Leading AI Claude Predicts the Price of XRP, Dogecoin, and Pi Coin by the End of 2025 Cryptonews

source

Home – Crypto Presales – Solana, Pi Coin Or Layer Brett; Which Of These Are Experts Calling The Best Investment In 2025?

Veteran investors see Solana (SOL), Pi Coin (PI) and Layer Brett (LBRETT) as interesting crypto investment options, and for different reasons. Solana provides stability, and promises a decent return. The average investor sees projects like Pi Coin as a red flag, but some people believe it still has something decent to give. Layer Brett brings up the rear– new, unpopular, but with an insane potential. Which one of these would be the best crypto to buy in 2025? Read on to find out.

The most obvious feature about Layer Brett is that it is a meme coin. It has a meme vibe, and this means it can ride on market hype and explode with no notice. The other thing that makes it attractive, though, is its extraordinary staking rewards.

Built on the Ethereum network as a layer 2 solution, Layer Brett offers yield rewards in excess of 700% APY for its current investors. This creates a steady stream of passive income for holders, and with APYs of such magnitude, no DeFi practitioner has been able to say no to it.

But there’s more. This reward is designed on a first-come first-served basis. The earliest stakers get higher APY percentages and the value goes down the more people hop on. This, coupled with its $1 million giveaway has created a sense of FOMO around the project.

As a result, the Layer Brett presale has raised an astonishing $3. 7 million from the public, and it’s far from being over. Tokens are selling out fast at a price of $0.0058, as investors realize this could be a once in a lifetime opportunity to become a crypto millionaire.

Every crypto enthusiast acknowledges Solana as the fastest blockchain network out there. It’s the go-to for several DeFi practitioners and many believe that it has the potential to overtake Ethereum as the biggest smart contracts platform.

However, corporate institutions are only just getting the memo it seems. Galaxy Digital is one of the latest additions to the Solana corporate family. The entity recently acquired nearly $1.2 billion worth of Solana, and the wave of institutional buying has sent the Solana price on a decent momentum.

Solana is now firmly above $200, and looks set to test the $250 resistance level. A decisive breakout above this done could see SOL hit $300 before the year ends. That makes it a compelling investment option at the moment.

Pi Network may have risen to prominence on the back of mobile mining, but a lack of real utility is threatening its existence.

After launching around $1 early in the year, the coin exploded and almost hit $3 before a crushing blow sent it tumbling down. Pi Coin is now trading sub $0.3, and has been on a steady decline for months.

Several Pi Coin price predictions suggest PI might go to zero next year, but some investors believe there’s still value in it. The coin is already popular and has a massive global user base. It only takes a spark to ignite a rally, and this could quickly catch on to push Pi to new highs. That’s why they think now may be a good time to “buy low”.

Solana and Pi Coin look like decent bets for different reasons. But both coins have their ills. Solana is quite expensive and Pi Coin may actually not rise again. This leaves LayerBrett as the best coin to buy now.

It offers genuine utility and looks set to surge by 100x once it hits the exchanges. At an affordable $0.0058, now is the perfect time to hop aboard this meme revolution.

Layer Brett is in presale now, but it’s moving fast. Get in early, stake while rewards are high, and don’t miss your shot at the next 100x crypto!

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.

RELATED POSTS

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

Crypto Economy Newsletter

I accept the conditions and receive your newsletters.

© Crypto Economy

Privacy Policy

Ethical Journalism Politic

Cookie Policy | Contest Rules | Partners | About us

Ripple’s XRP-USD trades at $3.05, showing intraday gains of 1.5%, but the structure underneath is fragile. The token failed to hold the $3.10–$3.20 breakout zone and now sits within a tight range of $2.96–$3.07, with market cap at $180 billion and 24-hour trading volume of $6.01 billion. The rejection at $3.40 and the sharp reversal from the multi-year high of $3.66 has shifted sentiment, with technical indicators, whale flows, and ledger activity all flashing warning signs.

