanley Cup Champions from this draft class who defined the late 2000s and early-to-mid 2010s decades in the NHL.

This was the first draft lottery from the 2000s in the NHL early in that decade that saw the Los Angeles Kings get a lottery pick in the first round.

The first few rounds of the 2003 draft class in the NHL have gone down as a legendary group, with well over a dozen players from this class having played over 1,000 career games in the regular season.

This draft class also includes the last remaining active player from the pre-lockout period in the NHL, defenseman Brent Burns of the Colorado Avalanche this season.

Here's a redraft of the 2003 NHL Entry Draft lottery in the first round.

There is no reason in my mind why the Pittsburgh Penguins would make another pick in this hypothetical redrafting of the 2003 draft lottery at No. 1 overall besides legendary goalie Marc-Andre Fleury. It wasn't common to see goalies getting drafted first overall in the NHL in the entry draft at the time in the early 2000s decade.

But if any goalie has lived up to the hype of the first overall pick in the legendary 2003 draft class in this hypothetical reimagining of the lottery from this year, it is probably Fleury. No goalie has won more games, started more games, and/or had more shutouts in the regular season in this draft class from 2003 than Fleury for the Penguins.

Fleury also won three Stanley Cups (three with the Penguins) and won the Vezina Trophy and Jennings Trophy in the 2020-21 season.

Similar to the case with Fleury, I don't think it would make much sense for the Carolina Hurricanes to pick anyone else in the No. 2 overall slot in the first round in this redrafting of the 2003 draft than center Eric Staal. Could the Hurricanes pick someone else and have it make sense in an argument at the center position?

Probably.

But knowing what we know now that Staal won a Stanley Cup with the Hurricanes in 2006 (the first in franchise history) and he captained the team for nearly a decade, I think it's best to keep him here at second overall in the 2003 draft lottery in the first round.

Staal has played the most career regular season games of any center in this draft class and he ranks second in total points (1,063).

This is the first pick in this hypothetical redrafting of the 2003 draft lottery in the first round that is different in the top three than who the Florida Panthers picked at No. 3 overall.

The Panthers originally picked forward Nathan Horton in the 2003 draft lottery in the first round. Instead of picking Horton, the Panthers get a Stanley Cup-winning center and a longtime two-way respected player in center Patrice Bergeron at No. 3 overall in the first round in the lottery.

Bergeron is one of just four forwards from this draft class from '03 who played over 1,000 career regular season games and scored over 1,000 career points. Bergeron scored over 100 points in his career in the postseason and won the Selke Trophy six times in his career with the Boston Bruins over the course of nearly two decades.

Loading recommendations… Please wait while we load personalized content recommendations

© 2025 Minute Media – All Rights Reserved. The content on this site is for entertainment and educational purposes only. Betting and gambling content is intended for individuals 21+ and is based on individual commentators' opinions and not that of Minute Media or its affiliates and related brands. All picks and predictions are suggestions only and not a guarantee of success or profit. If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER.

President Trump promised to turn the US into ‘the crypto capital of the planet’. May James/SOPA Images/LightRocket/Getty Images

President Trump promised to turn the US into ‘the crypto capital of the planet’. May James/SOPA Images/LightRocket/Getty Images

Crypto should be soaring right now. All the conditions are in place for a spectacular rally: abundant money supply, easy financial conditions, and a US administration which is actively pushing crypto with favourable deregulation and the creation of a strategic reserve to boost its price. President Trump has promised to turn the US into “the crypto capital of the planet” — and he appears to mean it.

And yet, after a rally to an all-time peak at the start of October, Bitcoin has fallen hard, shedding some 15% of its value in just the last two weeks. Sharp volatility isn’t unusual in crypto but this pullback has happened at a time when the broader market has either held steady or kept rallying. G7 markets are off by 1 or 2% but emerging markets remain buoyant. Meanwhile, gold — the heavier, klunkier version of the “digital gold” that Bitcoin purports to be — is soaring, rising 7% over the same two-week period, and taking its gain since the new year to an eye-popping 60%.

