Why Bitcoin’s September gains are underwhelming ig.com

source

Are you looking to win big? The West Virginia Lottery offers a variety of games if you think it’s your lucky day.

Lottery players in West Virginia can choose from popular national games like the Powerball and Mega Millions, which are available in the vast majority of states. Other games include Lotto America, Daily 3, Daily 4 and Cash 25.

Big lottery wins around the U.S. include a lucky lottery ticketholder in California who won a $1.27 billion Mega Millions jackpot in December 2024. See more big winners here. And if you do end up cashing a jackpot, here’s what experts say to do first.

Here’s a look at Wednesday, Sept. 24, 2025 results for each game:

15-31-45-49-53, Powerball: 19, Power Play: 3

Check Powerball payouts and previous drawings here.

06-24-27-35-46, Star Ball: 02, ASB: 05

Check Lotto America payouts and previous drawings here.

1-7-2

Check Daily 3 payouts and previous drawings here.

4-4-3-2

Check Daily 4 payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Winning lottery numbers are sponsored by Jackpocket, the official digital lottery courier of the USA TODAY Network.

Tickets can be purchased in person at gas stations, convenience stores and grocery stores. Some airport terminals may also sell lottery tickets.

You can also order tickets online through Jackpocket, the official digital lottery courier of the USA TODAY Network, in these U.S. states and territories: Arizona, Arkansas, Colorado, Idaho, Maine, Massachusetts, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Puerto Rico, Washington D.C., and West Virginia. The Jackpocket app allows you to pick your lottery game and numbers, place your order, see your ticket and collect your winnings all using your phone or home computer.

Jackpocket is the official digital lottery courier of the USA TODAY Network. Gannett may earn revenue for audience referrals to Jackpocket services. GAMBLING PROBLEM? CALL 1-800-GAMBLER, Call 877-8-HOPENY/text HOPENY (467369) (NY). 18+ (19+ in NE, 21+ in AZ). Physically present where Jackpocket operates. Jackpocket is not affiliated with any State Lottery. Eligibility Restrictions apply. Void where prohibited. Terms: jackpocket.com/tos.

This results page was generated automatically using information from TinBu and a template written and reviewed by a USA Today editor. You can send feedback using this form.

Submit ICO

Home » Best Crypto Exchanges »

Suez is a freelance writer focused on cryptocurrency and its impact on global finance. With four years of experience, Suez has written for leading crypto…

Kai Man Ng is an editor and translator with a strong passion for crypto, blockchain, and Web3 technologies. He specializes in transforming complex technical concepts…

In today’s crypto landscape, privacy is becoming just as important as profit. While many popular trading platforms require identity verification, a growing number of traders prefer to keep their financial activity anonymous. That’s where anonymous crypto exchanges come in. These platforms allow you to buy, sell, and trade digital assets without giving up your personal information, making them an attractive choice for anyone who values discretion, security, and independence.

But with so many exchanges claiming to offer anonymity, how do you know which ones are truly safe, reliable, and feature-rich? In this guide, we break down the best anonymous crypto exchanges in 2025, comparing their strengths, security measures, and trading options. Whether you’re looking for a non-custodial swap, a futures trading platform with privacy features, or a secure place to trade without registration, you’ll find the right fit on this list.

Show Full Guide

Let’s explore these exchanges and find out what unique advantages they offer for in anonymous crypto trading.

Best Wallet tops the list of the best anonymous crypto exchanges for 2025. It offersing the best balance of privacy, security, and comprehensive feature support. Best Wallet is a non-custodial wallet with no KYC requirements. As you may know, no-KYC means you have full control of and control your private keys without sharing your identity with the authority.

The Best Wallet decentralized exchange (DEX) allows you to trade millions of crypto trading pairs through its exchange aggregation system. It merges liquidity from hundreds of pools and numerous DEX providers such as 1inch, Uniswap, Paraswap, SushiSwap, and Curve. This means users can instantly trade a wide range of tokens at the best rates.

The wallet DEX integrates 60+ blockchains and over 1,000 cryptocurrencies such as Bitcoin, Solana, Ethereum, Polkadot, Tether etc, supporting all BEP-20 and ERC-20 tokens.

Let’s look at Best Wallet’s key technical points:

✅ Trade pairs: Best Wallet provides native purchases and sales of cryptocurrencies, including the option of swapping among multiple blockchain ecosystems.

✅ Security: Best uses sophisticated Fireblocks technology, biometric verification, (Face ID, Touch ID), two-factor authentication, and an encrypted private key stored locally. It also uses multi-party computation (MPC) to both encrypt and split private keys to reduce the risk.

✅ Ease of use: It’s on iOS and Android with a mobile-first, simple-to-use interface. It also has a native DEX aggregator that connects to popular DEXs such as PancakeSwap.

✅ No KYC: No KYC is needed to sign up for an account. Just an email for a verification code keeps your identity a secret. It checks projects to get rid of scam tokens, lets you buy crypto presales with native staking, and lets you connect third-party wallets and DApps.

✅ Additional Highlights: Other features include real-time price alerts, token tracking, wallet health analytics, and secure backup options through a seed phrase.

Overall, Best Wallet stands out as the top anonymous crypto exchange because of its support for a wide range of blockchains and tokens (over 60) and its strong privacy features, including no KYC and self-custodial keys. It also offers a high level of safety through Fireblocks technology, MPC and biometric protection, and allows you to trade directly from the wallet.

✅True no-KYC DEX

✅Best security features for anonymous trading

✅Non-custodial crypto wallet for further anonymity.

❌ Not available on any computer OS yet

CoinFutures is a newer player in the field, but it has quickly become popular because of its distinctive gamified crypto futures trading environment, with one of the easiest and most user-friendly interfaces on the market.

With CoinFutures, you can guess how crypto prices may change in the short term through a futures trading game. You don’t need a full trading orderbook, complex crypto wallets, or the confusing user interface that many other crypto platforms have. You also don’t have to deal with KYC, obviously.

The main idea behind CoinFutures is to give traders control, allowing them to cash out whenever they want and even increase the stakes by up to 1000 times. Traders can choose from a wide range of assets, including the major ones like Ethereum, Bitcoin, and Solana, and many altcoins. More trendy meme coins like Bonk, Doge, and Shib are also added regularly.

✅Up to 1000x Leverage: CoinFutures gives traders a lot of leverage in crypto futures contracts, which lets them increase their positions and potential profits by a lot while still being able to manage risk with flexible multiplier settings.

✅Advanced Risk Management Tools: Features like stop-loss, take-profit, and auto cash-out let you manage your positions automatically.

✅Simulated Real-Time Market Data: The platform uses smart algorithms that closely mimic real cryptocurrency volatility. Futures contracts can exhibit changing price movements without requiring the ownership of any underlying assets.