On the daily chart, XRP has been forming a descending triangle since the rally to $3.66, with a flat support near $2.70 and lower highs pressing downward. The attempted breakout above $3.00 turned into a fakeout, leaving resistance stacked at $3.05–$3.15. A bear flag on the same timeframe points to further downside, with measured targets around $2.40–$2.06, implying a 20–31% correction from current prices. Moving averages provide context: the 50-day SMA at $3.00 must be reclaimed to neutralize the bearish setup, while the 200-day SMA at $2.50 is the next critical support if breakdown follows.

Intraday action shows $2.95 as the pivot for immediate momentum. Holding above $3.00 could fuel short bursts to $3.08 and $3.15, but consistent closes above $3.13 are needed to validate a bullish turn. Below $2.95, the path opens to $2.85, and then $2.65, where a retest could trigger either capitulation or accumulation. The oscillators reflect indecision: RSI at 53.2 is neutral, stochastic at 71.7 leans near overbought, and ADX at 17.3 confirms weak trend strength. MACD remains marginally bullish at 0.0215, but momentum is already turning down at –0.201.

Santiment data shows entities holding 1–10 million XRP reduced balances sharply, offloading more than 160 million XRP worth $476 million during the past two weeks. Supply controlled by these whales has fallen to a six-week low of 6.79 billion XRP, underscoring distribution pressure. Glassnode reports exchange reserves rising by 665 million XRP to 3.94 billion, suggesting inflows prepared for additional selling. Historically, such exchange balance surges have preceded local tops, adding to downside risk despite ETF approval speculation or broader Fed liquidity narratives.

Daily active addresses on the XRP Ledger have collapsed from 50,482 in July to just 21,000 currently, a 58% drop. New wallet creation is also down, from 11,000 to 4,300 daily, signaling erosion in retail participation. This contraction reduces transaction volume and network liquidity, weakening bullish cases that rely on growing adoption. While fundamentals like fast settlement and institutional pilots remain intact, price action often tracks usage, and the current decline raises near-term caution.

The Federal Reserve’s anticipated rate cuts, combined with institutional interest in altcoins, offer potential macro support. Former legal headwinds for Ripple have eased with progress in SEC disputes, which could open the door for ETF products. Still, the timing of approvals remains uncertain, and the broader crypto environment shows signs of profit-taking after Bitcoin’s stall near $116,000. Ripple’s $25 million RLUSD commitment to small-business lending highlights corporate engagement, but philanthropy alone is not a direct price catalyst.

A fringe thesis circulating projects 100,000% gains for XRP, implying a price near $2,990 per token. While historical runs (like the 60,000% surge in 2017) fuel such optimism, the market cap implications would exceed global equity benchmarks. For now, realistic targets are more restrained: analysts outline a bearish case at $2.40–$2.65, a neutral case at $3.30–$5.00, and a bullish case at $6–$9+ into 2026, assuming adoption, regulation, and ETF flows materialize.

Ripple’s XRP-USD sits at a crossroads. The bullish structure relies on reclaiming $3.07–$3.13, which would unlock upside to $3.40 and $3.66. Failure to defend $2.95–$2.85 invites a slide to $2.65–$2.40, with worst-case triangle targets near $2.06. Whale distribution, declining ledger activity, and neutral oscillators all lean bearish short term, but oversold signals near $2.65 could attract accumulation. Based on current data, XRP is best viewed as a Hold with tactical Buy zones below $2.80 for those anticipating regulatory and institutional catalysts. Bulls retain medium-term potential, but near-term risks remain skewed to the downside.

Enter your email to receive our newsletter

Program directors and former fellows share advice on navigating rigorous applications for programs that let journalists study and develop media solutions at leading universities.

International journalism fellowships are an opportunity for professional and personal growth for Latin American journalists who want to advance their careers and impact the local industry.

As part of these programs, journalists generally spend an academic year studying at an esteemed university and working on a project focused on an issue central to media.

While they provide journalists time and resources to find solutions for complex problems and a break from the day-to-day rigors of professional life, those in Latin America and the Caribbean may view the application process as challenging and out of reach.