It could be that Bitcoin’s seemingly relentless upward climb will resume in the coming days and that all this will turn out to be much ado about nothing. But the past fortnight could also be a harbinger of its eventual demise. The Bitcoin oligarchs may find it eventually explodes in their hands.

When Bitcoin was created amid the angry fallout from the 2008 bank bailouts, it was designed to take money out of the hands of the bankers and oligarchs who dominated finance and hand it to the people, offering them an alternative system in which to conduct their business. Its political purpose was buried in the very first block of Bitcoin mined, which contained the line: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The digital currency was built upon the novel blockchain technology, which substituted a digital chain for the ledgers used by banks to record transactions, enabling users to thereby circumvent the banks. By fixing its supply at a maximum of 21 million, Bitcoin’s creators ensured that unlike the fiat currency managed by central banks, it could not be devalued: the more money central banks printed to re-capitalise the collapsed financial system, the more valuable Bitcoin would become.

Yet the revolution in finance it was meant to bring about never took place. True, for those rebels who got in early, Bitcoin has certainly paid off handsomely. Worth mere pennies at its creation, it surpassed the $10,000 mark by the end of its first decade and is worth over $100,000 today.

Beyond that, though, not much remains of Bitcoin’s early, idealistic vision. There was admittedly some democratisation, as over 50 million people bought Bitcoin — more if one includes people who’ve bought shares in funds that own Bitcoin. Yet it never managed to become an actual currency, being too cumbersome and volatile to be useful as a medium of exchange.

More tellingly, the crypto universe is now dominated by a handful of oligarchs managing large funds and “Bitcoin treasuries” who, by forging close ties with the Trump administration, have used state patronage to boost their asset values, much as the banks did in 2008. Trump and his family have themselves reportedly made $1 billion off their crypto creations. And with investment banks now offering crypto products to their clients, the formal takeover of crypto seems complete. This isn’t the radical, decentralised financial system we were promised.

Rather than treat crypto as an alternative financial system, these “crypto-garchs” have turned it into a speculative asset, whose price they manipulate through Bitcoin treasuries — large funds whose purpose is to take Bitcoin off the market so as to further boost its price.

The biggest of these funds is MicroStrategy (which, though recently re-branded as Strategy, still goes by the stock-ticker label of MSTR). MSTR was originally a software company founded in 1989 by American entrepreneur Michael Saylor. After a history of setbacks and repeated run-ins with regulatory and tax authorities, Saylor finally found his pot of gold in 2020. At that time, as central banks responded to the Covid crash by flooding the market with money, Bitcoin rallied strongly. Saylor used his company’s cash to buy a relatively small stash of Bitcoin. When it rose in value, his plan took flight.

The business model was simple: by buying Bitcoin in large quantities, MSTR helped bid up its price. As the value of its holdings rose, so did the company share price. That meant MSTR could both sell new shares and raise new debt, further boosting its holdings. And on it went for the next four years in a virtuous — to the company and its shareholders — upward spiral. The value of MSTR’s Bitcoin holdings rose from $250 million in 2020 to over $40 billion this year, while MSTR’s share price shot up from $12 to over $400 in the same time span. Other funds soon followed suit, and today the vast majority of Bitcoin are held by just 2% of its owners, with a few dozen of them alone controlling a fifth.

Taking over the market in this way gave the crypto-garchs both economic and political leverage: economic, in that by removing Bitcoin from circulation they reduced the market’s liquidity, which amplified the impact of their further purchases, since they were now bidding for a smaller pool of Bitcoin. And political, in that they now had deep pockets with which to influence politicians in the 2024 election.