✅Secure Infrastructure: User funds are kept in cold wallets with strong encryption. SSL-secured communication and connections to Fireblocks vaults make sure that everything is as safe as possible.

✅Multi-Platform Access: CoinFutures lets you trade easily on both desktop and mobile. The app is easy to use and has real-time alerts and controls that work well on all devices.

✅Diverse crypto futures including major and meme coins

✅Advanced risk management tools

✅Strong security with cold wallets and Fireblocks integration

❌ Limited spot trading

GhostSwap is another well-known anonymous exchange that has already served over a million people around the world. The trading platform is secure and has a clear, low-cost fee structure. GhostSwap is a leading no-KYC exchange because it has handled over $600 million in crypto swaps.

You may trade 1,500+ cryptocurrencies supported by GhostSwap and swap between almost all major blockchain networks. GhostSwap lets you trade Bitcoin for Ethereum or the newest altcoins without giving out any personal information.

Like the previous two, GhostSwap is also a non-custodial option. While centralized exchanges hold your money (and sometimes your data), GhostSwap ensures that your crypto remains in your control during the entire exchange process.

✅No KYC / No Account Required: Allows you to make completely anonymous swaps without proving your identity or signing up for an account.

✅Non-Custodial Swaps: Users always have full control over their money; GhostSwap never holds users’ crypto.

✅Wide Crypto Support: You can swap more than 1,500 cryptocurrencies, like Bitcoin, Ethereum, Monero, and Solana, across different blockchains.

✅Cross-Chain and Atomic Swaps: Use atomic swap technology and smart contracts to make cross-chain trades easy and safe, so you don’t have to worry about them.

✅Quick and Clear Transactions: Swaps usually finish in 5 to 30 minutes, and the transaction hashes are verified by the blockchain for clarity.

✅Supports 1500+ cryptos

✅Fast swaps (5-30 minutes)

✅Cross-chain swaps can be made

❌ Limited advanced features

❌ Slow processing and response on times

TorrentSwap is a decentralized, non-KYC cross-chain swap platform designed for cryptocurrency traders who prioritize privacy. The exchange has a strict 0% KYC policy, meaning all transactions on TorrentSwap are processed autonomously.

You can swap cryptocurrencies across five major blockchains on TorrentSwap’s No KYC Cross-Chain Swap platform without having to give out any personal information.

First, pick the cryptocurrencies you want to swap. You can choose from Bitcoin, Ethereum, Solana, Arbitrum, or Polkadot. Next, give the address where you want to get the swapped assets and an address for a refund in case the swap doesn’t go through. You then get a detailed quote that includes the exchange rate, fees, and the estimated time for the swap to happen (usually 10 to 30 minutes).

Once you’ve checked the details, send your cryptocurrency to a special deposit address. When the deposit is found and confirmed on the source blockchain, the platform automatically uses decentralized smart contracts to make the swap.

✅Trading Pairs: Supports more than 100 trading pairs on major blockchains like Bitcoin, Ethereum, Solana, Arbitrum, and Polkadot.

✅Decentralized Liquidity: Non-custodial, audited smart contracts handle trades and get liquidity on-chain instead of relying on centralized providers. This way, users always have full control over their assets.

✅Cross-Chain Compatibility: Lets users swap native tokens from different chains in one transaction, thanks to decentralized protocols like Chainflip.

✅Execution Times for Swaps: Most swaps are done in 30 minutes or less, with real-time pricing transparency, clear fee disclosure, slippage protection, and settlement on the blockchain.

✅Public Transaction Tracker: This lets everyone see the status of a swap so that everyone can be sure that each transaction is safe and secure.

✅Privacy and Freedom: Users don’t have to go through KYC or register, so they can trade without giving up their personal information.

✅Decentralised liquidity

✅Globally accessible

✅True self-custody

❌ Limited pairing options

❌ Limited liquidity pool sources

The final one on our list is Blofin. Blofin allows you to trade both in spot and futures exchanges. The platform supports over 564 spot cryptocurrencies and 440 futures contracts with leverage up to 150x. Blofin charges a 0.1% fee for both makers and takers, regardless of whether you are trading spot or futures.

Copy trading is one of the best things about Blofin. It lets you copy the trades of experts who have an excellent history and benefit from their tactics. There is also bot trading, but for now, the only option is the Signal Bot. More options will be available soon. Blofin also lets you earn money on USDT, BTC, and ETH for both short and long periods of time.

The exchange has teamed up with Fireblocks, a company that provides institutional crypto custody, to offer insurance coverage. It also integrates AI-powered blockchain intelligence tools like Chainalysis and AnChain.AI to monitor transactions in real time. Blofin also has a service called Wallet as a Service (WaaS) and uses Merkle Tree verification to show that it has enough money.

Blofin works transparently by having a public and regularly updated Proof of Reserves, which guarantees that all customer assets are fully backed. The amount of money you can withdraw depends on your KYC level. Unverified users can withdraw up to $20,000 a day, while advanced KYC users can withdraw up to $2 million.

✅Anonymous Crypto Exchange: BloFin is a centralized platform that lets you trade without having to go through KYC verification, as long as you don’t withdraw more than $20,000 a day. For higher limits (up to $2 million a day), KYC verification must be done in steps.

✅Wide Asset and Market Support: BloFin supports more than 564 cryptocurrencies for spot trading and about 440 futures contracts with leverage up to 150x. This means that both spot and derivatives traders can use it.

✅Security Infrastructure: The platform works with Fireblocks to provide the best cold wallet custody and insurance in the business. It uses Chainalysis and AnChain.AI, which are real-time transaction monitoring tools, to improve compliance and find suspicious activity.

✅Trading Tools and Features: BloFin offers advanced trading interfaces with various order types, real-time charts, USDT-margined perpetual contracts, and calculators for determining the liquidation price, as well as cross and isolated margin trading. It also has an automated copy trading system and demo trading accounts for spot and futures with fake money.

✅Fees: Spot trading costs 0.10% (maker/taker), while futures trading costs 0.02% for makers and 0.06% for takers. This is very low compared to other platforms, which is great for active traders.

✅Geographic Accessibility: BloFin works in more than 150 countries, but users from the US, Canada, and China can’t use it because of rules.

✅Fireblocks cold storage and AI monitoring

✅Copy trading and demo trading

✅Transparent with Proof of Reserves

❌ Does not support fiat withdrawals

❌Not available in USA, Canada, and China

KCEX is a relatively new crypto exchange that launched last year. It is still establishing its reputation for reliability and security compared to older platforms. Unlike the previous exchanges, however, it’s a centralized platform.

KCEX allows you to trade in both spot and futures markets, just like MEXC or Margex. It has a wide range of crypto assets, including ETH, BTC, SOL, PEPE, SHIB, DOGE, and TRB. You can also use leverage up to 100x. KCEX is easy to use for both beginners and experts. It has a clean interface and is available as a mobile app, making it easy to access.