To demystify this journey and help potential candidates, LatAm Journalism Review (LJR) sought advice from fellowship participants and those in charge of the international programs at universities in the U.S. and UK.

Although the application period hasn’t yet begun, the need to prepare in advance, even before the selection process officially opens, was unanimous among those interviewed. The key to success, they said, lies in meticulous preparation, self-confidence and a deep understanding of the program they’re applying for.

“You have to be really interested in your subject because you will be working only on that for several months, and you want to enjoy your fellowship and write a useful paper,” Chilean journalist Francisca Skoknic, alumna of the 2023-2024 class at the Reuter’s Institute, told LJR. “I think it’s important to study the chosen subject, to start your application well in advance—this shouldn’t be a last-minute effort, and to clearly articulate why your project matters.”

Francisca Skoknic shares the findings of her project during her fellowship in August 2024. (Image: Andrew Bailey)

For her project, Skoknic focused on media funding transparency, which culminated in the publishing of her paper “The looming threat (and possible solutions) to Latin America’s foreign donor-funded journalism” in August 2024. Skoknic, who is editor and co-founder of journalistic platform LaBot, said the biggest challenge during the application process was writing the required texts.

“On the one hand, you need to show your best accomplishments and strengths, which always makes me uncomfortable,” she said. “On the other hand, you have to develop a project that’s both interesting to you and appealing to the selection committee.”

To apply for the Reuters Institute fellowship, which is located at the University of Oxford in the UK, applicants must submit a one-page project idea explaining the topic they will be working on during the program. They must also write a one-page motivation letter detailing why the fellowship is right for them and what they plan to do with the project upon returning to their home country. The program is suitable for mid-career journalists with more than five years of experience who will return to the profession after completing their studies. Other documents and requirements necessary for the application and can be found on the Reuters Institute’s official website. Applications usually open the second week of January.

“Typically, we’re looking for ideas that are timely, will have a demonstrable impact on your career or newsroom, and are motivated by personal experience,” Caithlin Mercer, associate director of the Journalism Fellowship Programme, told LJR. “We are not looking for thoroughly sourced research proposals or academic experience.

Mercer recommends that applicants keep an eye on past fellows’ projects published on the program’s website to better prepare before the application period begins. She said most new projects are published in August, September, December, and April because they are released between academic semesters. If the topic the applicant wants to explore is the same, she advises building on that work.

“I’m not going to lie and tell you it’s easy,” she said. “Less than 1% of people who apply to this programme get in. But just because it’s difficult, doesn’t mean you are not worthy of giving it your best shot. At the Reuters Institute, our final decision always comes down to the best mixture of ideas and experiences, not just the best ideas. You never know when you might be the missing ingredient we’re looking for.”

Skoknic echoes the challenge of the process, but believes that if the candidate is an experienced journalist, the program isn’t out of reach. She said it’s a good idea to include a concrete outcome for the project, such as identifying solutions to a specific problem or a practical application for journalists.

“You have to work hard on your application. Focus on subjects you know well and avoid topics that are too broad,” she said. “I read extensively about my chosen subject to develop an informed proposal. I also gave myself plenty of time: I like to write a draft, let it rest for a few days, and then revise it. It always improves.”

In the year since she published her paper, she said she still gets comments and invitations to speak about the subject, even going abroad.

“Almost without realizing it, I’ve become an expert in this field,” Skoknic said.

Brazilian journalist Sérgio Spagnuolo, executive director of Núcleo Jornalismo and a 2025-26 John S. Knight Fellow at Stanford University in California, said putting together a good application is one of the biggest challenges of the selection process. He spoke with fellows from previous years, read and reread the required submissions, paid close attention to the requested topics, and reviewed all grammar and spelling.

“I was never satisfied with the first draft of my answers; there was always room for improvement,” Spagnuolo told LJR. “It’s very important to prepare in advance. I speak from experience: many people leave the entire application until the last few days, and that’s not a good idea, especially because you don’t have time to reflect on what you can write and improve the quality of the material.”