By John Rapley

With the Biden administration taking a sceptical view of crypto, the crypto-garchs turned to Donald Trump. Although originally a crypto-sceptic, calling it a scam as recently as 2021, Trump saw the opportunity in forging ties with an industry that was then out of favour. The industry donated more than $130 million to election campaigns, with an eye on displacing crypto-sceptics and supporting their backers, led by Trump. In return, Trump promised to lift regulation and promote the industry.

After Trump won the election, he came good on his pledges. He appointed big crypto-donors such as Howard Lutnick to his Cabinet, ended investigations into firms such as Gemini, which is owned by the same Winklevoss twins who’d donated $3 million to his political action committee, and withdrew a lawsuit against Coinbase, which together with some of its owners had contributed some $16 million to Trump’s campaign funds. After announcing his plan to create a strategic Bitcoin reserve, Trump hosted several crypto-garchs at the White House, Michael Saylor among them, to discuss its implementation.

All this paid big dividends to MSTR. In the month after Trump’s election victory, the price of Bitcoin rose over 50%, which enabled Saylor to return to the market with a major share flotation. MSTR raised $21 billion in share sales, giving it a powerful armoury to juice the Bitcoin price further.

But for all its lucre, there was an obvious flaw in this plan. Given their dominance of the market, that amplification of the impact of their purchases worked both ways. Given the relatively low volume of Bitcoin trades on any given day, even a small sale will sharply raise the supply — MSTR alone owns more Bitcoin than trade daily, so even a small liquidation of its portfolio would cause prices to fall sharply. If the crypto-garchs sold in volume to cover their debts or meet expenses, they’d crash the market. In for a penny, they were now in for a pound.

The crypto-garchs may now be holding a time-bomb. If MSTR is anything to go by, the money may be drying up: of the $21 billion the company raised last year, MSTR blew it all in the following three months. Since then, the company has struggled to raise new share capital.

The company isn’t under any imminent pressure. The debt MSTR raised to buy Bitcoin doesn’t come due for another two years, and having purchased its stash of Bitcoin for an average price of around $74,000, it’s still nearly 50% up. But if Bitcoin doesn’t resume rising, MSTR will struggle to raise more capital. In the meantime, its purchases of Bitcoin are diminishing, and failing — for now, at least — to bolster the price. MSTR is still buying Bitcoin at a weekly rate, but it is paying above market rates and its purchases have grown much smaller. Amid this, smaller Bitcoin treasuries are now starting to go to the wall.

This may explain why the gold market is booming as Bitcoin suffers. It appears that investors believe that if the only thing left of Bitcoin is a digital equivalent to gold — a store of value with limited fungibility — they might as well stick with the original. After all, humans have turned to gold amid social and economic crises for millennia, but have only held Bitcoin for a few years. If they sense a major crash might be coming, atavism may lead them back into the fold of what they know to work.

In the short term, given all the favourable tailwinds, it seems more likely than not that Bitcoin will resume its rise. But the events of the last two weeks may foreshadow Bitcoin’s eventual endgame: the spark that lights a fire under markets. Bitcoin has now spread so deeply into the formal system that a major crash would likely force other liquidations as fund managers looked to cover their losses, possibly starting a chain-reaction through markets. And while oligarchs in 2008 had every reason to expect the government would bail them out, this time might be different. The proportionate size of US debt has doubled in the intervening years, and bailing out the Bitcoiners would likely send bond yields soaring. The crypto-garchs may thus not find the shelter they’d expect in a storm.

If this ends up toppling a few oligarchs, Bitcoin’s original creators may feel their vision came true after all.

John Rapley is an author and academic who divides his time between London, Johannesburg and Ottawa. His books include Why Empires Fall: Rome, America and the Future of the West (with Peter Heather, Penguin, 2023) and Twilight of the Money Gods: Economics as a Religion (Simon & Schuster, 2017).

We welcome applications to contribute to UnHerd – please fill out the form below including examples of your previously published work.

Please click here to submit your pitch.

Please click here to view our media pack for more information on advertising and partnership opportunities with UnHerd.