However, when it comes to anonymous crypto exchanges, KCEX is not fully anonymous. Since It works as a centralized exchange, you have to go through KYC (Know Your Customer) verification to use all of its services. KCEX allows you to withdraw up to 30 BTC per day without having to verify your identity.

You may also need to do this for higher limits and advanced features. As a component of its compliance with anti-money laundering (AML) laws and rules, the platform gathers personal data. KCEX uses typical safety precautions like two-factor authentication (2FA) and cold storage, but it doesn’t keep users completely anonymous.

Aside from these, an upside is that KCEX excels in a few areas compared to other exchanges. For example, it usually has fewer geographical limits than other exchange brands. It may also list niche or new cryptocurrencies that aren’t yet available on bigger platforms. The exchange is a good choice if you want to invest early in projects that aren’t very well-known.

✅No Mandatory KYC: KCEX lets users trade and withdraw without having to go through KYC verification, which puts privacy and ease of access first.

✅Support for Multiple Cryptos: KCEX supports an abundance of cryptocurrencies, including the most popular ones and altcoins, giving traders plenty of options.

✅High-Speed Transactions: KCEX makes sure that trades and withdrawals happen quickly, which is great for users who value speed in their trading.

✅Low Trading Fees: KCEX has competitive fees, making it a good choice for frequent traders who want to keep costs down.

✅24/7 Customer Support: KCEX has customer support available 24/7, so help is always available when you need it, which adds to the platform’s reliability.

✅Globally available in most countries

✅Features new cryptos earlier than other large exchanges

✅Both spot and futures trading available

❌ Up to 30 BTC anonymous withdrawals allowed

Changelly began its journey as a crypto exchange 10 years ago. It ranks as one of the best anonymous crypto exchanges as it supports a wide range of coins, such as Bitcoin and more than 500 altcoins. Ethereum, Monero, Shiba Inu, Solana, and Cardano are some of the top supported chains.

On Changelly, you may exchange any coin right away, as long as the exchange supports it. It has decent transaction speed. Moreover, Changelly sources its exchange prices from more than 20 liquidity providers, meaning traders can be sure they will get the best price.

Changelly, on the other hand, charges 0.25% more for swaps than other providers. We appreciate that Changelly doesn’t always require KYC. Similar to KCEX, it’s also not a completely anonymous crypto exchange. It’s a Hybrid platform. You can trade cryptocurrencies without giving your details as long as you don’t take out more than 1 BTC per day. Most traders should be fine with these limits.

✅Hybrid Platform: Changelly is a hybrid platform that combines elements of decentralization (instant swaps directly from users’ wallets) with centralized custody for buying and selling. It holds custody of assets during fiat transactions and order executions.

✅KYC Requirements: Changelly follows both basic and advanced KYC rules to stay within the law. For transactions of up to €10,000 every 48 hours, you need to show basic KYC, which is usually just a valid ID. For larger amounts, advanced KYC with face recognition, extra ID documents, and contracts is required.

✅No Custody for Swaps: Users don’t have to put money into Changelly wallets for crypto swaps. The swaps happen directly from user wallets to destination wallets, which lowers the risk of losing money.

✅Wide Crypto Support: The exchange supports over 700 cryptocurrencies along with more than 300,000 trading pairs. You can buy cryptocurrencies with fiat through affiliates like Simplex, MoonPay, and others.

✅Platform Variations: Changelly is available on the web, desktop, and mobile apps (for Android and iOS). It has a user-friendly interface for both quick swaps and more advanced trading on Changelly Pro, which has order books and charts.

✅Fast transaction speeds (5-40 minutes)

✅Non-custodial crypto swaps

✅24/7 active customer support

❌ Fees for fiat-to-crypto purchases can be high

❌Not available for U.S. residents

Margex is a highly secure anonymous crypto exchange that you can start using with just an email address. However, the Margex Exchange is a centralized platform for trading cryptocurrency derivatives. So even though you can skip verifications, it’s still regulated.

The platform’s technical infrastructure can handle up to 100 times the leverage on a wide range of perpetual futures contracts across more than 40 trading pairs. To keep order books deep and prices stable, Margex collects liquidity from more than a dozen sources. More liquidity pools mean big traders cannot manipulate the market.

The “MP Shield” system constantly monitors the market for price changes and unusual trading patterns to protect market integrity.

Margex also features cool options, such as multicollateral wallets, which allow traders to deposit any supported cryptocurrency and future trading in various assets without needing to own the underlying collateral directly.

To make things easier for users, Margex offers two separate mobile apps: one for trading leverage and derivatives, and another for copy trading, which lets you copy the strategies of more experienced traders. The platform has both cross-margin and isolated-margin modes, as well as different types of orders, such as instant orders. It also has advanced charting tools thanks to a TradingView integration.

✅Anonymous Crypto Exchange: Margex lets users trade without having to go through KYC verification. Users can sign up and start trading with just an email address, which keeps their identity and privacy very private. But finishing KYC can give you higher withdrawal limits and access to more features.

✅Security Infrastructure: The exchange uses strong security measures to keep user accounts and assets safe. For example, most user funds are kept in cold storage, wallets require multiple signatures, SSL encryption is used, and two-factor authentication (2FA) is required.

✅Trading Options: Margex lets you trade with up to 100x leverage on more than 49 perpetual futures contracts for a wide range of cryptocurrencies. It ensures that spreads are tight and the market is stable by combining liquidity from multiple sources.

✅Advanced Risk Controls: The proprietary “MP Shield” system keeps an eye on trading activity to find price manipulation and keep the market honest, making it a safer place to trade.

✅MP Shield system prevents price manipulation

✅Staking options with up to 5% APY

✅Has a zero-fee converter for free swaps

❌ Maximum conversion limit of $30,000

❌Limited trading pairs

BingX is a centralized cryptocurrency exchange. Like many other exchanges, it targets both ease of use and advanced trading features and lets you trade more than 700 cryptocurrencies on the spot and offers more than 500 perpetual futures contracts with leverage of up to 150x. This makes it a suitable choice for traders of all levels, from beginners to experienced traders.

One of the best things about BingX is that it doesn’t require KYC for most trading activities, meaning you can deposit, trade, and withdraw cryptocurrencies without having to fully verify your identity.

However, you need to do KYC to get higher withdrawal limits, loans, and use the OTC desk. BingX has a full set of trading tools, including a strong social and copy trading system with more than 15,000 top traders whose strategies can be copied in real time.

BingX features grid trading bots that automatically execute trading strategies on behalf of users. It also has wealth products that let users stake their money for flexible or fixed periods of time with APYs of up to 8%, as well as products that protect the principal.

✅Centralized Exchange (CEX): BingX is a centralized crypto exchange that keeps users’ money safe and handles their orders.