According to JSK’s official website, the fellowship is open to American and international journalists working in media outlets, independent journalists, journalism entrepreneurs, strategists and innovators. Applicants must have at least five years of professional journalism experience, and a college degree or experience in traditional newsrooms is not required.

Alberto Mendoza, director of the JSK fellowship program, emphasizes that the program seeks professionals with leadership skills and a willingness to propose solutions to industry problems. He said this leadership doesn’t need to be tied to formal positions, but rather to concrete actions and initiatives that the individual has implemented in their community.

“This is a journalism fellowship that focuses on helping leaders become even more well rounded,” Mendoza told LJR. “You really have to step into that [being a leader] and know that because you want to do something to change the industry, this is the perfect fellowship to give you that opportunity.”

Mendoza also emphasized the importance of submitting a detailed application. Applicants should be able to clearly state the types of classes that interest them, what they specifically hope to gain from being a JSK fellow, and what questions they hope to answer during their time at Stanford. He also said that the proposal made during the application is only a starting point for what will be done during the fellowship.

“We want to have people that are coming here with a question. ‘What would happen if?’ And that while they’re at Stanford, they’re going to look for all the different answers and be influenced by everything that they’re exposed to here,” Mendoza said. “The project is basically the exploration of a concept that you’re going to put to test in the fellowship. The reason why I say that that’s important is because half of our fellows sometimes change their direction. And so, if we were very focused on just what the proposal is, you know, then sometimes we miss the opportunity to pivot.”

Among the most common mistakes made by Latin American applicants, Mendoza cited generalizations, a lack of connection between their past experiences and the project they’re proposing, and a difficulty in valuing their own career. He also said it’s essential to contextualize the reality of the applicant’s home country and the local press, as well as explain why their work is important in the region, since evaluators won’t stop to research this amid thousands of applications.

“Latin Americans, as one myself, we are not very comfortable with bragging or we’re not comfortable talking about ourselves,” he said. “This is the moment to be really proud of the things that you’ve accomplished and share those. And then by the same token, sharing the vulnerabilities is good too.”

Applications for the next JSK fellowship class open on Oct. 15 and run until Dec. 3. All information about prerequisites and fellowship benefits can be found on the program’s official website.

While at Oxford, the research project carries significant weight, and at Stanford, leadership is key, at the University of Michigan, the approach is focused on innovation. Lynette Clemetson, director of Wallace House Center for Journalists, said a strong application presents a clear argument as to why the fellowship is necessary to accomplish something that was not possible in the normal course of work, or something that truly requires time, as well as academic and financial support to develop.

“Generally, I think fellowships like ours are looking for journalists who are several years into their career, who have been working long enough to have a sense of what skills or training or opportunities they could have to advance their career”, Clemetson told LJR. “We are more of a mid-career fellowship. And I don’t use the term mid-career on our website because I think it is really tricky now because sometimes people come to journalism from other fields.”

Clemetson said one of the most common mistakes is submitting generic applications or applications lacking knowledge about the program. She also explained that it’s not uncommon for candidates to apply for different fellowships with the same materials, without considering the specific requirements for and benefits of each program.

The Wallace House director also emphasized the importance of having a solid level of English fluency and being comfortable communicating in the language. Clemetson said that last year, she saw an application for the first time that clearly used artificial intelligence in the preparation of the material.

“Sometimes I will get an application that says I would like to study in the Journalism School. But Michigan doesn’t have a journalism school. So I know that that person hasn’t done some preliminary research,” she said. “And also, if they’re accomplished, they don’t need to study journalism, right? If your level of facility with English is at one level in the application and then we do a phone interview and it’s clear that this is not your working fluency, that’s really difficult to work around.”

Like Mendoza, Clemetson reinforced the importance of being very specific about the context of local journalism in Latin America and the candidate’s role in this context. She recommended that candidates organize their ideas and write in the same way they would in a good article on a complex topic unfamiliar to readers: bringing the information to life and making it understandable for the public.

“If you assume that most applicants in Latin America would be embedded in journalism ecosystems that maybe the person reading your application isn’t familiar with, you have to bring those alive and be able to talk about the dynamics of where and how you do your work,” Clemetson said. “The more you can make your own personal journey and your resume come alive and demonstrate not just what you have done but the things that you still want to do and are your personal mission to get done, that’s very, very appealing.”