✅Wide Asset Support: It has more than 700 cryptocurrencies for spot trading and more than 500 perpetual futures contracts with leverage up to 150x. This covers a wide range of market instruments.

✅Social and Copy Trading: BingX has one of the biggest social trading networks, with more than 15,000 vetted elite traders. Users can copy trades and get real-time trading feeds.

✅Automated Trading Bots: These include Grid Trading Bots, which come in different types (Spot Grid, Futures Grid, Spot Infinity Grid), and they let you use automated market strategies to make money without doing anything.

✅Security and Transparency: BingX performs Proof of Reserves audits twice a month. These include bank-grade custody solutions, encryption, and multi-factor authentication.

✅15,000+ elite traders

✅automated grid trading bots

✅Regular Proof of Reserves audits

❌ KYC needed for large withdrawals

❌Limited customer support responsiveness

The next best anonymous Crypto Exchange on our list is SwapRocket. It’s a privacy-focused exchange with over 50,000 users in more than 190 countries, handling over $250 million in monthly trading volume. There are no extra fees after you confirm your swap, and all charges are transparent because they are included in the rates shownyou see.

It’s a well-known decentralized exchange where you can quickly trade cryptocurrencies without having to go through KYC. You can use its suite of over 2000 cryptocurrencies, which includes well-known coins like Ethereum, Bitcoin, and Solana, among other well-known tokens and best altcoins.

Besides, SwapRocket is a non-custodial exchange, meaning your crypto goes directly to your wallet during a trade and is never stored on SwapRocket’s servers.

Transactions on SwapRocket can be completed in just a few clicks, making the process simple and straightforward. Additionally, the platform’s intuitive interface makes it easy for beginners to select trading pairs, enter wallet addresses, and complete transactions.

✅No Account or KYC Required: You can swap cryptocurrencies instantly without any identity verification, registrations, or personal data submission on SwapRocket.

✅Non-Custodial Model: SwapRocket never holds your funds in custody; all trades occur directly from users’ wallets to counterparties.

✅Wide Crypto Support: You can swap more than 2000 cryptocurrencies, including Bitcoin, Ethereum, and other major coins, as well as niche altcoins.

✅Quick Transactions: Most trades finish in a few minutes (5 to 40 minutes, depending on the blockchain).

✅Multi-Exchange Aggregation: Connects to several exchanges and liquidity providers in the background to get the best rates and a lot of liquidity.

✅Supports 1500+ cryptos

✅Competitive rates

✅Transparent fee structure

❌ Lacks advanced trading tools/apps

❌ Lacks a phone app

❌ Possible swap delays

An anonymous crypto exchange is a platform where you can buy, sell, or trade cryptocurrencies without providing your real name or submitting Know Your Customer (KYC) information. In theory, these kinds of exchanges put user privacy and transaction secrecy first. They are expected to collect as little data as possible or not at all, and to keep user identities and transaction histories private.

There are two types of these exchanges:

Anonymous crypto exchanges often have privacy features that work in the following ways:

➡️Ring Signatures and Stealth Addresses: Privacy coins like Monero use these cryptographic methods to hide the information of the sender and receiver. They make transactions look like they are happening between many different people.

➡️Zero-Knowledge Proofs (zk-SNARKs): Used by coins like Zcash to confirm transactions without showing the amounts or parties involved.

➡️Coin Mixing Services: Some exchanges or built-in tools mix transactions together to hide where the money came from and where it is going.

➡️No Storing Personal Metadata: Don’t keep IP addresses, device fingerprints, or email addresses.

➡️Use of Privacy Coins: Supporting coins that are made to be anonymous, like Monero (XMR), Zcash (ZEC), or Dash.

Bitcoin and Ethereum let you be pseudonymous, which means that your wallet addresses are visible on public ledgers but not directly linked to your real-world identity. On the other hand, anonymous trading platforms and privacy coins actively break the link between financial data and user identities. It keeps your information as private as possible.

In reality though, crypto exchanges are not completely anonymous. According to the cryptocurrency regulations in the US, all crypto exchanges must acquire KYC from the user.

Regulatory requirements bind them. These requirements require some level of KYC/AML compliance. So, most platforms find a balance between privacy and following the law by letting people trade without giving their names up to a certain point, after which they have to prove their identity.

Although an anonymous crypto exchange gives you freedom and security, it also comes with risk, including scams, frauds and, cyberattacks. That’s why choosing a safe no-KYC exchange should be your top priority. These are the things you should look for in an exchange:

🛡️ Prioritize Privacy Features: Since you’re looking to trade anonymously, prioritise privacy. Look for exchanges that do not require personal identification or work with minimal KYC for basic trading and withdrawals.

⚡Trading Volume & Liquidity: Choose platforms with high liquidity and trading volume to avoid slippage. Low liquidity pools may mean outdated prices. Also, platforms with constantly high trading volumes tend to be more reliable.

🔒 Security Practices: Check for industry-standard security such as cold wallets, two-factor authentication, encryption, and regular audits.

🔄 Asset Selection & Trading Pairs: Platforms have their limitations when it comes to blockchains, tokens, and trading pairs. Ensure the exchange supports a wide variety of cryptocurrencies and trading pairs to meet your specific portfolio or trading needs.

⚙️ Trading Tools & Features: Look for advanced features like margin trading, futures trading, limit orders, and automated bots if you want more than simple swaps. Some platforms offer copy trading and demo trading for newbies.

💰 Withdrawal Limits: No-KYC or anonymous crypto exchanges always have a withdrawal limit. Consider it to avoid restrictions on moving large amounts of crypto anonymously. Larger withdrawals generally require KYC, no matter the platform.

📊 Transparency & Reputation: Favor exchanges with transparent operations, visible proof of reserves, and positive user feedback regarding anonymity and service reliability.

📱 Platform Usability: The platform should be user-friendly and accessible via web and mobile apps.

Not all anonymous crypto exchanges can be trusted, and not all platforms are transparent. It is important for you to be certain about who you’re trading with and how. Look for signs to make sure the platform is authentic and offers the necessary features/pairs for your preferred trading experience. Always put safety first.

All the exchanges listed above support anonymous trading, but to some extent. Most of the time, there’s a limit to how much you can trade without KYC.

Best wallet is one of the top exchanges where you can trade without an ID. It’s not only a no-KYC platform, but it also has a DEX that provides an additional layer of anonymity. Comes with its own decentralized wallet.

Best Wallet is our solid pick.

Monero. It’s built for privacy, and it is much harder to trace than Bitcoin or Ethereum.

Platforms like Swaprocket, GhoseSwap and Changelly don’t ask for ID. Just check limits before you start.

Suez is a freelance writer focused on cryptocurrency and its impact on global finance. With four years of experience, Suez has written for leading crypto platforms BlockInsider and CoinMarketCap.

icobench.com is a cryptocurrency data website tracking 18896 cryptocurrencies trading on 402 exchanges.

© 2025 Icobench.com. All rights reserved.

The information provided on this website is for educational and informational purposes only and does not constitute financial, legal, or investment advice. Investing in cryptocurrencies, tokens, or Initial Coin Offerings (ICOs) carries significant risks, including the possible loss of your entire investment. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions.

XRP rebounded toward key resistance levels as speculation intensified about the imminent launch of XRP-spot ETFs.

NovaDius Wealth Management President Nate Geraci shared a report on a potential final wave of ETF amendment filings by the end of the week. The filings, including amendments to XRP-spot ETF applications, would suggest continued dialogue with the SEC and the potential approval of the pending spot ETFs. He stated:

“Final wave of amendments could be filed by the end of this week on various spot crypto ETFs incl XRP & SOL… ‘Those filings are pretty far along in the review process.’ Countdown to launch is on.”

21Shares, Bitwise, Canary Capital, CoinShares, Franklin Templeton, Grayscale, and WisdomTree have filed for XRP-spot ETFs, awaiting approval. While the final decision deadlines range from October 18 to November 14, it is plausible that the SEC approves the entire batch on October 18 to avoid giving any issuer a first-launch advantage.

Nate Geraci underscored the significance of the crypto ETF market, stating:

“Spot crypto ETFs continue to lead ‘all’ ETF categories in inflows since April 8th S&P 500 low. Nearly $35bil.”

Crypto trader DREGEN commented on the surge in demand for crypto-spot ETFs, stating:

“When you see spot crypto leading every possible category by such a huge margin, it tells you everything you need to know. This is a massive wave of new money pouring into the space. And with a whole new batch of ETFs coming next month? It’s really hard not to be incredibly bullish right now. The demand is real.”

For perspective, precious metal ETFs, including gold, have reported net inflows of $22.4 billion since April 8th.

XRP could hit fresh highs if XRP-spot ETFs experience similar demand to BTC-spot and ETH-spot ETFs. Bitcoin (BTC) struck an all-time high of $123,731 (August 14), while Ethereum (ETH) hit a record high of $4,958 (August 24) on surging demand for spot ETFs.

XRP’s rebound came despite one key ETF issuer remaining silent on its plans for an XRP-spot ETF filing. The launch of a BlackRock (BLK) iShares XRP Trust could be pivotal to the success of an XRP-spot ETF market.

BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA) dominate the crypto market, with net inflows of $60.7 billion and $13.4 billion, respectively. For context, Fidelity’s BTC-spot and ETH-spot ETFs rank #2, with net inflows of $12.4 billion and $2.8 billion, respectively.

Will BlackRock file for an XRP-spot ETF?

In August, Nate Geraci speculated about a potential application for an XRP-spot ETF, stating:

“So, yeah, BlackRock is just waiting for indication of SEC approval of generic listing standards for crypto ETFs before filing for spot XRP & SOL ETFs.”

The SEC approved the Generic Listing Standards for commodity-based trust shares on September 18. The approval removes the need for an ETF issuer to file 19-b forms and pass the SEC’s review process if the ETF meet the Generic Listing Standards. BlackRock has yet to file, but SEC rule changes mean it can file without delay.

XRP rallied 3.57% on Wednesday, September 24, reversing the previous session’s 0.4% fall, closing at $2.9273. The token crucially snapped a six-day losing streak and outperformed the broader market (0.83%) on its climb toward key resistance levels. Traders are watching the following technical levels:

In the near term, several key events could drive price action:

The balance of flow trends, regulatory headlines, and institutional demand could determine whether XRP tests lower support levels or breaks above resistance.

Bearish Scenario

These bearish events could drag XRP toward $2.8. If breached, $2.5 would be the next key support level.

Bullish Scenario

These catalysts could send XRP toward $3. A move through $3 may pave the way toward $3.2. A sustained move through $3.2 opens the door to testing $3.335.

Potential delays to the Market Structure Bill’s Senate floor vote have turned investor focus to the XRP-spot ETF applications.

The launch of XRP-spot ETFs could fuel institutional demand, potentially sending the token to new highs. An application for an iShares XRP Trust could add fuel to the fire. Meanwhile, a continued delay in spot ETF approvals and regulatory roadblocks may cap the upside.

Analysts will closely monitor how regulatory and economic risks affect XRP’s trajectory in the coming weeks.

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

NASDAQ Index, SP500, Dow Jones Forecasts – Stocks Pull Back As Traders Focus On Fed Policy Outlook

China Housing Stimulus Bets Lift CSI 300 and Shanghai Composite

Oil and Natural Gas Analysis: Energy Prices Gain on Supply Draws and Geopolitical Risks

U.S. Dollar Rallies As Powell Stays Cautious On Rate Cuts: Analysis For EUR/USD, GBP/USD, USD/CAD, USD/JPY

US Dollar Forecast: Gains Continue in DXY as Fed Stance Limits Easing Bets

A closely watched crypto commentator known as plur daddy (@plur_daddy) has resurfaced with a macro thesis that places Bitcoin and gold at the center of an approaching policy inflection—arguing that President Donald Trump’s push to assert greater control over US monetary policy could catalyze a liquidity wave that undermines the dollar and forces institutional participation in alternative stores of value.

The remarks arrive as global policymakers debate the use of Russia’s immobilized reserves to backstop new loans to Ukraine and as gold trades near record highs, sharpening the contours of a market regime in which Bitcoin increasingly trades as a function of liquidity and institutional credibility rather than a halving-linked “four-year cycle.”

Trump’s Fed Takeover Could Supercharge Bitcoin

“It’s been great being off Twitter… I continue to be long BTC and also significantly sized up my gold position in August. This is driven by my belief that Trump’s efforts to take control of the Fed represent a momentous catalyst, the kind that happens once a decade,” he wrote, adding: “Once he takes control, it is logical that he will not only cut rates, but engage in some form of yield curve control… The USD will get destroyed as a result.”

The post frames Bitcoin and gold as “more pure beneficiaries of an environment where liquidity is increasing and institutional credibility is undermined,” and contends that lingering fears about a halving-style market top are misplaced now that “BTC… has been captured by tradfi and is a more pure expression of liquidity conditions.” The policy backdrop he sketches has moved from hypothetical to contested reality in recent weeks. Federal Reserve Chair Jerome Powell publicly rejected claims that the central bank is acting politically, even as investors parse appointments and public pressure from the White House.

“Cheap shots,” he said of accusations about the Fed’s motives, defending the data-dependence of recent decisions. In parallel, global policymakers and market strategists have openly debated whether ongoing political intervention could force the Fed toward explicit yield-curve control to contain long-term borrowing costs—an approach not used in the US since the 1940s.