Applications for the Knight-Wallace Fellowship open in October, and the deadline for international applicants is Dec. 1. Clemetson recommends that interested applicants from Latin America speak with former fellows and university professors before applying to strengthen their candidacy. All requirements for participating in the selection process are available on the official Knight-Wallace website.

The Nieman Foundation awards fellowships to selected journalists who are invited to spend an academic year at Harvard University in Cambridge, Massachusetts, pursuing individual study plans to strengthen their knowledge and leadership skills. Each year, 12 American and 12 international journalists are selected. Henry Chu, interim curator of the Nieman Foundation, said the fellowships are investments in journalists who have not only excelled but also demonstrated potential for more.

“We’re on the lookout for applicants who have thought deeply about how a year away from their workplaces and at Harvard will benefit their journalism and equip them to be stronger leaders in their newsrooms or in the industry more generally,” Chu told LJR.

Brazilian Simone Iglesias is part of the 2026 Nieman Class. (Image: Archive)

Brazilian Simone Iglesias, a business and government reporter for Bloomberg News in Brasília, is part of the 2026 Nieman Class. For her, the biggest challenge of the selection process was balancing the development of her project with an intense reporting schedule. Iglesias decided to apply in March 2024 and only completed her application in November of the same year.

“Every day I was mentally organizing myself to produce, a crisis or a story to cover would arise,” Iglesias told LJR. “It was eight months of taking notes, researching, reading, pestering friends with my topic, and gaining insights between interviews, conversations with sources, coverage of the G20, the BRICS, presidential trips, and maddening time zones.”

To apply for the Nieman Fellowship, as with other programs, journalists must have at least five years of professional experience. The fellowship website is categorical about English fluency in speaking, writing and reading. Iglesias believes that no program is out of reach for journalists in Latin America, but she emphasizes that it’s important to select the right program for each stage of a journalist’s career.

“For Nieman, you need more experience. The Harvard professors who welcomed me into their chairs don’t see me as an undergraduate student, but as someone who can contribute to the class as a whole more effectively in a debate about my field,” she said. “I would never have applied to Nieman at the beginning of my career. I made my pitch at the right time. Journalists from Latin America are absolutely welcome in these programs. We have a lot to contribute to foreign universities with our knowledge.”

Applications open in October, and the deadline for international journalists is Dec. 1. Complete application information can be found on the Nieman Fellowship website. For journalists considering applying, Iglesias recommends following the announcement’s instructions to the letter.

“This week, a Mexican colleague talked to me about the application process. He asked me for contact information for foundation staff for tips. I told him it’s not the right way,” Iglesias said. “Read the entire process carefully dozens of times. Do exactly what’s asked. But do it absolutely well.”

Knight Center for Journalism in the Americas

300 West Dean Keeton

Room 3.212

Austin, TX, 78712

© The University of Texas at Austin 2025

Our Newsletters are emailed weekly

Join thousands of subscribers who receive the LatAm Journalism Review newsletter every Thursday.

SUBSCRIBE

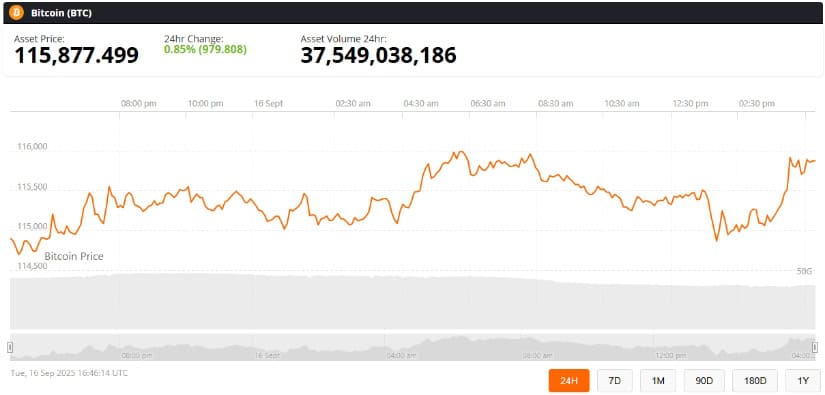

Bitcoin (BTC) is showing resilience near $115,877, as traders and investors closely watch for a potential breakout amid the Federal Reserve’s anticipated rate cut on September 18, 2025.