In a follow-up thread, “plur daddy” outlined a pathway to lower mortgage rates via government-sponsored enterprises (Fannie Mae and Freddie Mac) buying more mortgage bonds, with capital requirement tweaks and derivatives used to manage duration.

That proposal distinguishes itself from QE by shifting spreads through asset mix rather than expanding central-bank balance sheets directly. The argument aligns with the broader political incentives ahead of US midterms: “Markets are forward looking… They have a strong incentive to juice the economy and markets,” he wrote, while cautioning that direct stimulus would carry inflation risks.

The liquidity lens extends to the Treasury General Account (TGA), which has been rebuilt rapidly into late Q3. Research desks had warned that an aggressive TGA refill into September could briefly drain market liquidity before easing, a pattern that crypto traders have long monitored given Bitcoin’s outsized sensitivity to changes in dollar system reserves and bills-versus-reserves mix. “BTC is hypersensitive to any shift in liquidity conditions, much more so than equities,” the post asserts, echoing analysis that mapped TGA dynamics to risk-asset performance.

Another pillar of the thesis is Europe’s evolving stance on Russia’s frozen sovereign assets—roughly $300 billion immobilized after the 2022 invasion. Brussels is weighing a structure in which new loans to Kyiv are backed by those assets and only repaid if Russia pays reparations—an outcome the author argues “will never happen,” calling the mechanism a de facto seizure that “massively bolsters the raison d’être for crypto.”

Market context has been sympathetic to the store-of-value leg of the argument. Gold has pierced new highs this month, with multiple banks projecting scenarios toward $3,700–$4,000 over the next several quarters if central-bank buying remains strong—and potentially higher if private investors accelerate hedging flows away from US dollar assets amid policy and geopolitical uncertainty. “It makes sense that BTC start moving [when] gold’s momentum slows down,” “plur daddy” added, positing a rotation once bullion’s advance stalls.

The post has drawn quick agreement from notable traders. “Agree, I am trying to time this, I think < 6 months & > 90k,” wrote Ansem (blknoiz06), sketching a timeline that implies a Q1 2026 window for a new Bitcoin leg higher. Macro strategist Alex Krüger called it a “great post.” Forward Guidance podcast host Felix Jauvin added: “So very well said. Good to see you man.”

The policy backdrop the expert sketches now features a Fed Board with a freshly confirmed Governor, Stephen I. Miran, who immediately dissented at the September FOMC for a larger cut and has been publicly arguing for materially faster easing in the dot plot.

In parallel, the administration’s attempt to remove Governor Lisa Cook via lawsuit has put an unprecedented spotlight on the legal protections around Federal Reserve independence. Those developments—together with Europe’s evolving plan to leverage frozen Russian assets—are the concrete signposts of the “once-a-decade” moment described above.

At press time, BTC traded at $113,121.

Select market data provided by ICE Data Services. Select reference data provided by FactSet. Copyright © 2025 FactSet Research Systems Inc.Copyright © 2025, American Bankers Association. CUSIP Database provided by FactSet Research Systems Inc. All rights reserved. SEC fillings and other documents provided by Quartr.© 2025 TradingView, Inc.

Home – Crypto Presales – XRP Price Prediction: Next Stop $2.50 or $3.50? Analysts Point Out Layer Brett’s Unstoppable Momentum

The latest XRP price prediction has sparked debate as traders weigh whether Ripple’s token can climb to $2.50 or even $3.50 in 2025. While XRP remains a top choice for those seeking stability in digital payments, many investors are also eyeing Layer Brett (LBRETT), an Ethereum Layer 2 presale token gaining serious traction. Analysts argue that while XRP’s growth may be steady, Layer Brett’s upside could be far greater.

At around $2.86, XRP has recovered strongly from its past lows and is once again showing resilience in a competitive market. Ripple’s progress in building real-world adoption has been a major driver of this momentum. Banks and payment providers continue to test and adopt Ripple’s network for cross-border settlement, giving XRP a clear use case beyond speculation.

Analysts tracking XRP price prediction models believe the coin could make a push toward $2.50 in the short term if current momentum holds. Should adoption accelerate further, targets as high as $3.50 are being discussed. These levels would represent meaningful growth for a large-cap token, though the gains are far smaller than what investors look for in emerging presales. For many, XRP is a steady bet on digital payments, but it may no longer deliver the kind of life-changing multiples that new tokens can provide.

Despite its utility, XRP is not without obstacles. Its large supply and already significant market capitalization mean that achieving another 50x or 100x run is nearly impossible.

This is where Layer Brett (LBRETT) enters the picture. Touted by analysts as one of the most promising presales of 2025, it is combining meme coin culture with Ethereum Layer 2 infrastructure. By building on L2, Layer Brett offers low transaction fees, near-instant processing, and the security of Ethereum’s base network. That makes it stand out from meme coins that rely purely on hype.

The presale has already raised more than $4 million, with tokens priced at just $0.0058. Early adopters are also taking advantage of staking rewards, currently paying out around 660% APY. These yields will naturally decline as more holders stake, creating urgency for those wanting the best rates. On top of this, Layer Brett has a roadmap that includes NFT features, gamified incentives, and a $1 million community giveaway, moves designed to maintain engagement beyond the presale stage.

The contrast between XRP and Layer Brett highlights the difference between established coins and early-stage tokens. XRP could still climb to $2.50 or $3.50, offering steady, moderate gains for long-term holders. In comparison, some analysts argue that Layer Brett’s momentum could translate into 50x, 80x, or even 100x returns if adoption grows at the pace its community expects.

For traders looking for stability, XRP remains a strong contender, but for those chasing outsized returns, $LBRETT is increasingly being called the project to watch. The overlap of meme culture and Layer 2 scalability gives it a unique edge that could set it apart from both traditional meme coins and pure infrastructure plays.

The latest XRP price prediction suggests further upside, with $2.50 and $3.50 targets widely discussed. However, XRP’s size means its growth potential is naturally capped compared to newer tokens. Layer Brett, by contrast, is still in its early stages, offering both high staking rewards and the chance to buy before exchange listings. For traders balancing stability with risk, the conversation is shifting toward combining established assets like XRP with higher-upside plays such as Layer Brett.

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: Telegram: View @layerbrett

X: (1) Layer Brett (@LayerBrett) / X

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

RELATED POSTS

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

Crypto Economy Newsletter

I accept the conditions and receive your newsletters.

© Crypto Economy

Privacy Policy

Ethical Journalism Politic

Cookie Policy | Contest Rules | Partners | About us

The finance world is always changing, and right now, stablecoins are on the rise as a savvy payment solution for payroll, especially for startups trying to navigate tricky regulatory waters. Let’s dive into how these digital assets can make payroll management smoother, ensure compliance, and give businesses an edge in today’s fast-paced economy. It’s all about finding new ways to manage payroll effectively and securely.