Despite short-term uncertainty, market participants are positioning for both potential pullbacks and a sustained upward move, with technical patterns and macroeconomic indicators pointing to a possible historic rally.

After bouncing from the $111,000 zone, Bitcoin has found a firm footing around $115,877, testing resistance between $116,000 and $118,000. The daily chart shows the 0.618 Fibonacci retracement level at $115,429 acting as a critical support.

Bitcoin (BTC) was trading at around $115,877, up 0.85% in the last 24 hours at press time. Source: Bitcoin Price via Brave New Coin

Additionally, the 20-day and 50-day EMAs at $113,645 and $113,478 provide further stability. Breaking above $116,000 could set the stage for a push toward $123,600, while failure to clear this resistance may lead to a short-term pullback.

The Federal Reserve is expected to cut rates due to 3.1% inflation and 4.3% unemployment, adding liquidity to the financial system. This move could cause Bitcoin to dip temporarily to $104,000, or potentially toward $92,000 where a CME futures gap has yet to be filled.

Bitcoin may dip ahead of the Fed rate cut before rebounding, as analysts warn of short-term volatility. Source: @TedPillows via X

Historical patterns show that rate cuts often trigger brief sell-offs before recovery. Bitcoin’s volatility, which can spike 3–4 times higher than equities during policy changes, reinforces the risk of short-term price swings ahead of the Fed decision.

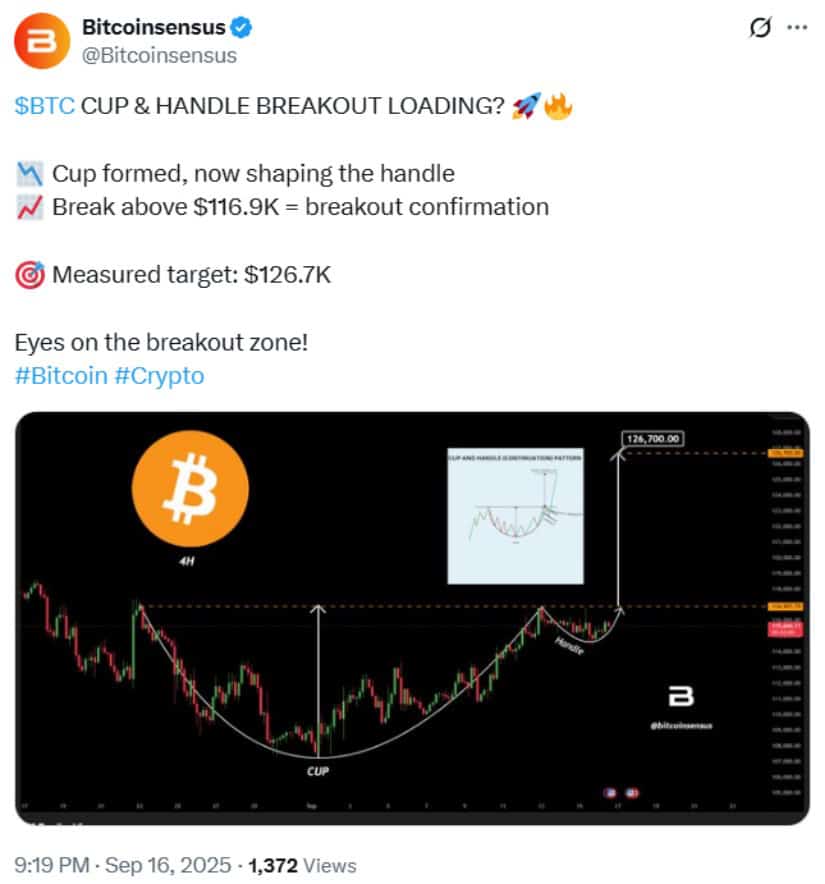

Short-term charts show a cup and handle pattern forming on the 4-hour timeframe, with a U-shaped recovery from $105,000 to $116,900 followed by a small pullback. A breakout above $116,900 could send Bitcoin toward $126,700, following the pattern’s historical performance.

BTC cup & handle nears breakout—surge above $116.9K could target $126.7K! Source: @Bitcoinsensus via X

While such patterns have generally low failure rates in bull markets, frequent formations near all-time highs may produce false breakouts. Traders should be cautious and wait for confirmation before entering large positions.

Immediate support sits at $113,500, reinforced by the 20-day and 50-day EMAs. If this level breaks, Bitcoin could test $111,100 and the 200-day EMA at $105,349, reflecting the scenarios for potential short-term pullbacks.

Bitcoin’s next move hinges on the Fed rate cut, with potential dips before a push toward a $126K breakout if support holds. Source: Morad762025 on TradingView

Key resistance levels include $116,000, $118,000, $120,000, and $123,600, which could determine whether Bitcoin continues its upward trend. Surpassing these points may pave the way for a $126,000 breakout in the medium term.

Bitcoin’s near-term direction will depend heavily on the market’s reaction to the Fed rate cut. As long as BTC remains above $113,500, medium-term momentum is expected to stay constructive.

Traders should prepare for possible dips toward $104,000–$111,000 before a sustained rally. If resistance levels are overcome and support holds, a historic $126K breakout remains within reach.

17 Sep 2025

17 Sep 2025

17 Sep 2025

Ahmed Ishtiaque|17 Sep 2025|News|

Ahmed Ishtiaque|17 Sep 2025|News|

Naveed Iqbal|17 Sep 2025|News|

Naveed Iqbal|17 Sep 2025|News|

Ahmed Ishtiaque|17 Sep 2025|News|

Auckland / Melbourne / London / New York / Tokyo

A Techemy company

PO Box 90497, Victoria St West, Auckland Central, 1010, New Zealand.

© 2025 Brave New Coin. All Rights Reserved.

Sponsored

FOND DU LAC – A lottery player in Fond du Lac has gotten lucky this week.

Philly’s on 4th Grocery & Deli, 321 Fourth St., sold a winning $350,000 “SuperCash!” ticket — the top prize — for the Sept. 15 drawing, according to Wisconsin Lottery. The winning numbers were 16-24-27-30-37-39.

“SuperCash!” players buy two plays for $1, then wait for the daily draws after 9 p.m. The odds of matching all six numbers and earning the top prize are one in 1,631,312.

The winner has 180 days to claim their prize.

Philly’s on 4th often continues Fond du Lac’s lucky lotto streak: the city was called Miracle Mile in the 1990s after a number of retailers sold winning tickets amounting to millions of dollars.

Before it was Philly’s on 4th, the business was called Ma & Pa’s in the Miracle Mile, and sold a $6.5 million winning ticket in 1994 and a $208.6 million ticket in 2006.

In just the last five years, the store sold winning scratch tickets of $1 million, $100,000 and $10,000, as well as two winning Badger 5 jackpots and a winning $100,000 All or Nothing ticket, according to Wisconsin Lottery.

Daphne Lemke is the Streetwise reporter for the Fond du Lac Reporter. Contact her at dlemke@gannett.com.

The Pi Network Price Prediction has become a critical warning sign for investors watching the cryptocurrency bloodbath unfold in 2025. While Pi holders face devastating 85% losses from previous highs, savvy investors are quietly accumulating positions in an emerging altcoin that could deliver life-changing returns before the masses catch on. Find out more in this article.

The numbers do not lie. Pi price sits at around $0.3469 with a pathetic $39 million daily volume, down 3% and showing zero signs of recovery. Sellers are crushing any attempt at a rally. The RSI below 50 confirms what smart money already knows: this ship is sinking fast.