How startups integrate crypto payroll into their systems is heavily influenced by regulatory frameworks. These frameworks set rules for tax, compliance, and reporting that startups must follow to use stablecoins legally and effectively. For example, the IRS treats stablecoins as property, which means each payroll payment can trigger taxable events. Employers are required to withhold payroll taxes based on the USD-equivalent wage value at the time of payment, and they have to report wages on forms like W-2 for employees and 1099-NEC for contractors. This adds a layer of complexity to record-keeping and compliance work, especially with constantly evolving reporting thresholds and new forms.

For startups wanting to use stablecoins in their payroll, compliance is key. They have to follow local and international regulations, including KYC and AML rules. Companies like Rise are using advanced compliance tools to verify identities and monitor transactions, helping startups meet regulatory demands and issue appropriate tax documentation. Acts like the GENIUS Act are also giving clearer regulatory approval of stablecoins as valid payment instruments, allowing startups to integrate stablecoins with more confidence while ensuring their partners comply with the new standards.

But that’s not all. The future of payroll is also about AI agents entering the mix. These agents are expected to change how stablecoin transactions are done by becoming the primary users, enabling autonomous, real-time, and programmable payments. This could help drive efficiency and innovation in the system. AI agents will have the capability to perceive their environments, make complex decisions, and transact independently without human oversight, all while using stablecoins for value transfer.

As AI agents evolve, they’ll start to use stablecoins for everything from paying for self-driving taxis to creating content on demand. This could lead to a surge in stablecoin transaction volumes, as these agents will prefer stablecoins over traditional banking methods, paving the way for a new decentralized economic model.

For those working with international teams, stablecoins provide an attractive option with faster and cheaper payroll solutions. But then there are the challenges of cross-border tax reporting and compliance to consider. They can enable compliant multi-blockchain transactions, making it simpler for businesses to handle payroll across different jurisdictions, which is especially helpful in high-inflation countries with unreliable banking systems.

By embracing stablecoins, startups can smooth out their payroll processes, cut down transaction costs, and make sure employees get paid on time, no matter where they are in the world. This boosts operational efficiency and gives startups a competitive edge in the global arena.

In countries with high inflation, stablecoins act as a refuge for individuals looking to safeguard their wealth. For instance, in Argentina, many residents are turning to stablecoins to escape strict currency controls and rampant inflation. But relying on stablecoins for payroll in such environments is not without its downsides, including reserve risk and peg fragility. If a stablecoin’s reserves are inadequate or lack transparency, it can lose its peg and value, causing uncertainty for those relying on it for their paychecks.

Also, businesses using stablecoins for payroll face a maze of compliance requirements that can be costly and complex to navigate. Non-compliance can lead to penalties and damage to reputation, making a solid compliance framework essential for startups.

Stablecoins are making waves, and their integration into payroll systems for startups is a big shift in how businesses manage their financial transactions. By leveraging these digital assets, startups can enhance compliance, streamline payroll processes, and gain a leg up in the digital economy. The future of payroll is not just about being efficient; it’s about creating a fairer and more accessible financial landscape for businesses and their employees.

To sum up, stablecoins are changing the payroll game for startups, providing innovative solutions for regulatory challenges, enhancing operational efficiency, and opening up growth opportunities in today’s rapidly evolving financial world. As we move into the future, stablecoin adoption is poised to play a key role in shaping global finance.

Get started with Crypto effortlessly. OneSafe brings together your crypto and banking needs in one simple, powerful platform.

The 21Shares Dogecoin ETF proposal sparks new optimism for DOGE, analyzing market trends, technical patterns, and potential price predictions in the evolving crypto landscape.

Discover innovative strategies for tax-compliant crypto payroll solutions for remote teams, ensuring seamless payments and global compliance.

Vitalik Buterin defends Base against centralization claims, highlighting risks and user trust in DeFi. Explore the future of Layer 2 networks.