Despite 7.7 billion tokens in circulation and a $3.5 billion market cap that looks impressive on paper, institutional investors are running for the exits. The Pi Network price prediction models show catastrophic losses ahead. Support at $0.40 is crumbling.

Once that breaks, there is nothing stopping a freefall. Early believers who ignored the warning signs are learning an expensive lesson about backing the wrong horse in crypto.

While Pi holders watch their portfolios evaporate, Remittix is exploding with unstoppable momentum. This is not another worthless meme coin or broken promise. Remittix delivers revolutionary cross-chain DeFi technology that solves real problems and generates actual value.

The Remittix team is now fully VERIFIED by CertiK, the world’s most trusted name in blockchain security. Even better? Remittix is officially RANKED #1 on CertiK for Pre-Launch Tokens. Beta testing is now LIVE for the Remittix wallet, with community users actively testing game-changing functionality that will disrupt traditional finance forever.

The presale has already crushed $25,8 million+ raised. BitMart and LBank listings are confirmed. Early investors are sitting on massive unrealized gains while latecomers scramble to get in before the inevitable explosion. This is your last chance to position yourself before institutional money floods in.

The Pi Network price prediction is not looking good for anyone still holding. Meanwhile, Remittix presale tokens are flying off the shelves. Smart money is rotating out of dead projects into this next 100x opportunity. When Remittix hits major exchanges, current prices will look like the deal of the century.

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

The Cardano price prediction is once again in the spotlight as investors look ahead to…

Analyst Austin Hilton has sounded a major XRP warning even as the price continues to consolidate. He declared that this is the last chance to get into the altcoin before its price goes on a parabolic run.

Last Chance To Get In On XRP Before Its Q4 Bull Run

In a YouTube video, Austin Hilton warned that this is the last chance for investors to accumulate XRP before its major bull run in the last quarter of this year. He noted that September was expected to be a slow month with little action from the altcoin, especially as investors wait on a Fed rate cut.

The analyst further remarked that the altcoin has even outperformed expectations this month, considering that it was able to reclaim the psychological $3 level and has held well above support levels. However, Austin Hilton predicts that a greater run lies ahead for the altcoin, with liquidity set to return in the fourth quarter from both retail and institutional investors.

Another bullish fundamental he alluded to is the fact that XRP is being taken off exchanges, which indicates that crypto whales are actively accumulating the token. This could lead to a supply shock, which could serve as a catalyst for higher prices. Bitcoinist reported that Coinbase’s reserves have crashed by 90% as whales move tokens off the exchange to hold for the long term.

Meanwhile, four major crypto exchanges, including Binance, saw massive demand earlier in the month, leading them to add 1.2 million coins to meet this demand. The CryptoQuant analysis that pointed this out noted that the demand might have been coordinated and might have come from institutions. This comes ahead of the potential XRP ETFs launch, which is bullish for the altcoin’s price.

Institutions Set To Flow Into The Altcoin With ETF Launch

Institutions are set to inject new capital into the ecosystem with the launch of the first spot XRP ETF, which is happening this week. REX Shares confirmed that its REX-Osprey XRP ETF (XRPR) is coming this week. It noted that this will be the first U.S. ETF to deliver investors spot exposure to XRP.

Bloomberg analyst James Seyffart stated that the REX-Osprey XRP ETF isn’t a “pure” spot ETF. He explained that it will hold spot directly and other spot XRP ETFs from around the world to get its exposure. The analyst also noted that the fund’s prospectus includes language that would allow it to invest in derivatives for exposure if needed. However, that won’t be the primary exposure method.

The spot XRP ETFs could get a SEC approval in October, which is another factor that could serve as a catalyst for higher prices for the cryptocurrency heading into the fourth quarter. Seven fund issuers are currently awaiting the SEC’s approval to offer a 100% spot XRP ETF.

At the time of writing, the XRP price is trading at around $2.97, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Select market data provided by ICE Data services. Select reference data provided by FactSet. Copyright © 2025 FactSet Research Systems Inc.© 2025 TradingView, Inc. SEC fillings and other documents provided by Quartr.