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free

7 Top Questions About PCOS & Pregnancy HealthCentral

source

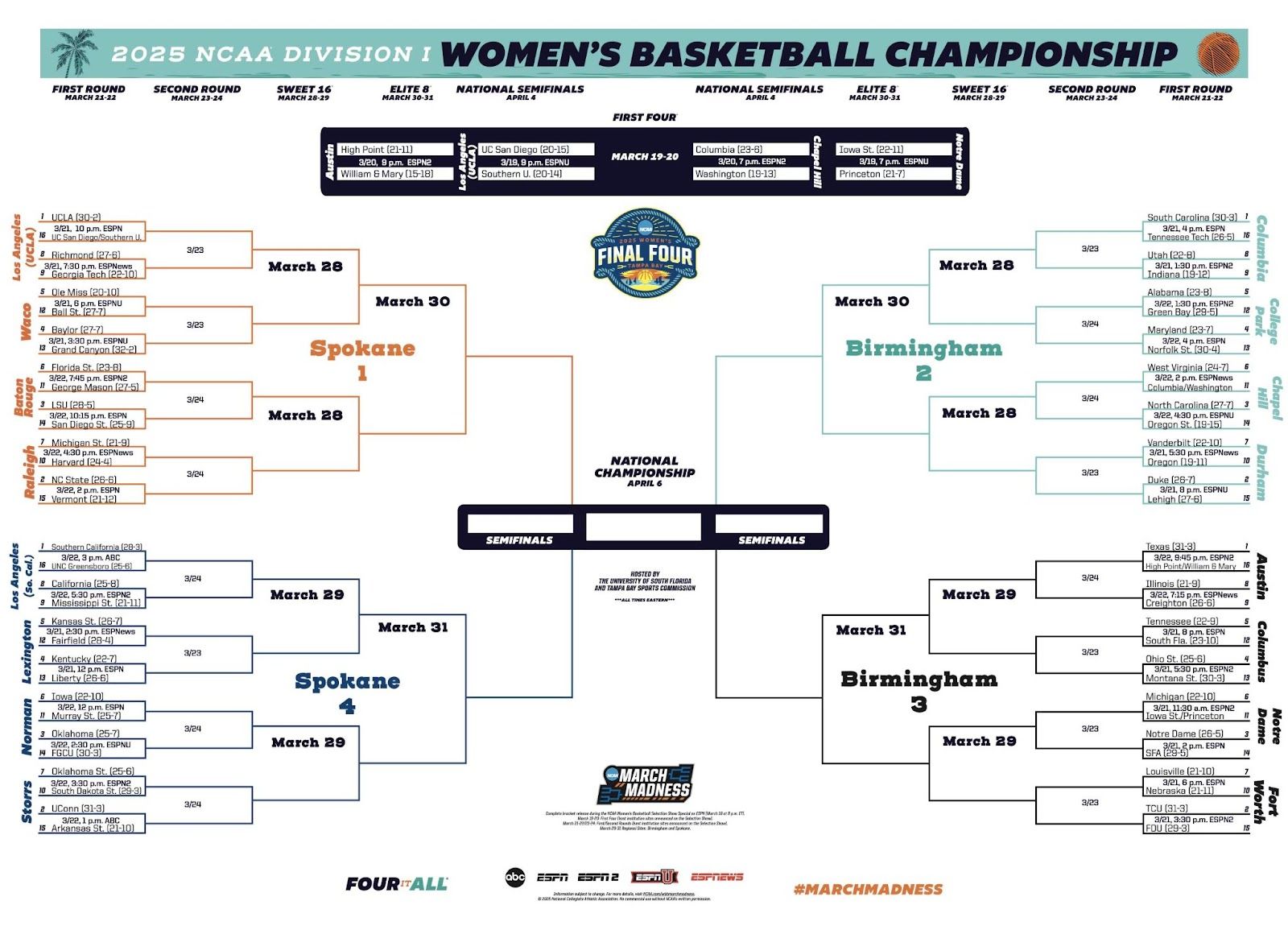

The women’s 68-team, single-elimination bracket works just the same as the men’s — after the First Four, there’ll be six rounds of high-stakes hoops, culminating with the April 6th national championship.

The biggest difference between the women’s and men’s tourney structures? Location, location, location. Starting in the first round through the Elite Eight, each men’s bracket quadrant or “region” is played in a neutral city, but the women’s first two rounds are scattered across the country.

From there, the remaining contenders will travel to neutral sites. Spokane, WA, hosts the left side of the bracket, aptly named Spokane 1 and 4, for the Sweet 16 and Elite Eight, while the right side of the bracket, Birmingham 2 and 3, will head to — you guessed it — Birmingham, AL.

🐻 UCLA Bruins (Spokane 1): The Bruins have been historically good, weaving together their first 30-win season in program history and rattling off 22 straight double-digit dubs in the process. UCLA has everything they need to go the distance: a superstar in junior Lauren Betts, the Robin to Betts’ Batman in junior Kiki Rice, and the depth to keep the wheels turning. It’s net-cutting or bust.

❤️ South Carolina Gamecocks (Birmingham 2): The defending champs felt snubbed after the aforementioned Bruins snagged the No. 1 overall seed — but head coach (HC) Dawn Staley’s squad is used to silencing the haters, and the extra motivation is bad news for Gamecock adversaries as South Carolina hoops for its third title in four years.

🐂 Texas Longhorns (Birmingham 3): The Longhorns made a splash their first year in the SEC, winning a share of the regular-season conference title and enjoying a stint atop the AP Poll for the first time in more than two decades. The only stain on their résumé is abysmal three-point shooting, a stat their best-in-the-SEC defense works their tail off to make up for.

💛 USC Trojans (Spokane 4): The Trojans are so back, and the hometown kid, sophomore and Player of the Year frontrunner JuJu Watkins, is leading the charge. USC’s only improved since last year’s Elite Eight run, adding the country’s best freshman class and a wingwoman for Watkins in grad transfer Kiki Iriafen as they look to make the program’s first Final Four since 1986.

🐯 No. 3 LSU Tigers (Spokane 1): Full disclosure, the Tigers lost three of their last four games with leading scorer, junior Flau’Jae Johnson, sidelined due to injury. Then, senior double-double machine Aneesah Morrow left the SEC semifinals early. LSU’s success will hinge on the availability of their trifecta — Johnson, Morrow, and sophomore Mikaylah Williams. Health is wealth.

😈 No. 2 Duke Blue Devils (Birmingham 2): The Blue Devils went scorched earth in the ACC tournament, snagging their first conference title since 2013 and becoming the only ACC team to log wins against every conference opponent this season. Now, HC Kara Lawson’s surging squad is dancing into the tourney with their highest ranking since 2017.

💚 No. 3 Notre Dame (Birmingham 3): It’s been all green but definitely not all grand for the Irish, who’ve lost three of their last five games. But the dynamic duo of senior Olivia Miles and sophomore Hannah Hidalgo shouldn’t be underestimated: At one point this season, ND had won 19 straight games and were No. 1 in the AP Poll. They just have to rediscover that mid-season magic.

🐕 No. 2 UConn (Spokane 4): The perennial powerhouse Huskies haven’t hoisted the trophy in eight seasons as injuries have decimated HC Geno Auriemma’s squad in recent years. Now healthy, the three-pronged attack of senior Paige “Buckets” Bueckers, grad student Azzi Fudd, and freshman Sarah Strong is poised for a deep tourney run.

🦃 No. 10 Harvard Crimson (Spokane 1): Should Harvard pack their scissors? Probably not, but fresh off winning their first-ever conference title, the Crimson could certainly bust a few brackets. HC Carrie Moore boasts one of the best defenses in the country, while senior Harmoni Turner has been hooping, netting an Ivy League tournament–record 44 points in the semis.

🏔️ No. 6 West Virginia Mountaineers (Birmingham 2): Another defensive juggernaut, the Mountaineers’ D is the best in the Big 12: WVU’s crushing pressure generates nearly 24 turnovers per game, first among all Power Four programs. Dancing for the third straight season, the Mountaineers won’t bow out quietly.

🧡 No. 5 Tennessee Volunteers (Birmingham 3): The Vols are the only team to play in every single women’s tournament, amassing an incredible 43 consecutive appearances. Supermom HC Kim Caldwell’s team plays fast and hard, leading the SEC in scoring by averaging 87.2 points per game. Just giving the folks a little sizzle.

🐱 No. 5 Kansas State Wildcats (Spokane 4): These Cats are crossing their fingers that 6-foot-6 senior Ayoka Lee (who’s been nursing a foot injury) can put on her dancing shoes and pick up right where she left off. Kansas State was a dominant 18-1 with Lee on the court and a middling 8-6 without her.

⚡If all four No. 1 seeds advance to the Final Four, both national semifinals would feature conference championship rematches, pitting SEC foes South Carolina and Texas and Big Ten adversaries UCLA and USC against each other once more.

⭐ Though the madness is intensifying, upsets are far less common on the women’s side of the bracket. In fact, No. 14, No. 15, and No. 16 seeds are a combined 1-360 in the tournament’s 42-year history.

❌ From soliciting walk-ons two seasons ago to winning their first-ever conference title this year, No. 2 seed TCU has had a glow up for the ages — but it’s hard to celebrate a program that continues to start grad student Sedona Prince despite numerous allegations of sexual and physical abuse.

🧠 The Ivy League is sending three teams to this year’s tournament, the most in conference history: The aforementioned No. 10 seed Harvard, plus First Four contenders Princeton and Columbia. Brains and brawn.

🌲 Stanford won’t be dancing for the first time in 36 years, snapping the second-longest appearance streak in tournament history.

Sign up for The GIST and receive the latest sports news straight to your inbox three times a week.